The world of trading can feel like a complex labyrinth, filled with cryptic charts and flashing numbers. But beneath the surface lies a powerful tool that can illuminate the path to success: candlestick analysis. When I first encountered candlestick charts, I was initially intimidated. I felt like I was staring at a cryptic language I didn’t understand. But, with consistent practice and a focused approach, I found that candlesticks became my secret weapon in navigating the market’s choppy waters.

Image: www.fxdaytrades.com

Today, I want to share the insights I’ve gained through my experience. We’ll delve into the fascinating world of candlestick patterns, exploring their history, their unique significance, and how you can harness their power to make informed trading decisions. Whether you’re a seasoned veteran or a curious newcomer to the financial markets, the knowledge you’ll gain will be invaluable in your journey toward financial freedom.

Decoding the Market’s Language: Understanding Candlestick Patterns

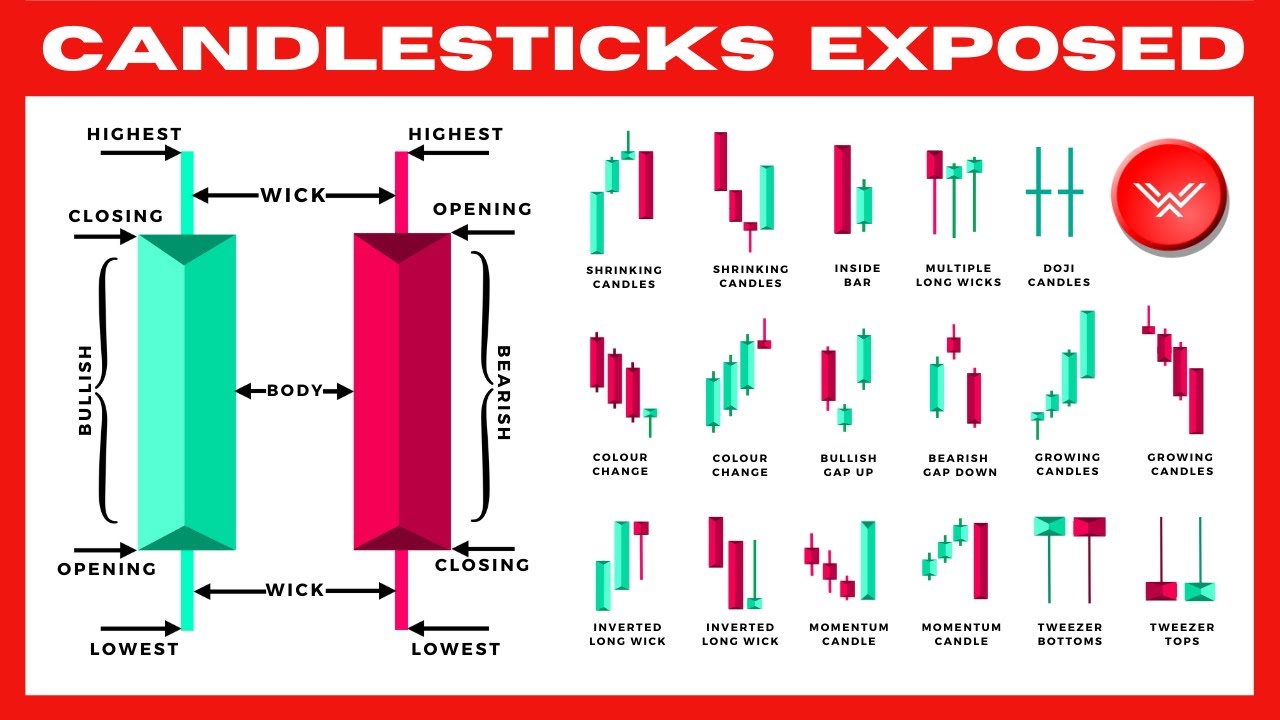

Candlesticks, named for their resemblance to the traditional Japanese candles, reveal a wealth of information about the dynamic interplay of buy and sell pressures in the market. Each candlestick embodies a specific time frame, typically ranging from one minute to one day, and captures the price movement within that period.

The candlestick’s body, represented by a filled-in rectangle, illustrates the difference between the opening and closing prices. If the closing price is higher than the opening price, the candlestick is “bullish” and represented by a white body. Conversely, a “bearish” candlestick, with a closing price lower than the opening price, is depicted with a black body. The wicks, or “shadows,” extending above and below the body, showcase the highest and lowest prices reached within the specified timeframe, providing a visual representation of the price range.

Candlestick patterns are formed when several candlesticks follow a specific arrangement. These patterns can be bullish or bearish, hinting at potential price reversals or continuations. Understanding the language of these patterns can provide valuable insights into market sentiment and help you anticipate price movements.

