Image: getknowtrading.com

In the realm of forex trading, maximizing profits is an art form that requires meticulous precision. Whether you’re a seasoned trader or just starting out, calculating your take-profit level with confidence is the key to unlocking your trading ambitions. Join us on a captivating journey as we delve into the intricacies of take-profit calculation, empowering you with the knowledge to seize opportunities and secure your financial future.

Embark on the Path to Profit: A Comprehensive Guide

Before we dive into the technicalities, let’s unravel the essence of take-profit calculation. As a forex trader, your primary objective is to sell a currency pair for a higher price than you bought it or buy a currency pair for a lower price and sell it later. The take-profit level represents the predefined price point at which you intend to execute this transaction, securing your desired profit.

Laying the Foundation: Understanding Key Terms

To embark on this journey, we must first familiarize ourselves with the fundamental concepts of forex trading.

- Pip: The smallest price change possible in a currency pair. As an example, a movement from 1.1234 to 1.1235 represents a pip gain.

- Lot: A standard unit used to measure the size of a forex trade. One lot typically represents 100,000 units of the base currency.

- Margin: The amount you deposit with your broker as security against potential losses.

- Leverage: The ability to borrow capital from your broker, allowing you to control larger positions with a smaller margin.

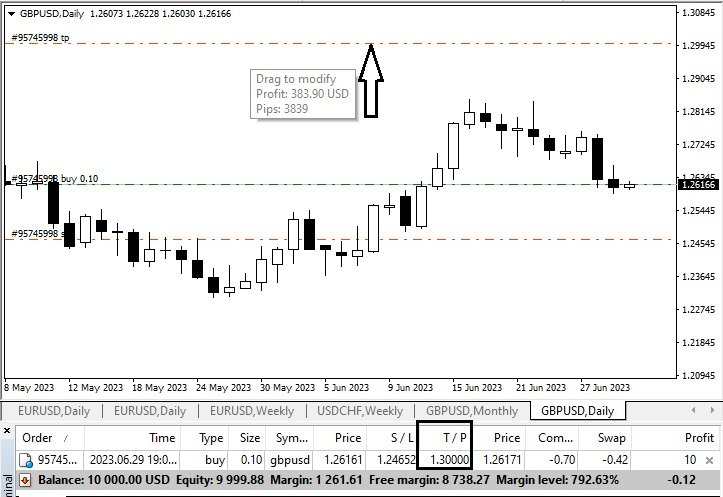

Navigating the Mathematical Maze: Calculating Take-Profit

Now, let’s delve into the heart of the matter: calculating your take-profit level.

-

Determine the Pip Value:

a. Establish the value of a pip based on your account currency and lot size. -

Calculate Your Take-Profit Amount:

a. Multiply the number of pips you aim to gain by the pip value. -

Determine the Take-Profit Price:

a. Add your take-profit amount to your entry price (for buy trades) or subtract it from your entry price (for sell trades).

For instance, if you purchase the EUR/USD currency pair at 1.1234, with a target profit of 50 pips, and a EUR/USD pip value of 0.0001, your take-profit calculation would be:

- Pip Value: 0.0001 EUR per pip

- Take-Profit Amount: 50 pips × 0.0001 EUR = 0.005 EUR

- Take-Profit Price: 1.1234 EUR (Entry Price) + 0.005 EUR (Take-Profit Amount) = 1.1284 EUR

Expert Insights: Enhancing Your Take-Profit Strategy

-

Leverage Trend Analysis: Identify prevailing trends in the market to align your take-profit level with potential price movements.

-

Consider Support and Resistance Levels: Analyze historical price data to establish support and resistance levels that can indicate potential turning points for the currency pair.

-

Employ Risk Management Techniques: Determine an acceptable level of risk for each trade and set your take-profit accordingly to limit potential losses.

Conclusion: Embracing the Power of Precision

Mastering the art of take-profit calculation empowers you to navigate the forex market with confidence and discipline. By precisely calculating your take-profit level, you equip yourself to secure profits and minimize risks, propelling you towards your financial aspirations. Remember, the path to trading success is paved with knowledge and the ability to act with precision. Embrace the insights shared in this article, continuously refine your trading strategies, and unlock the full potential of your forex trading endeavors.

