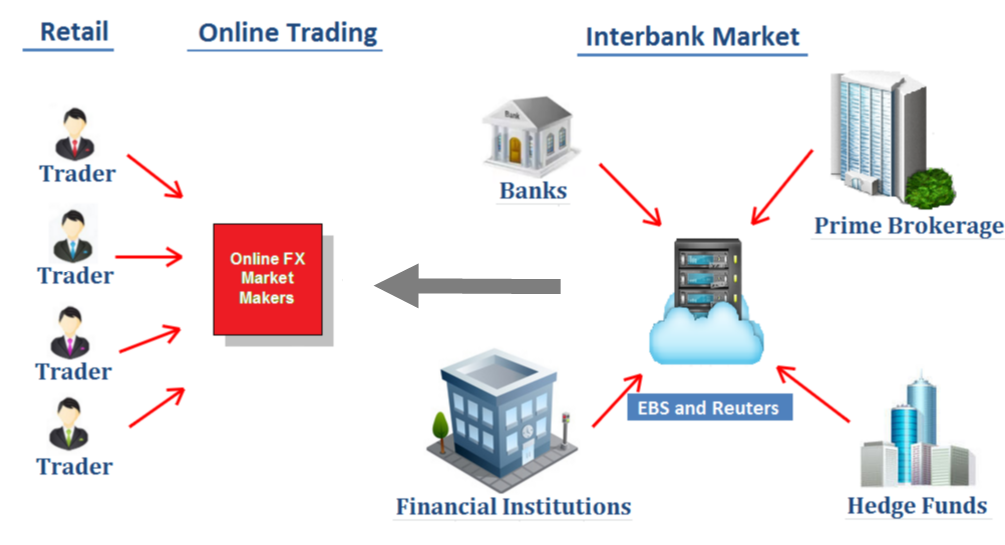

In today’s financial landscape, retail foreign exchange (forex) trading is gaining prominence among banks seeking to offer a comprehensive and diverse range of services to their clientele. This type of trading empowers individuals to trade currencies directly on the interbank market, providing access to a vast global financial ecosystem.

Image: myforexlearn.com

With retail forex trading, banks act as intermediaries between retail traders and the wholesale market, enabling them to capitalize on a dynamic and often volatile financial market. This direct market access empowers individuals to trade multiple currency pairs at competitive spreads, opening up opportunities for profit and portfolio diversification.

Understanding the Concept of Retail Forex

Retail forex trading involves the buying and selling of foreign currencies in relatively smaller volumes compared to institutional or corporate players. It is a speculative form of trading where traders seek to profit from fluctuations in currency exchange rates. Forex trading in banks is often conducted through online trading platforms that provide real-time market data and execution capabilities.

Retail forex trading differs from traditional interbank trading in terms of volume and access. While institutional players trade in large volumes, retail traders typically trade smaller amounts, making it accessible to a broader range of individuals and investors. Moreover, banks offer retail forex trading services to their clients, further expanding the reach of forex trading.

Benefits of Retail Forex Trading in Banks

- Access to global markets: Banks provide direct access to global forex markets, connecting retail traders to the vast liquidity of the interbank market.

- Competitive pricing: Banks offer tight spreads and competitive pricing, allowing retail traders to maximize their profit potential.

- Sophisticated trading platforms: Banks often provide advanced trading platforms with user-friendly interfaces, robust charting tools, and real-time market updates.

- Trusted and regulated: Banks are regulated financial institutions that adhere to strict regulatory frameworks, ensuring a secure and compliant trading environment.

- Customer support and education: Banks offer dedicated customer support and educational resources to assist retail traders in their trading journey.

The Dynamics of Retail Forex Markets

Retail forex markets are characterized by high volatility, influenced by a myriad of factors, including economic data releases, political events, and global market sentiment. Retail traders must possess a thorough understanding of market dynamics, including technical analysis, fundamental analysis, and risk management strategies.

Effective retail forex trading requires a disciplined and systematic approach. Traders must develop a trading plan that outlines their trading strategy, risk tolerance, and position sizing. They must also conduct thorough market research, monitor market news, and adapt to evolving market conditions to increase their chances of success.

Image: marketbusinessnews.com

Tips for Successful Retail Forex Trading in Banks

- Develop a trading plan: Define your trading strategy, risk appetite, and position sizing to guide your trading decisions.

- Manage risk effectively: Use stop-loss orders to limit potential losses and position sizing strategies to manage your overall market exposure.

- Practice discipline: Stick to your trading plan and avoid emotional decision-making. Markets can be unpredictable, and discipline is crucial for long-term success.

- Stay up-to-date with market news: Monitor economic data releases, political events, and global market sentiment to understand how they might impact currency prices.

- Utilize technical and fundamental analysis: Combine technical analysis (chart patterns and indicators) with fundamental analysis (economic data and market news) to make informed trading decisions.

Frequently Asked Questions (FAQs) About Retail Forex Trading in Banks

- Q: How can I start retail forex trading in banks?

A: Open an account with a bank that offers retail forex trading services and fund your account to start trading. - Q: What is the minimum deposit required to trade forex in banks?

A: Minimum deposit requirements vary, but most banks set a low minimum to make forex trading accessible to a wider range of individuals. - Q: Are there any risks involved in retail forex trading?

A: Yes, forex trading involves risk of loss, as currency prices can fluctuate rapidly. Always trade within your means and manage your risk carefully. - Q: How can I learn about retail forex trading?

A: Banks often provide educational resources and webinars on forex trading. Online resources, books, and courses are also available to enhance your knowledge. - Q: Can I make a lot of money trading forex?

A: While it’s possible to profit from forex trading, it’s important to have realistic expectations. Retail forex trading requires a well-defined strategy, risk management, and patience.

What Is Retail Forex In Banks

Conclusion

Retail forex trading in banks offers individuals a compelling opportunity to diversify their portfolios and potentially generate profits by trading currencies directly on the interbank market.

By leveraging the benefits of competitive pricing, sophisticated trading platforms, and regulated environments provided by banks, retail traders can embark on a journey in forex trading. However, success requires a strategic approach, risk management, and a commitment to continuous education.

Are you ready to explore the world of retail forex trading in banks? Connect with us to access exclusive market insights, trading strategies, and educational resources to enhance your trading experience.