In the labyrinth of global finance, where currencies dance and exchange rates fluctuate, the Forex Application Form at Axis Bank stands as a beacon for aspiring currency traders. Embarking on a Forex trading journey requires a meticulous process, and Axis Bank’s online Forex Application Form is the gateway to unlocking this world of opportunity.

Image: www.techieraj.com

Unlocking the World of Forex Trading

Foreign Exchange trading, commonly known as Forex trading, is the vibrant arena where currencies are bought, sold, and exchanged. It’s a fast-paced, dynamic market that offers the potential for both profits and risks. With the Forex Application Form, Axis Bank empowers individuals to navigate this complex landscape.

Opening a Forex account with Axis Bank is a straightforward process designed for convenience and efficiency. Once approved, traders gain access to a comprehensive trading platform with real-time market data, advanced charting tools, and a range of currency pairs to choose from.

The Forex Application Form plays a pivotal role in ensuring compliance and security. By providing accurate and verifiable information, applicants demonstrate their understanding of the risks associated with Forex trading and their commitment to responsible financial management.

Understanding the Forex Application Form Process

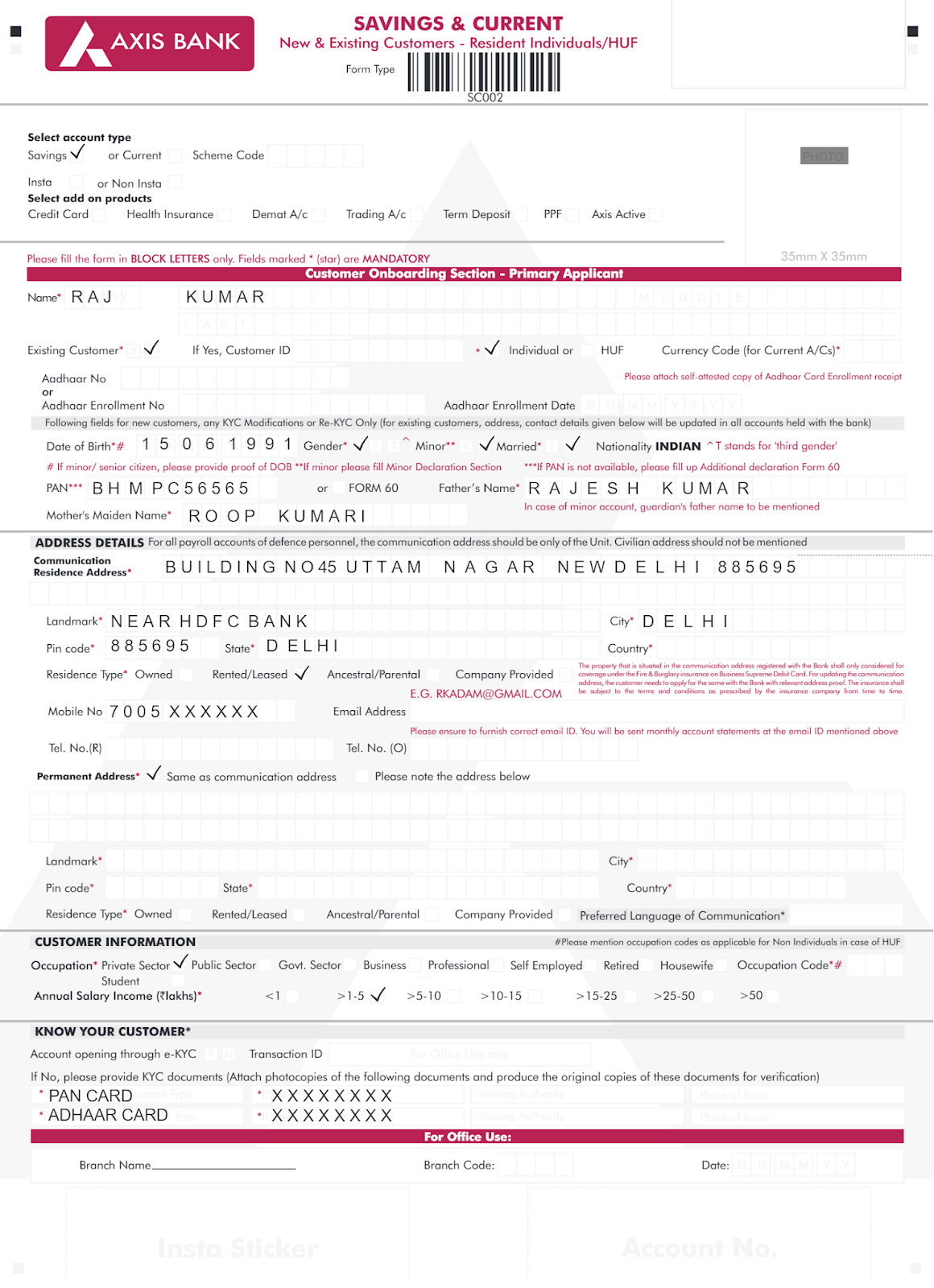

At its core, the Forex Application Form collects vital personal, financial, and trading-related information to:

- Identify the applicant and verify their identity.

- Assess the applicant’s financial standing and risk tolerance.

- Establish the applicant’s trading goals and objectives.

- Ensure compliance with regulatory requirements

To enhance the application’s efficiency and accuracy, Axis Bank has implemented a step-by-step guide to assist applicants. The form is categorized into various sections, each designed to gather specific information:

- Personal Information: Name, age, address, citizenship

- Financial Information: Income, net worth, tax identification number

- Trading Experience: Trading knowledge, risk appetite, investment goals

- Account Details: Desired account type, initial deposit amount

- Risk Acknowledgement: Disclosure and acceptance of trading risks

Upon completing the application form, applicants can expect a processing time of up to 3 working days. Axis Bank diligently reviews each application to ensure that the applicant meets the eligibility criteria and has a clear understanding of the Forex market.

Navigating the Forex Application Form Effectively

