In the dynamic world of forex trading, leverage is a powerful tool that can amplify both profits and losses. Understanding the concept of leverage is crucial for traders at all levels, as it can significantly impact trading outcomes. This guide delves into the ins and outs of leverage, exploring its benefits, risks, and practical applications.

Image: app.jerawatcinta.com

Defining Leverage: A Crucial Concept in Forex

Forex leverage refers to the ability to control a larger position size using a relatively smaller amount of capital. This effectively magnifies the potential profits and losses, making it a double-edged sword. By employing leverage, traders can access larger market exposure and potentially generate higher returns on their investments.

Benefits of Leverage: Enhancing Trading Capabilities

Leverage offers several distinct benefits for traders:

- Increased Profit Potential: By magnifying position sizes, leverage allows traders to potentially reap higher profits from successful trades.

- Lower Initial Investment: With leverage, traders can initiate positions that are larger than their account balance, reducing the initial capital required to enter the market.

- Increased Flexibility: Leverage provides traders with the flexibility to optimize their trading strategies and adjust their risk tolerance accordingly.

Risks of Leverage: Balancing Opportunity and Danger

While leverage offers significant advantages, it also comes with inherent risks that traders must be aware of:

- Amplified Losses: Just as leverage magnifies potential profits, it can also amplify potential losses. Traders must carefully manage their risk exposure to avoid substantial losses of capital.

- Margin Calls: If a trader’s account balance falls below a certain level due to adverse market movements, they may be forced to increase their margin or close their positions to avoid liquidation.

- Psychological Bias: Leverage can lead to overconfidence and hasty decisions, as traders may be tempted to take on excessive risk in the pursuit of higher returns.

Image: fcsapi.com

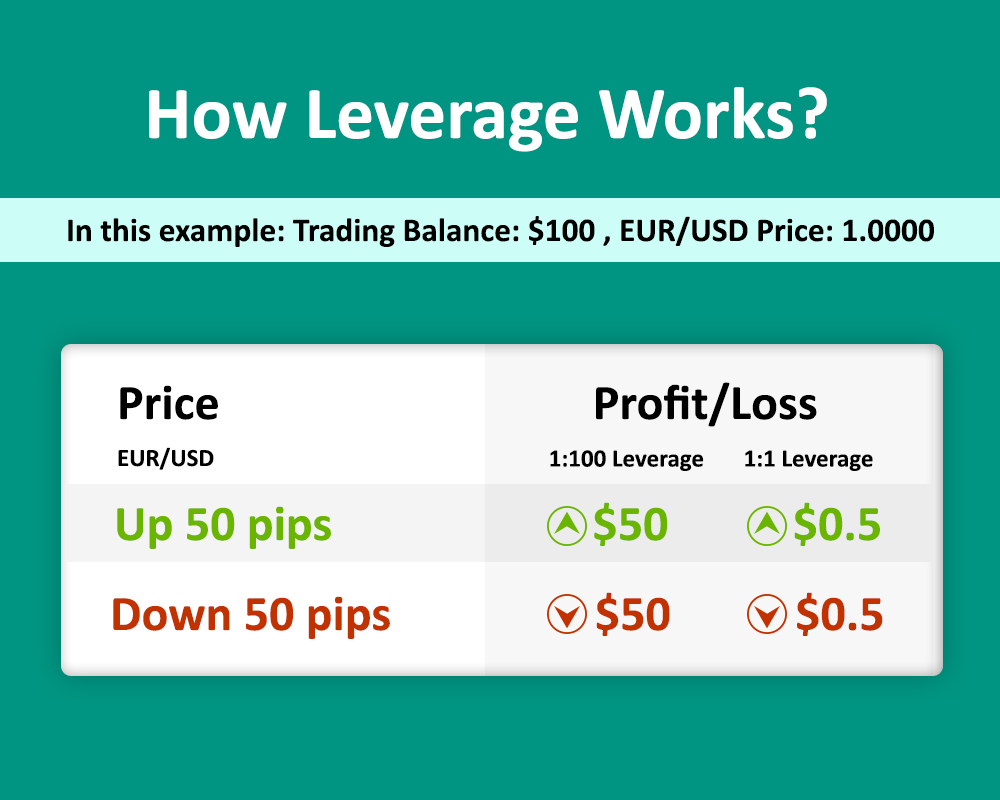

Calculating Leverage: Understanding the Ratios

In forex, leverage is typically expressed as a ratio, such as 1:100 or 1:500. This ratio indicates the amount of leverage available to the trader. For instance, a leverage ratio of 1:100 implies that a trader can control a position worth $100,000 with a capital balance of $1,000.

Practical Applications of Leverage: Trading Strategies

Traders can utilize leverage in various ways to enhance their trading strategies:

- Scalping: Leveraging allows scalpers to enter and exit trades quickly, capitalizing on small price movements, even with a limited account balance.

- Position Trading: Leveraging enables position traders to hold positions over longer periods, potentially magnifying profits on successful long-term trades.

- Hedging: Leverage plays a crucial role in hedging strategies, where traders use it to offset risk and protect their portfolio from adverse market fluctuations.

Managing Leverage: A Balancing Act for Traders

Effective leverage management is key to successful trading. Here are some critical tips:

- Risk Tolerance Assessment: Traders must carefully assess their risk tolerance and determine the appropriate level of leverage to employ.

- Leverage Selection: Based on their risk tolerance, traders should choose a leverage ratio that aligns with their trading goals and risk-taking abilities.

- Margin Monitoring: Traders must regularly monitor their account’s margin level to ensure they are not at risk of margin calls.

- Stop-Loss Orders: Employing stop-loss orders is crucial to limit potential losses and protect against market volatility.

What Does Leverage Mean In Forex

Conclusion: Leverage in Forex – A Powerful Tool, Wisely Wielded

Leverage in forex is a potent tool that can turbocharge trading outcomes, but it should be handled with caution and discipline. By understanding the principles of leverage, its benefits, and risks, traders can harness its power to their advantage. Managing leverage effectively is paramount to optimizing trading performance and mitigating potential setbacks. Ultimately, the wise utilization of leverage empowers traders to maximize profits and navigate the ever-evolving forex market with confidence and control.