From towering skyscrapers to humble market stalls, the world of finance is illuminated by a tapestry of charts and graphs. Amidst this visual symphony, candlestick patterns emerge as visual gems that hold the secrets to market behavior. These intricate formations, like hieroglyphs etched into the parchment of time, provide a window into the mind of the markets, offering traders invaluable insights into price movements and potential trading opportunities.

Image: www.tradingsim.com

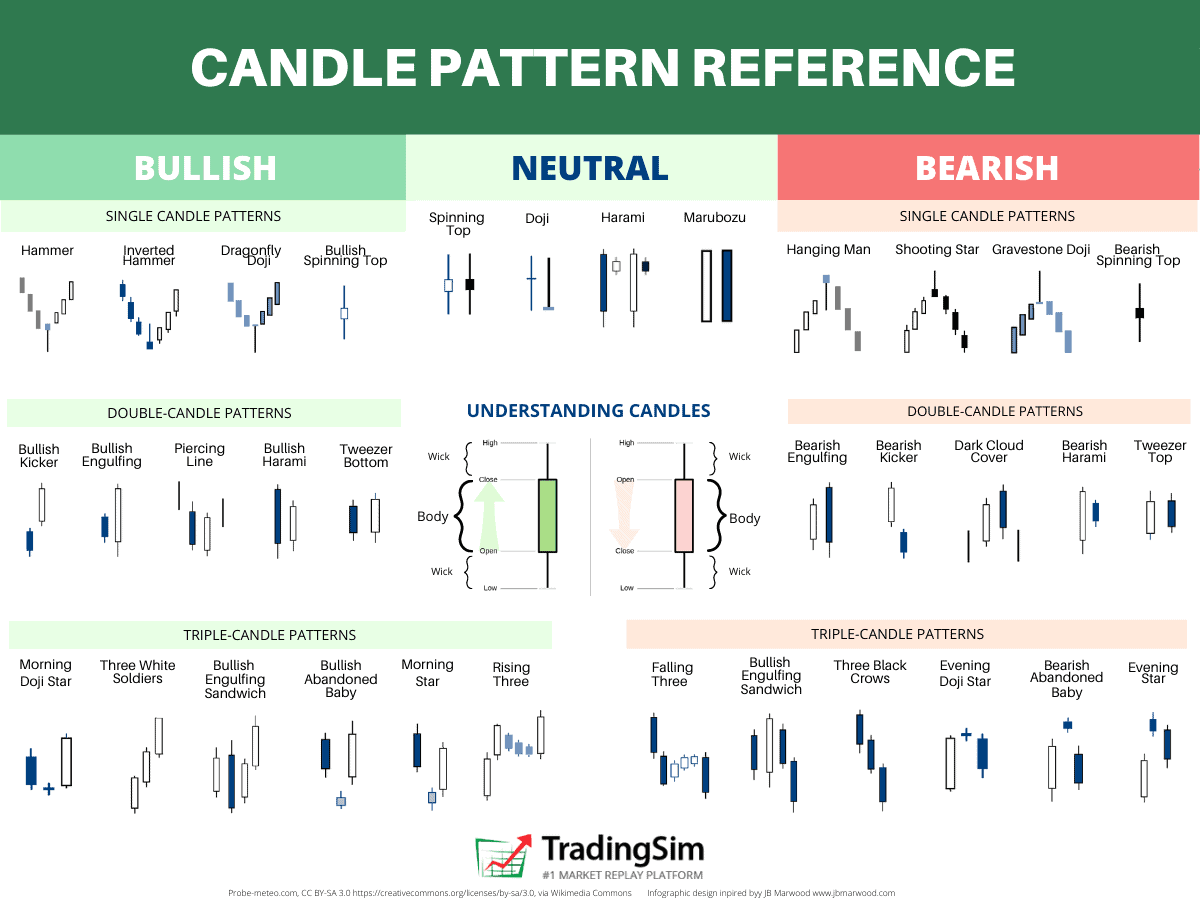

Candlesticks, first developed by 18th-century Japanese rice traders, have become the lingua franca of technical analysis. Each candlestick captures a snapshot of market activity over a specific time frame, typically ranging from a few minutes to several hours or even days. By interpreting the shape, color, and position of these candlesticks, traders can discern patterns that foreshadow future price movements.

The Anatomy of a Candlestick

Body

The body of a candlestick represents the difference between the opening and closing prices of the specific time frame. A filled or hollow body indicates whether the closing price was higher or lower than the opening price.

Wicks

The wicks, or shadows, extending above and below the body represent the highest and lowest prices reached during the timeframe. Long wicks indicate volatility or indecision in the market.

Image: howtotradeonforex.github.io

Major Candlestick Patterns

Bullish Patterns

Inverted Hammer: A small body with a long lower wick suggests that buyers stepped in to push prices higher after a decline. It indicates a potential reversal or continuation of an uptrend.

Bullish Engulfing: A large green candle that completely engulfs the previous red candle signifies bullish momentum and a potential reversal from a downtrend.

Bearish Patterns

Hanging Man: A small body with a long upper wick indicates that sellers took control at the end of the session, potentially signaling a reversal or continuation of a downtrend.

Bearish Engulfing: A large red candle that completely engulfs the previous green candle suggests bearish momentum and a potential reversal from an uptrend.

Trading with Candlesticks

Candlestick patterns provide valuable insights into market sentiment, but they should not be the sole basis for making trading decisions. Traders should consider multiple technical indicators and fundamental analysis to confirm their trading strategies.

Tips and Expert Advice

Understanding the relationship between wicks and the body can shed light on market volatility.

Combining candlestick patterns with other technical analysis tools, such as moving averages and trendlines, can enhance trading strategies.

Backtesting candlestick patterns on historical data can help traders evaluate their effectiveness and calibrate their trading plans.

FAQs

Q: What are candlestick patterns used for?

A: Candlestick patterns help traders identify potential trading opportunities and anticipate price movements based on historical market behavior.

Q: Can candlestick patterns be used in all markets?

A: Candlestick patterns are primarily used in financial markets, including forex, stocks, and commodities, but they can also be applied to other areas such as economics and psychology.

Q: Do candlestick patterns provide guaranteed results?

A: While candlestick patterns offer valuable insights into market behavior, they do not guarantee profitable trades. Traders should use them in conjunction with other analysis methods and risk management strategies.

Forex Candlestick Patterns And What They Mean

Conclusion

Forex trading is a complex and challenging endeavor, but by mastering the language of candlestick patterns, traders can gain an invaluable edge in navigating the markets. These ancient trading tools provide a roadmap to potential market turns and trading opportunities. Whether you are a seasoned trader or just starting your trading journey, understanding candlestick patterns is a fundamental step towards unlocking the secrets of the financial world.

Are you ready to dive deeper into the fascinating realm of forex candlestick patterns? Explore our comprehensive blog for a treasure trove of knowledge and insights designed to empower your trading success!