Approaching the Forex Application Form with care and attention to detail is essential for a seamless experience. Here are some valuable tips to consider:

- Provide Accurate and Comprehensive Information: Ensure that all information provided on the form is accurate and verifiable. Incomplete or inaccurate information may delay processing.

- Thoroughly Review the Risk Disclosure: Read and understand the risk disclosure statement carefully. Forex trading involves potential losses, and it’s crucial to acknowledge and accept these risks.

- Consider Your Trading Goals: Clearly define your trading goals and objectives before filling out the application. This will help you choose the appropriate account type and trading strategy.

- Seek Professional Advice if Needed: If you’re unsure about any aspect of the Forex Application Form or Forex trading in general, consult with a financial advisor or experienced trader.

By adhering to these tips, you can increase your chances of successful Forex application submission and embark on your trading journey with confidence.

Image: roposh.com

FAQs on the Forex Application Form

Q: What are the eligibility criteria for opening a Forex account with Axis Bank?

A: Generally, applicants must be Indian citizens or residents over 18 years of age. Certain financial criteria may also apply.

Q: How long does the application processing take?

A: Axis Bank aims to process Forex applications within 3 working days, subject to the submission of complete and accurate information.

Q: Can I open multiple Forex accounts?

A: Yes, you may open more than one Forex account with Axis Bank, but each account must have a distinct purpose.

Q: Is there a minimum deposit requirement?

A: Yes, Axis Bank requires a minimum deposit amount to open a Forex account.

Q: What happens if my application is rejected?

A: In the event of application rejection, Axis Bank will provide feedback, suggesting reasons for the decision. Applicants may seek guidance from the bank or a financial advisor.

Forex Application Form Axis Bank

Conclusion

The Forex Application Form at Axis Bank serves as a crucial juncture in the journey of aspiring Forex traders. By completing the form with accuracy and understanding, applicants can take the first step towards accessing the dynamic world of currency trading. Remember, Forex trading carries both opportunities and risks. It’s essential to trade responsibly, manage risks effectively, and seek professional advice when needed.

For those intrigued by the allure of global finance, I invite you to explore the Forex Application Form and embark on your own trading adventure. Stay informed, embrace the challenges, and conquer the markets.