Ignite Your Forex Trading Journey with Proven Signals

As a seasoned forex trader, I have witnessed the transformative power of reliable buy and sell signals firsthand. These signals act as guiding stars, illuminating the path towards informed trading decisions and potentially lucrative profits. In this comprehensive guide, I will unveil the intricacies of forex buy and sell signals, empowering you with the knowledge to enhance your trading strategy and navigate the ever-evolving forex landscape.

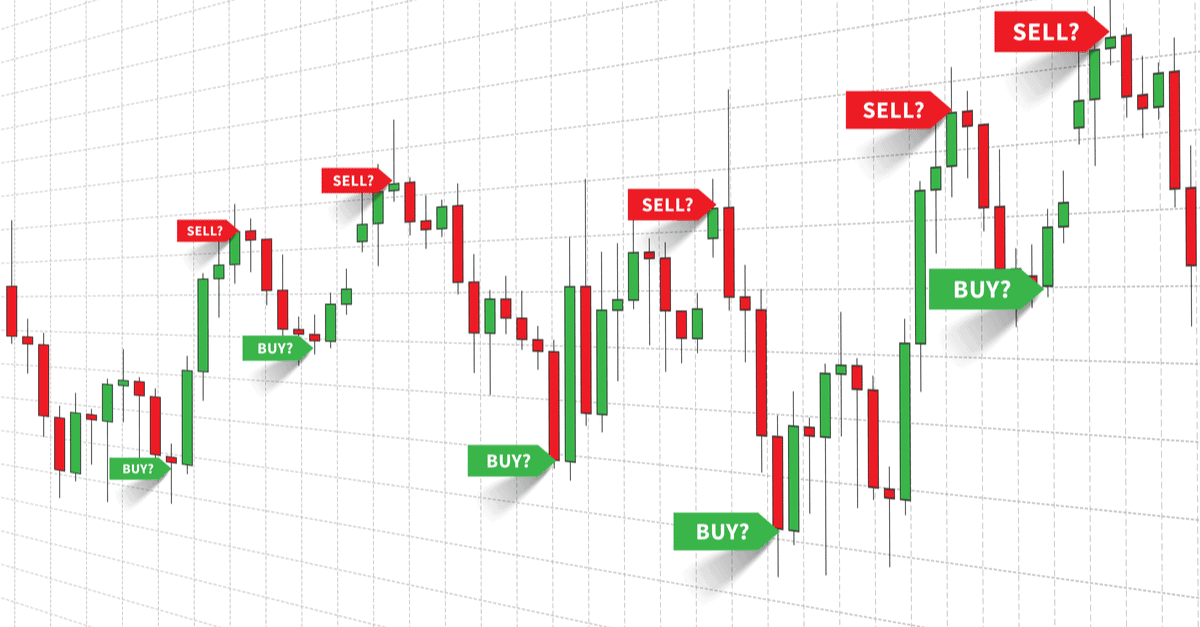

Image: www.pinterest.co.uk

Forex buy and sell signals are actionable alerts, generated through technical or fundamental analysis, that indicate favorable entry and exit points in forex pairings. These signals provide traders with an objective assessment of market conditions, reducing the subjectivity often associated with human decision-making. By leveraging buy and sell signals, traders can effectively time their trades, optimizing their risk-reward ratio and increasing their chances of success.

Understanding the Science Behind Forex Trading Signals

Forex buy and sell signals are derived from a variety of sources, each with its own unique approach to market analysis. Technical signals utilize historical price data to identify patterns and trends, such as moving averages, support and resistance levels, and chart formations. These signals assume that historical market behavior holds predictive value for future price movements.

Fundamental signals, on the other hand, consider economic indicators, political events, and global news that may influence currency valuations. These signals analyze factors that affect supply and demand, providing insights into potential shifts in currency markets. By combining both technical and fundamental analysis, traders can triangulate their decision-making and enhance the accuracy of their trading signals.

Navigating the Forex Signals Landscape: A Trader’s Toolkit

The forex signals market is a dynamic landscape, with a plethora of providers offering varying levels of accuracy and reliability. Manual signals are generated by experienced traders who manually analyze market data and provide trading recommendations. These signals offer a personalized approach but require significant time and expertise to interpret.

Automated signals, powered by algorithms and artificial intelligence, provide real-time analysis and trading recommendations. They offer the convenience of automated execution but may lack the flexibility of human-generated signals. Social trading platforms facilitate copy trading, allowing traders to follow the strategies of successful signal providers. This approach enables beginners to benefit from the experience of seasoned traders but requires careful selection of signal providers.

Insider Trading Tips from a seasoned Professional

Having navigated the turbulent waters of forex trading for years, I have accumulated a wealth of invaluable insights. Here are some exclusive tips to maximize your trading potential: Diversify your signals: Do not rely on a single signal provider. Combine signals from multiple sources with varying methodologies to gain a more comprehensive view of market conditions.

Test signals before investing: Before committing capital, backtest signals using historical data or simulate trades on a demo account. This will provide valuable insights into signal performance and mitigate potential risks.

Manage your risk effectively: Implement a sound risk management strategy to safeguard your capital. Use stop-loss orders to limit potential losses and define your risk tolerance before entering any trade.

Image: www.forextraders.com

Frequently Asked Questions: Unraveling the Mysteries of Forex Signals

- Q: How accurate are forex buy and sell signals?

A: Signal accuracy can vary depending on the provider, market conditions, and the underlying trading strategy.

- Q: How much capital do I need to start trading with signals?

A: The capital required depends on your risk tolerance and trading strategy. It’s recommended to start small and gradually increase your investment as you gain experience and confidence.

- Q: Can I automate my forex trading using signals?

A: Yes, many signal providers offer automated trading solutions that execute trades based on their signals. This eliminates the need for manual trading but requires a reliable signal service

Forex Trading Buy Sell Signals

Conclusion: Embracing Signals for Success

Forex trading buy and sell signals are powerful tools that can elevate your trading performance. By understanding the science behind signals, navigating the signals landscape, and applying proven trading tips, you can unlock a world of profitable trading opportunities. Whether you are a seasoned trader or just starting your forex journey, embrace signals as your trusted guide to the ever-changing forex markets.

Are you ready to embark on a transformative forex trading experience with the power of buy and sell signals? Share your thoughts and questions in the comments below. Let’s ignite your trading journey and illuminate the path to financial success together!