Decoding the Forex Transaction Numbers

In the world of international currency exchange, understanding the components of a foreign transaction number is crucial. For seasoned traders and novice investors alike, identifying the specific digits that initiate a transaction enables seamless execution and eliminates potential hiccups. This article delves into the intricacies of foreign transaction numbers, deciphering their structure and highlighting their significance in the Forex market.

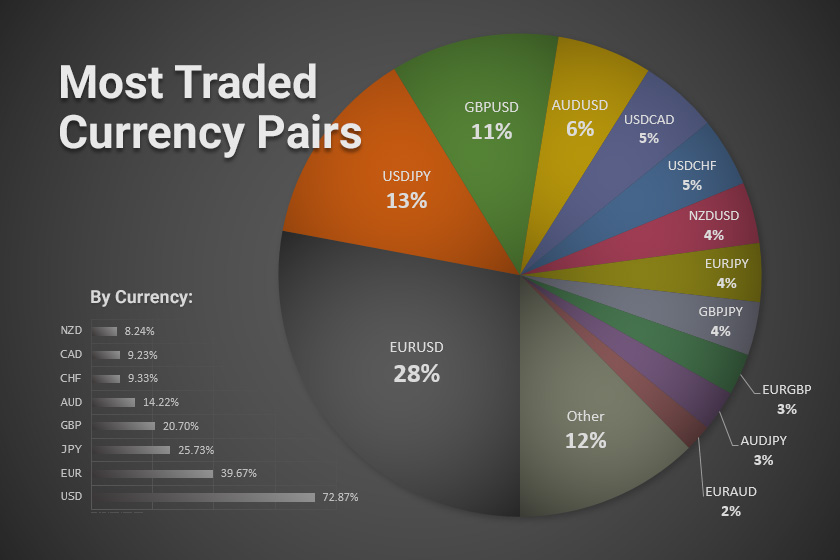

Image: carlfajardo.com

Understanding the Foreign Transaction Number

A foreign transaction number, also known as a Foreign Identification Number (FIN), is a unique code assigned to each international money transfer. It facilitates the tracking of transactions across borders and ensures compliance with regulatory frameworks. Typically, a foreign transaction number comprises 18 to 35 digits, each serving a specific purpose.

Dissecting the Foreign Transaction Number Structure

- The first few digits: The initial digits of a foreign transaction number typically indicate the country of origin. For instance, transactions originating from the United Kingdom may start with “GB,” while those from the United States often commence with “US.”

- Intermediary bank identifier: Subsequent digits identify the intermediary bank involved in facilitating the transaction. This information is critical for routing funds efficiently between the sender and recipient banks.

- Unique transaction reference: A unique identifier is incorporated within the foreign transaction number to differentiate the transaction from others processed by the same bank on the same day. This reference serves as a traceable record for both the sender and recipient.

- Check digit: To ensure accuracy, a check digit is appended to the end of the foreign transaction number. This digit is calculated based on an algorithm that verifies the validity of the preceding digits.

Significance of Foreign Transaction Numbers

- Accurate transaction routing: Foreign transaction numbers play a crucial role in ensuring that funds are routed accurately to the intended recipient. Mismatched or incorrect numbers can lead to delays, errors, or even failed transactions.

- Tracking and reconciliation: These numbers facilitate easy tracking of transactions, enabling businesses and individuals to monitor their international payments and reconcile their accounts efficiently.

- Regulatory compliance: Foreign transaction numbers aid regulatory bodies in monitoring cross-border transactions for compliance purposes. They help identify potential illicit activities and ensure adherence to anti-money laundering and counter-terrorism financing regulations.

Image: www.freesignalbinary.com

Expert Tips for Understanding Foreign Transaction Numbers

- Confirm with your bank: The best way to decode a specific foreign transaction number is to check with your bank. They can provide detailed information about the transaction’s origin, purpose, and intermediary banks involved.

- Use online tools: Numerous online resources and tools are available to help you interpret foreign transaction numbers. These tools can quickly provide information based on the number’s structure and format.

- Check the SWIFT code: The SWIFT code (Society for Worldwide Interbank Financial Telecommunication) is often included in the foreign transaction number and can provide additional context about the transaction’s origin and destination.

Frequently Asked Questions

- Q: Where can I find the foreign transaction number?

A: The foreign transaction number is typically included in the bank statement or payment confirmation you receive for international money transfers. - Q: Why are foreign transaction numbers different lengths?

A: The length of a foreign transaction number varies depending on the country of origin, the intermediary banks involved, and the specific format used by the sender’s bank. - Q: Is it essential to know the foreign transaction number?

A: Yes, understanding the foreign transaction number is crucial for tracking and reconciling international payments, especially for businesses that engage in frequent cross-border transactions.

What Does Foreign Transaction Number In Forex Start With

Conclusion

Understanding foreign transaction numbers is pivotal in the world of Forex trading. By deciphering the structure and significance of these codes, traders and investors can navigate international transactions with confidence. Whether you’re a seasoned professional or just starting your journey in currency exchange, a thorough grasp of foreign transaction numbers empowers you to make informed decisions, streamline your operations, and mitigate potential risks.

Are you interested in learning more about the intricacies of foreign transaction numbers in Forex? Delve deeper into this fascinating topic by exploring additional resources, engaging in online discussions, and consulting with experts in the field. Your quest for knowledge will enhance your understanding, enabling you to navigate the global currency markets with expertise and precision.