Introduction:

In the fast-paced world of financial markets, the foreign exchange (forex) market stands as a colossal arena where currencies are traded incessantly. However, contrary to popular perception, forex is not a perpetual 24/7 trading zone. Its ebb and flow are dictated by specific market hours, reflecting the global nature of currency exchange. Embark on a journey into the realm of forex trading and grasp the rationale behind its cyclical nature.

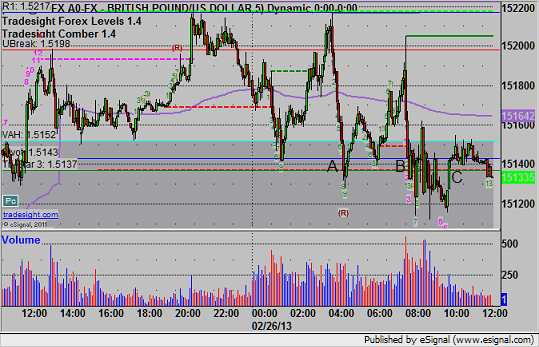

Image: www.tradesight.com

Delving into the Rhythms of Forex Trading:

The forex market’s operating hours are carefully designed to accommodate the diverse time zones of its global participants. Unlike stock exchanges confined to specific trading days and hours, forex trading spans across the globe, following the sun’s journey. As a result, trading sessions overlap, ensuring continuous market activity throughout the week, albeit at varying levels of liquidity and volatility.

The heart of forex trading lies within the major financial hubs: London, New York, Tokyo, Zurich, and Sydney. These metropolises serve as the anchors of the forex market, their time zones dictating the market’s peak trading periods. Each financial center opens and closes at specific times, creating overlapping trading sessions that span the globe 24 hours a day, five days a week.

The Significance of Market Sessions:

The trading sessions in the forex market play a crucial role in shaping its dynamics and liquidity. Each session witnesses a unique interplay of market forces, contributing to the overall price action of currencies.

The Asian session, spanning from 10 p.m. to 6 a.m. GMT, is typically characterized by lower liquidity and volatility. However, as the Tokyo session overlaps with the London session, market activity intensifies, setting the stage for more substantial price movements.

The European session, from 7 a.m. to 4 p.m. GMT, marks the convergence of the world’s major financial centers, leading to the highest liquidity and volatility in the forex market. This period is often characterized by significant price fluctuations, making it an opportune time for active traders.

The American session, from 1 p.m. to 10 p.m. GMT, overlaps with the latter part of the European session, maintaining a relatively high level of liquidity. However, as the European markets close, market activity gradually wanes, paving the way for a quieter trading environment until the Asian session resumes.

The Interplay of Holidays and Market Liquidity:

Holidays play a pivotal role in the rhythm of forex trading, significantly affecting market liquidity and volatility. When major financial centers observe public holidays, trading activity can plummet, leading to thinly traded markets. As a result, price movements during these periods tend to be more erratic and unpredictable.

Traders must remain vigilant during holiday periods, closely monitoring economic calendars and news events that may impact currency prices. Understanding holiday schedules and adjusting trading strategies accordingly can help mitigate potential risks associated with reduced market liquidity.

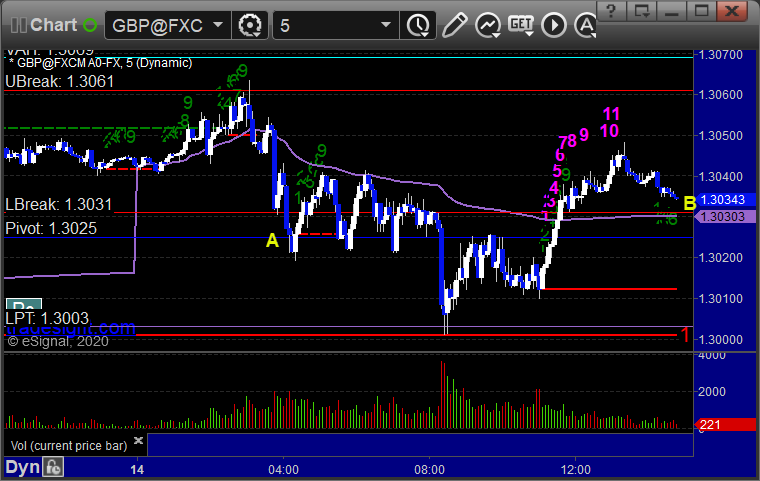

Image: www.tradesight.com

Why Forex Is Not 24 7

Conclusion:

The forex market is a dynamic and ever-evolving environment, its ebb and flow governed by the rhythm of global market sessions and the interplay of holidays. Embracing the cyclical nature of forex trading empowers traders to navigate the complexities of this colossal financial realm. By understanding the dynamics of each trading session and adjusting strategies accordingly, traders can seize opportunities and mitigate risks, ultimately unlocking the full potential of the forex market.