A Glimpse into History: The Origins of Candlestick Analysis

Candlestick analysis has deep roots in Japan, where it was first developed centuries ago by a rice merchant named Homma. He observed that the price of rice fluctuated based on subtle shifts in demand and supply. To better understand these fluctuations, he developed a system of visualizing price movements through the use of candlesticks. In the 18th century, this powerful tool made its way to the Western world, eventually becoming a cornerstone of technical analysis.

The beauty of candlestick analysis lies in its simplicity and intuitiveness. Even a novice trader can grasp the fundamental principles, and with practice, one can decipher the complex narratives etched into the patterns. Understanding candlestick signals empowers traders to identify potential trends, anticipate price reversals, and make informed trading decisions.

Mastering the Essentials: Key Candlestick Patterns

While there are numerous candlestick patterns, certain patterns stand out as fundamental building blocks for any trader’s repertoire.

Image: www.pinterest.fr

Bullish Candlestick Patterns

- Morning Star: This pattern suggests a potential bullish reversal. It consists of a small black body followed by a larger white body, closing above the midpoint of the previous black body, and ending with a small black or white body. The morning star signals that the selling pressure may be weakening, opening the door for a bullish rally.

- Hammer: This pattern indicates a potential bullish reversal. It is characterized by a small body at the top of the candlestick, with a long lower wick, suggesting buyers stepped in to support the price at a low level.

- Bullish Engulfing: This pattern suggests a bullish continuation. It features a long white body completely engulfing the previous black body, indicating strong buying pressure outweighing the previous selling pressure.

Bearish Candlestick Patterns

- Evening Star: This pattern suggests a potential bearish reversal. It consists of a small white body followed by a larger black body, closing below the midpoint of the previous white body, and ending with a small black or white body. This pattern signals a weakening in buying pressure, indicating a potential bearish trend.

- Hanging Man: This pattern indicates a potential bearish reversal. It is characterized by a small body at the top of the candlestick, with a long lower wick, suggesting sellers are taking control and the price might fall.

- Bearish Engulfing: This pattern suggests a bearish continuation. It features a long black body completely engulfing the previous white body, indicating strong selling pressure outweighing the previous buying pressure.

Candlestick Analysis in Action: Combining Patterns for Deeper Insights

The true power of candlestick analysis lies in recognizing patterns in combination with other analytical tools. When combined with other technical indicators, candlestick patterns can provide a holistic view of market dynamics. For example, a bullish morning star pattern supported by a rising moving average and increasing trading volume can strengthen the signal of a potential price reversal.

While candlestick patterns offer valuable insights, they should not be interpreted in isolation. Successful trading requires a well-rounded approach, incorporating fundamental analysis, risk management, and other technical indicators. Understanding market context and interpreting candlestick patterns within a broader framework is crucial for making informed trading decisions.

Leveraging Candlesticks: Expert Tips and Strategies

Here are some expert tips for effectively using candlestick analysis:

- Choose Your Timeframe: The candlestick patterns you observe can vary depending on the time frame you choose. Experiment with different timeframes, whether they be 1-minute, 5-minute, 15-minute, 1-hour, or daily charts, to find what best suits your trading style and strategy.

- Confirmation is Key: Don’t act solely on a single candlestick pattern. Seek confirmation from other technical indicators or fundamental analysis. Look for patterns that align with the overall market trend or support other signals.

- Practice and Refinement: Like any skill, mastering candlestick analysis requires practice and constant refinement. Keep a journal of your observations and the outcomes of your trades to identify what works best for you.

Frequently Asked Questions (FAQs) about Candlestick Analysis

Q: How accurate are candlestick patterns?

Candlestick patterns are not foolproof predictors, but they offer valuable insights into market sentiment and potential price movements. The accuracy of a pattern depends on its context, confirmation from other indicators, and the overall market environment.

Q: Can I use candlestick analysis for any market?

Candlestick analysis can be used for any market that moves and has price data. They are commonly used for stocks, forex, commodities, and even cryptocurrencies.

Q: What tools can I use to analyze candlestick patterns?

Many trading platforms and software programs have built-in tools for candlestick analysis. You can also use online charting tools that offer free or subscription-based access to candlestick charts and other technical indicators.

Q: What are some common mistakes to avoid when using candlestick analysis?

Avoid relying solely on candlestick patterns without considering the broader market context. Be cautious of “confirmation bias,” where you only seek out information that confirms your pre-existing beliefs. Practice disciplined risk management and don’t trade beyond your comfort zone.

Trading With Candlestick

Closing Thoughts: The Journey Begins Here

Candlestick analysis, a potent blend of history, science, and human psychology, offers a unique and valuable methodology for interpreting market trends. Mastering this art unlocks a richer understanding of market dynamics, allowing you to make informed trading decisions with greater confidence.

Are you interested in learning more about candlestick analysis, or do you plan to incorporate this knowledge into your trading strategy? Share your thoughts and experiences in the comments below! Let’s continue the journey towards mastering the market’s secrets together.