Navigating the dynamic world of forex trading requires the ability to execute trades swiftly and efficiently. This is where liquidity solutions step in, offering an array of benefits that empower traders to maximize their potential. In this comprehensive guide, we delve into the transformative advantages of these solutions, shedding light on how they can elevate your trading experience.

Image: www.leaprate.com

Liquidity: The Lifeline of Forex Trading

Liquidity, the lifeblood of any financial market, refers to the ease with which an asset can be converted into cash. In the forex market, liquidity is paramount, as it enables traders to enter and exit positions swiftly, without incurring significant slippage or price distortions.

Benefits of Liquidity Solutions in Forex Trading

Liquidity solutions provide a comprehensive suite of benefits that address the unique challenges of forex trading, including:

Faster Trade Execution:

Liquidity solutions connect traders to multiple liquidity providers, creating a vast pool of liquidity. This enables traders to execute trades instantaneously, minimizing the risk of missed opportunities or unfavorable price movements.

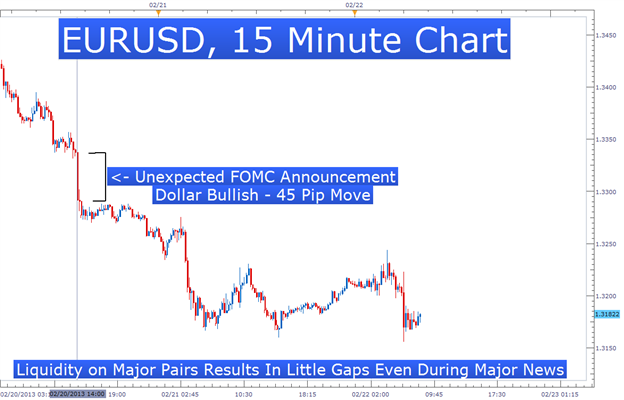

Image: www.dailyfx.com

Reduced Slippage:

Slippage, the difference between the desired and actual execution price, is a common hurdle in forex trading. Liquidity solutions effectively mitigate slippage by matching traders with providers offering the best quotes, reducing the likelihood of price deviations.

Competitive Spreads:

In the highly competitive forex market, spreads, the difference between the bid and ask prices, play a crucial role in profitability. Liquidity solutions aggregate quotes from multiple liquidity providers, allowing traders to access the tightest spreads and maximize their returns.

Improved Market Access:

Liquidity solutions break down geographic barriers, providing traders with access to global liquidity pools. This enables them to trade currencies from any location, maximizing market opportunities and capturing price movements across different time zones.

Enhanced Risk Management:

With improved liquidity, traders can control their risk exposure more effectively. They can execute larger trades with greater confidence, knowing that they have access to sufficient liquidity to mitigate potential losses.

Implementing Liquidity Solutions in Your Forex Strategy

To reap the full benefits of liquidity solutions, traders must strategically incorporate them into their trading plans. Here are some practical steps to follow:

Choose a Reputable Provider:

Selecting the right liquidity provider is essential. Partner with providers who offer high liquidity levels, low spreads, and fast trade execution.

Explore Different Models:

Liquidity providers offer various liquidity models, such as ECN (Electronic Communication Network) and DMA (Direct Market Access). Research the features of each model to determine the one that aligns best with your trading style.

Utilize Multiple Providers:

Diversify your liquidity by connecting to multiple providers. This approach ensures that you have access to a wide range of liquidity sources and minimizes the risk of liquidity constraints.

Monitor Liquidity Levels:

Keep a close eye on liquidity levels, especially during market volatility or news events. Monitor spread values and the availability of quotes from different liquidity providers to make informed trading decisions.

Benefits Liquidity Solutions In Forex

Unlocking the Full Potential of Forex Trading

By leveraging the power of liquidity solutions, forex traders can unlock a world of possibilities. These solutions provide a gateway to faster trade execution, reduced slippage, competitive spreads, improved market access, and enhanced risk management. By incorporating these strategies into their trading plans, traders can elevate their performance, maximize their returns, and confidently navigate the complexities of the forex market.