The hustle and bustle of the foreign exchange market, also known as forex, captivates traders around the globe. Its liquidity and round-the-clock nature present endless opportunities for profit. However, understanding the market’s intricate opening and closing times is paramount to maximizing your trading potential.

Image: homecare24.id

Navigating the Forex Market’s Extended Hours

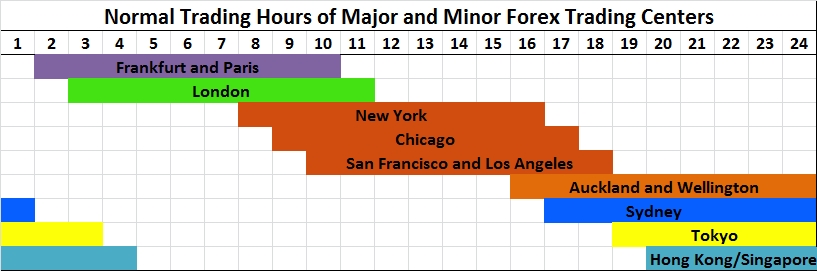

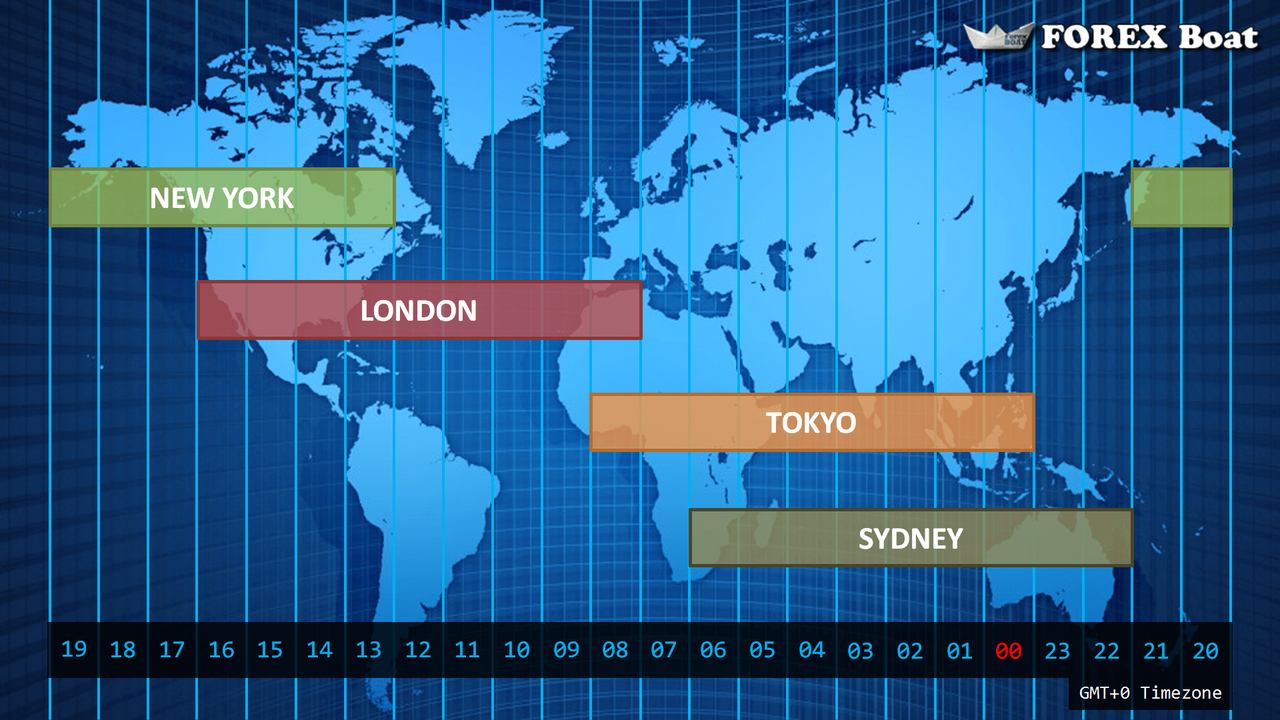

Unlike traditional stock exchanges, the forex market operates 24 hours a day, five days a week, from Sunday evening to Friday evening. This uninterrupted trading environment empowers investors to capitalize on market movements across different time zones. However, it’s important to note that the market’s activity and liquidity fluctuate throughout the day.

The major forex trading hubs – London, New York, Tokyo, and Sydney – each host a specific trading session. As one session closes, another opens, ensuring continuous trading activity. The overlap between these sessions, particularly during the London and New York sessions, offers heightened liquidity and volatility, making it an ideal time for executing trades.

Each trading session typically spans eight hours, with the exception of the Sydney session, which lasts for seven. Here’s a breakdown of the forex market’s daily trading schedule:

- Sydney Session: 5 pm EST to 1 am EST

- Tokyo Session: 7 pm EST to 3 am EST

- London Session: 3 am EST to 11 am EST

- New York Session: 8 am EST to 4 pm EST

Market Closures and Rollover Impact

While the forex market operates continuously during weekdays, there are brief periods when trading is suspended. These closures align with major holidays and weekends. For instance, the market is typically closed on Christmas Day, New Year’s Day, and Thanksgiving Day in the United States.

During these closure periods, open positions are subject to a process called rollover. This involves adjusting the position’s value to account for interest rate differentials between the two currencies involved. Rollover fees can impact traders’ returns, making it essential to consider these costs when planning your trades.

Enhancing Your Forex Trading Strategy

Understanding the forex market’s opening and closing times is a fundamental aspect of successful trading. With this knowledge, you can plan your trading sessions strategically to align with periods of high liquidity and volatility. By monitoring market closures and accounting for rollover fees, you minimize potential risks and maximize your chances of profitability.

- Choose trading hours within your most comfortable time zone to maintain focus and efficiency.

- Identify the overlap between major trading sessions to take advantage of increased liquidity and market movements.

- Plan your trades meticulously, considering market closures and rollover fees to mitigate financial risks.

In the dynamic world of forex trading, knowledge is power. By comprehending the market’s operating hours, you unlock a wealth of opportunities for success. Embrace the intricate nature of the forex market, and let your trading journey flourish with confidence and expertise.

Image: www.sistemasinversores.com

Frequently Asked Questions

What are the benefits of trading during the major trading sessions overlap?

Increased liquidity and volatility, offering enhanced opportunities for profit.

How can I minimize the impact of rollover fees?

Carefully plan your trades, considering market closures and interest rate differentials.

What Time Does The Forex Market Close Today

Is it possible to trade forex during the weekends?

No, the forex market is typically closed on weekends due to a lack of liquidity.