Have you ever wondered how individuals can make a living by trading currencies? The foreign exchange (forex) market is the largest financial market globally, with a daily turnover of trillions of dollars. As a result, traders have numerous opportunities to profit from currency fluctuations.

Image: tradeciety.com

How Forex Trading Works

Forex trading involves speculating on the price movements of currency pairs. Traders buy and sell these pairs, aiming to profit from the spread between the prices. For example, if a trader purchases the EUR/USD pair at 1.10 and the pair subsequently rises to 1.12, the trader will realize a profit.

Key Concepts in Forex Trading

- Pip: The smallest unit of price change in a currency pair.

- Spread: The difference between the bid and ask prices of a currency pair.

- Leverage: Borrowing funds from a broker to increase the potential profit (and risk).

Types of Forex Trading Strategies

Forex traders adopt various strategies to analyze market trends and make informed trading decisions. Common strategies include:

- Technical Analysis: Using historical price data to identify patterns and make predictions.

- Fundamental Analysis: Analyzing economic data and events that may influence currency prices.

- Scalping: Taking many small profits over a short period.

- Trend Trading: Holding positions for days or weeks to ride out market trends.

Image: possibiltydesign.blogspot.com

Latest Trends in Forex Trading

The forex market is constantly evolving, and traders need to keep abreast of the latest trends and developments. Emerging trends include:

- Automated Trading: Using algorithms or bots to execute trades.

- Social Trading: Copying the trades of experienced traders.

- Increased Regulation: Major financial institutions govern and monitor forex trading.

Tips and Expert Advice for Forex Traders

To succeed in forex trading, consider the following tips and expert advice:

- Educate Yourself: Thoroughly understand market dynamics and trading strategies.

- Manage Your Risk: Implement risk management techniques to limit potential losses.

- Use Technical and Fundamental Analysis: Analyze both technical and fundamental factors to make informed decisions.

- Start with a Demo Account: Practice trading without risking real money.

- Be Disciplined: Follow your trading plan and avoid emotional decision-making.

Explanation of Tips and Expert Advice

Understanding the nuances of forex trading is crucial for minimizing risk. Managing risk involves setting stop-loss orders and position sizing based on your account balance. Utilizing both technical and fundamental analysis provides a comprehensive view of market behavior.

Starting with a demo account allows you to familiarize yourself with the trading platform and gain practical experience without the pressure of real money. Lastly, maintaining discipline is essential for resisting the temptation to deviate from your trading plan, which can lead to costly mistakes.

FAQ on Forex Trading

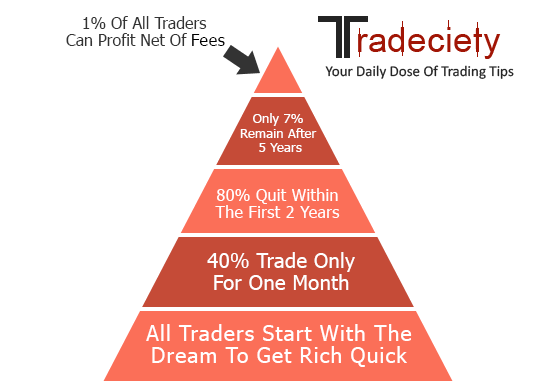

- Q: Can I make a living from forex trading?

A: Yes, but it requires significant knowledge, skill, and risk management. - Q: What is the best forex trading strategy?

A: The best strategy depends on an individual’s risk tolerance and trading style. - Q: Is forex trading risky?

A: Yes, forex trading involves high risk due to market volatility and leverage.

How Do Forex Traders Make Money

Conclusion

Forex trading presents both opportunities for profit and potential risks. By understanding market dynamics, implementing risk management techniques, and seeking guidance from experienced traders, individuals can navigate the market effectively.

Are you ready to explore the exciting world of forex trading? Embrace the challenge, educate yourself, and join the ranks of successful traders who have mastered the art of currency speculation.