Image: howtotradeonforex.github.io

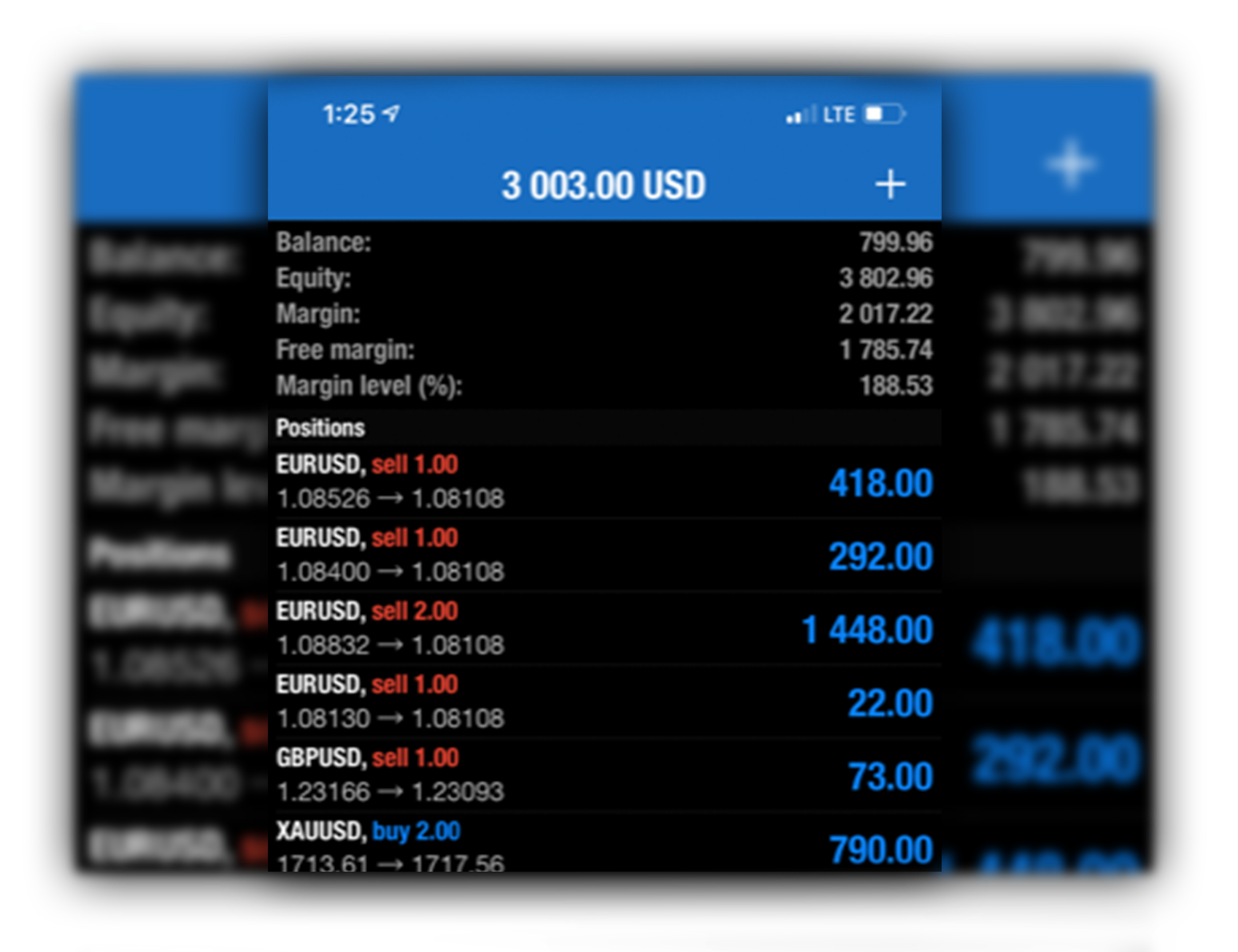

How To Calculate Take Profit In Forex