Introduction:

In today’s globalized world, it’s more important than ever to have access to convenient and cost-effective ways to manage your finances overseas. Whether you’re a frequent traveler, an aspiring digital nomad, or simply want to make international purchases without breaking the bank, understanding the differences between forex and international debit cards is crucial. In this comprehensive guide, we’ll unravel the pros and cons of each option and help you make an informed decision that aligns with your financial needs.

Image: programminginsider.com

Forex: A Comprehensive Overview:

Forex, short for foreign exchange, refers to the global decentralized market where currencies are traded. When you exchange currency using a forex provider, you’re essentially buying one currency while selling another. Forex transactions are typically conducted between banks, financial institutions, and individuals, and the exchange rates are determined by supply and demand.

Benefits of Forex:

- Competitive exchange rates: Forex providers often offer more competitive exchange rates compared to banks or traditional money changers.

- Flexibility and convenience: You can access forex services online or through mobile apps, allowing you to exchange currencies anytime, anywhere.

- Transparency: Forex markets are highly transparent, with real-time exchange rates displayed on trading platforms.

Drawbacks of Forex:

- Transaction fees: Forex providers typically charge transaction fees that can vary based on the amount being exchanged and the currency pair.

- Complexity: Forex trading can be complex for beginners, requiring an understanding of market trends and currency dynamics.

- Security concerns: Choosing a reputable and regulated forex broker is essential to ensure the security of your funds.

Image: forextradingza1.blogspot.com

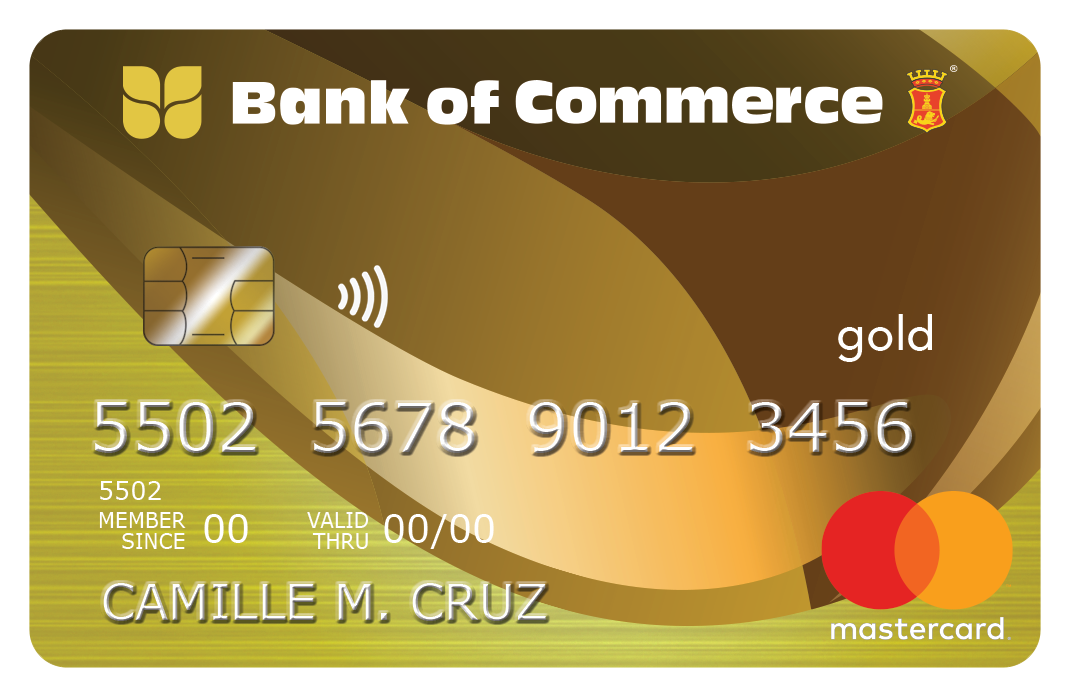

International Debit Card: A Travel Essential:

An international debit card is a debit card that can be used to make purchases and withdraw cash overseas. When you use an international debit card, the transaction is processed through the card’s network (e.g., Visa, Mastercard), which converts the currency at its own exchange rate.

Benefits of International Debit Card:

- Convenience: International debit cards offer the convenience of using one card for all your international expenses.

- No currency exchange fees: Many international debit cards charge no currency exchange fees, making it a cost-effective option for small purchases.

- Wide acceptance: International debit cards are widely accepted at ATMs and merchants around the world.

Drawbacks of International Debit Card:

- Lower exchange rates: The exchange rates offered by international debit cards may not be as competitive as those offered by forex providers.

- Withdrawal fees: International debit card withdrawals may incur fees, particularly when withdrawing from ATMs that are not part of the card’s network.

- Security concerns: As with any debit card, there is a risk of fraud or unauthorized use if the card is compromised.

Which Option Is Right for You?

The choice between forex and an international debit card depends on your specific needs and travel habits. If you’re looking for the best possible exchange rates and flexibility, forex may be a better choice. However, if convenience and simplicity are your priorities, an international debit card might be a more suitable option.

- For frequent travelers who make large international purchases: Forex offers more competitive exchange rates, potentially saving you significant amounts of money.

- For digital nomads or those living abroad: Forex allows for easy and regular currency exchange, making it a practical solution for managing your finances overseas.

- For infrequent travelers who prioritize convenience: An international debit card eliminates the hassle of currency exchange and allows for easy access to cash at ATMs around the world.

Empowering You with Knowledge:

Navigating the complexities of forex and international debit cards can be daunting. That’s why it’s crucial to equip yourself with the right knowledge. Here are some tips:

- Research reputable providers: Whether choosing a forex broker or an international debit card issuer, do your due diligence to select a reputable and reliable provider.

- compare exchange rates: Compare exchange rates offered by different providers before making a transaction to ensure you’re getting the best possible deal.

- Understand transaction fees: Be aware of any transaction fees associated with your chosen option and factor them into your budget.

Forex Vs International Debit Card

https://youtube.com/watch?v=vS8YrQTxZZ4

Conclusion:

Empowering yourself with knowledge about forex and international debit cards is essential for making informed financial decisions when traveling or managing your finances abroad. By understanding the pros and cons of each option, you can choose the one that aligns with your needs and financial goals. Remember, the right decision will provide you with peace of mind, convenience, and the best possible value for your money.