The realm of foreign exchange, commonly known as forex, has long captivated traders with its inherent volatility and lucrative potential. However, the blanket of secrecy surrounding Sunday trading in forex markets often confounds those eager to capitalize on this lucrative opportunity. In this comprehensive guide, we will shed light on the enigmatic world of forex market open Sunday GMT, providing traders with the tools to navigate this enigmatic realm with precision and confidence.

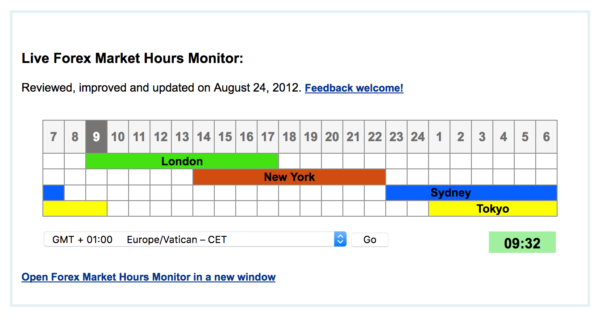

Image: xbinop.com

Origins of the Sunday Trading Enigma

Historically, forex markets were largely dormant on Sundays due to the closure of major financial institutions and exchanges. This hiatus primarily stemmed from religious observances and societal norms that considered Sunday a day of rest. However, as the forex market evolved into a 24-hour behemoth, the demand for Sunday trading surged. This demand was further fueled by the advent of electronic trading platforms that enabled traders to access the market remotely at any time.

To adapt to this evolving landscape, several forex brokers recognized the need to bridge this Sunday trading void. They forged partnerships with liquidity providers and banks willing to operate on Sundays, thus giving birth to Sunday forex trading in its current form.

The Landscape of Sunday Forex Trading

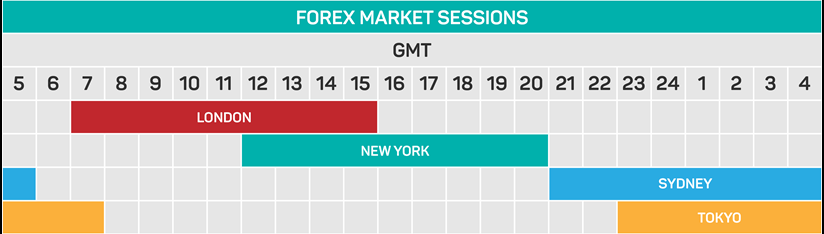

Sunday forex trading differs from weekday trading in a few notable aspects. The most significant distinction lies in market liquidity. Due to reduced participation from large financial institutions and central banks, liquidity tends to be lower on Sundays. This reduced liquidity can lead to wider spreads, increased volatility, and potentially less favorable trade executions.

Another key consideration for Sunday forex traders is the absence of major news announcements and economic releases. As these events typically occur during weekdays, traders may have to rely on limited information when making trading decisions on Sundays. This reinforces the importance of conducting thorough pre-market analysis before engaging in Sunday forex trades.

Benefits and Challenges of Sunday Forex Trading

Venturing into Sunday forex trading offers several potential advantages:

-

Extended Trading Hours: Sunday trading allows traders to extend their trading activities beyond the traditional weekday schedule. This flexibility can be particularly advantageous for those with busy weekday schedules or those seeking to explore new trading opportunities.

-

Potential Profitability: Sunday forex trading can present unique profit-making opportunities due to reduced market liquidity. Skilled traders may leverage this environment to identify and exploit price inefficiencies that may arise during this time.

However, Sunday forex trading also comes with its fair share of challenges:

-

Lower Liquidity: As mentioned earlier, lower market liquidity on Sundays can result in wider spreads and increased volatility, potentially reducing profit margins.

-

Limited Market Information: The lack of major news announcements and economic releases on Sundays can limit the availability of real-time market information, increasing reliance on pre-market analysis.

-

Higher Risk: The reduced liquidity and limited market information on Sundays can amplify trading risks. Traders must exercise extra caution and implement sound risk management strategies.

Image: www1.equiti.com

Strategies for Successful Sunday Forex Trading

To navigate the unique challenges of Sunday forex trading successfully, traders should consider adopting the following strategies:

-

Meticulous Pre-Market Analysis: Dedicate substantial time to analyzing the market before the Sunday trading session begins. Identify potential trading opportunities based on technical analysis and current market conditions.

-

Small Position Sizing: Given the higher risks associated with Sunday trading, it is advisable to trade with smaller position sizes. This prudent approach helps mitigate potential losses and preserves trading capital.

-

Leverage Stop-Loss Orders: Implement stop-loss orders to limit potential losses in case of adverse price movements, especially during periods of lower liquidity.

-

Patience and Discipline: Sunday forex trading requires patience and discipline to exploit opportunities effectively. Avoid emotional or impulsive decision-making, and stick to your pre-defined trading plan.

Forex Market Open Sunday Gmt

Conclusion

Embarking on the path of Sunday forex trading empowers traders to extend their trading horizons and potentially seize new profit-making opportunities. However, navigating this unique trading environment requires a deep understanding of its inherent challenges and a refined trading strategy. By adopting the insights and guidance outlined in this comprehensive guide

Moreover, this article provides readers with valuable insights into an often-obscured aspect of forex trading, empowering them to make informed decisions and potentially enhance their trading endeavors.