In the dynamic world of forex trading, the daily candle closing time marks a critical juncture, presenting both opportunities and challenges for traders. Comprehending the significance of this time can empower investors with indispensable knowledge for informed decision-making and enhanced profitability.

Image: 2ndskiesforex.com

Deciphering the Forex Market Cycle

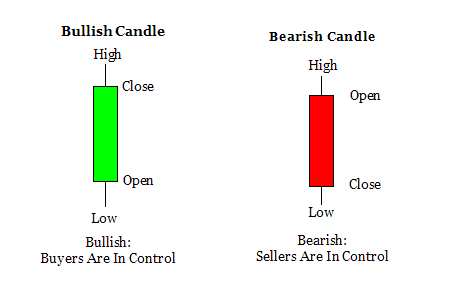

The forex market operates continuously, except for weekends. Each day, market activity is represented by a candle on a price chart. This candle encapsulates the high, low, open, and closing prices of the currency pair over a 24-hour period. The closing time, typically set at 5 PM Eastern Time (EST), marks the culmination of the trading day and signals the final price at which the currency pair settled.

Importance of Candle Closing Time

The daily candle closing time is paramount for several reasons:

- Trend Determination: The closing price provides crucial information about the prevailing market trend. If the candle closes higher than the previous day’s close, it suggests an uptrend, while a lower close indicates a downtrend.

- Support and Resistance Levels: The closing price can create significant support or resistance levels. Traders often use these levels as potential entry or exit points for trades.

- Sentiment Analysis: The closing price reflects the collective sentiment of market participants. If the candle closes significantly higher or lower than the open price, it can indicate increased volatility or a shift in market sentiment.

Trading Strategies Based on Daily Candle Closing Time

Traders can employ various strategies that capitalize on the importance of daily candle closing time:

- Close-Only Trading: This strategy involves trading uniquement based on the closing price of each day’s candle. Traders enter or exit trades at the closing price, avoiding the market noise and volatility during the trading period.

- Breakout Trading: Breakout traders look for candles that close decisively above or below significant support or resistance levels. These candles can indicate the initiation of new trends and offer potential trading opportunities.

- Trend Following: Trend followers analyze the closing price to identify and ride established trends. They enter trades in the direction of the trend and remain invested until the trend reverses.

Conclusion

Understanding the forex daily candle closing time is essential for successful trading. By deciphering its significance, traders can unlock valuable insights into market trends, support and resistance levels, and market sentiment. This empowered understanding empowers investors to make informed decisions, develop effective trading strategies, and navigate the complex world of forex trading with increased confidence and profitability.

Image: www.okforex.it

Forex Daily Candle Closing Time