Introduction:

The realm of forex trading, where fortunes are made and lost in a perpetual dance of currency exchange, has long been shrouded in mystery and perceived as a domain for the financial elite. However, the advent of scientific forex trading courses has democratized access to market mastery, empowering traders of all experience levels to unravel the complexities of this dynamic landscape.

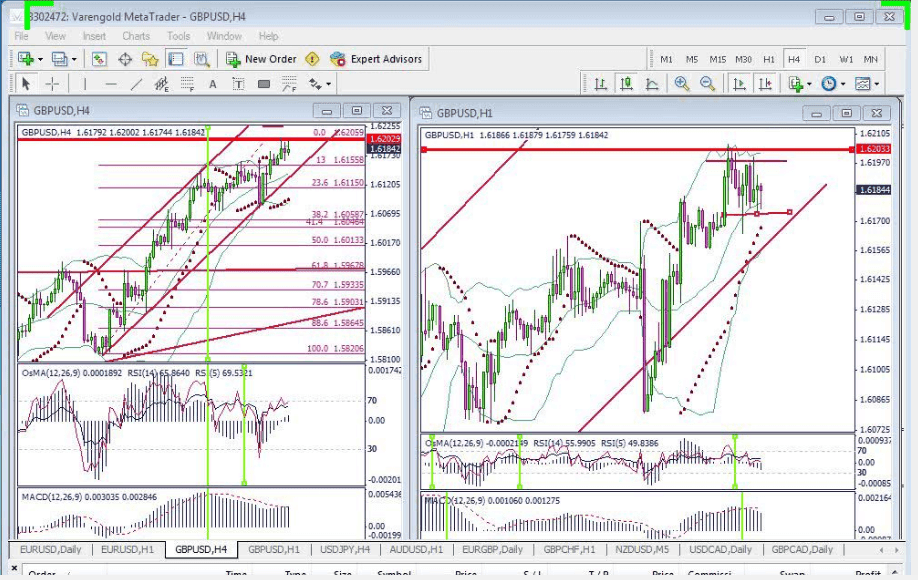

Image: forexlucrativo.com

In this comprehensive guide, we will shed light on the transformative power of scientific forex trading, examining its historical foundations, exploring core principles, and unveiling the innovative strategies that are shaping the future of currency trading. By integrating scientific rigor with market insights, you will gain the tools and confidence to navigate the uncharted territories of forex markets.

Unveiling the Roots: A Historical Perspective

The genesis of forex trading can be traced back to the ancient times of Babylonia and Mesopotamia, where merchants engaged in currency exchange to facilitate trade. Over the centuries, the practice evolved, with the rise of global commerce during the colonial era marking a pivotal point. However, it was not until the 1970s, when the Bretton Woods system collapsed, that forex trading truly took off, as currencies were freed from their fixed exchange rates.

Laying the Cornerstones of Scientific Forex Trading

Scientific forex trading emerged as a distinct discipline in the 1990s, merging the rigor of scientific inquiry with the dynamic nature of currency markets. This unique approach emphasized the application of empirical evidence, data analysis, and quantitative modeling to unravel market patterns and inform trading decisions.

Deconstructing Core Principles: The Building Blocks of Forex Success

- Technical Analysis: This approach harnesses historical price data to identify trends, support and resistance levels, and trading opportunities. By studying chart patterns, technical traders aim to predict future price movements.

- Fundamental Analysis: This method scrutinizes economic data, such as GDP growth, inflation, and interest rates, to gauge the health of economies and determine how they may impact currency valuations.

Adapting to the Evolving Landscape of Forex Markets

In the bustling world of forex trading, innovation reigns supreme. The rise of algorithmic trading, where automated bots execute trades based on pre-defined rules, has revolutionized the market. Furthermore, the emergence of social trading platforms, where traders share strategies and insights, has fostered a collaborative learning environment.

Conclusion: The Path to Forex Mastery

Scientific forex trading empowers traders to navigate the complexities of currency markets with confidence and precision. Its analytical rigor, coupled with market-driven insights, provides a solid foundation for trading success. By embracing the principles outlined in this article and continuously seeking knowledge, you can unlock the transformative potential of scientific forex trading and embark on a rewarding journey in the dynamic world of currency exchange.

Image: forexprofitway.com

Scientific Forex Forex Trading Course