Introduction

In the dynamic realm of forex trading, precision in communication is paramount. The choice between direct and indirect quotation can significantly impact the accuracy and clarity of currency prices. As seasoned traders navigate the forex market, understanding these two citation methods becomes imperative. This article delves into the intricacies of direct and indirect quotation, illuminating their advantages and consequences to empower traders with the knowledge necessary for informed decision-making.

Image: forextradingarbitragesystem.blogspot.com

Direct Quotation: The Market Standard

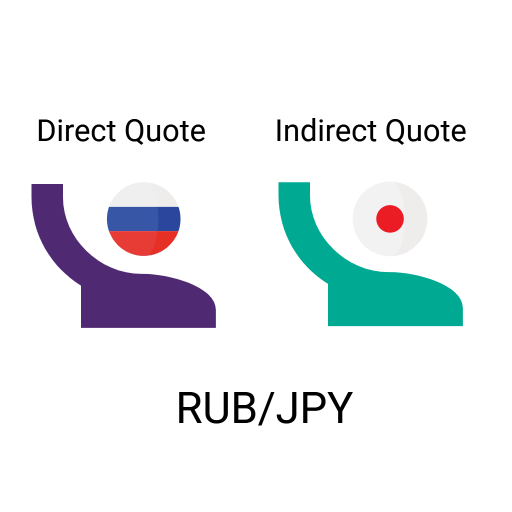

Direct quotation, also known as base currency quotation, presents currency pairs with the base currency denominated in one unit. For instance, in “EUR/USD,” one Euro is quoted against the U.S. Dollar. Notably, direct quotation is the standard practice in the majority of forex markets, including the interbank market. Its straightforwardness and prevalence make it the preferred method for currency trading.

Indirect Quotation: A Mirror Image

In contrast to direct quotation, indirect quotation, sometimes referred to as quote currency quotation, expresses currency pairs with the quote currency denominated in one unit. Using the same example, in “USD/EUR,” one U.S. Dollar is quoted against the Euro. Indirect quotation is commonly employed in specific regions, such as the United States, Japan, and the United Kingdom.

Advantages of Direct Quotation

-

Global Standard: Direct quotation is the universally accepted practice in forex markets worldwide, promoting consistency and ease of comparison across different platforms and brokers.

-

Widely Accepted: The global dominance of direct quotation ensures that currency pairs are quoted in this format on most trading platforms and charts. This widespread adoption simplifies navigation and eliminates confusion.

-

Facilitates Calculations: Performing calculations with direct quotes is straightforward. For instance, to calculate the number of units of the quote currency needed to purchase one unit of the base currency, simply divide the quoted price by one.

Image: boobie-blog67.blogspot.com

Disadvantages of Direct Quotation

-

Less Intuitive for Beginners: Some novice traders may find direct quotation counterintuitive, as it presents the value of the base currency in terms of the quote currency.

-

Requires Conversion for Indirect Markets: When trading in markets that employ indirect quotation, direct quotes require conversion to maintain accuracy. This additional step can introduce potential errors.

Advantages of Indirect Quotation

-

Intuitive for Beginners: Indirect quotation may be more intuitive for beginners, as it expresses the value of the quote currency in terms of the base currency.

-

Conversion Not Required: Currencies quoted indirectly in their respective markets eliminate the need for conversion, ensuring accuracy.

-

Compatible with Local Practices: Indirect quotation aligns with the local conventions of certain countries, providing traders with a familiar and convenient format.

Disadvantages of Indirect Quotation

-

Limited Global Acceptance: Indirect quotation is not as widely used as direct quotation and is confined to specific regions. This limited acceptance can restrict access to a broader range of trading opportunities.

-

Potential Confusion: As indirect quotation is not the norm, traders who are accustomed to direct quotation may face initial confusion.

-

Conversion Required for Direct Markets: When trading in markets that employ direct quotation, indirect quotes require conversion for accuracy. This extra step can introduce potential errors.

Factors Influencing Quotation Choice

The choice between direct and indirect quotation is influenced by several factors, including:

• Regional Conventions: The prevailing convention in a particular market typically determines the quotation method used.

• Trading Strategy: Some trading strategies may be more compatible with a specific quotation method.

• Personal Preference: Ultimately, traders may prefer a particular quotation method based on their own understanding and preferences.

Direct And Indirect Quotation In Forex

Conclusion

Direct and indirect quotation are both valid methods of currency pair citation in forex trading. Direct quotation, as the global standard, offers advantages in terms of consistency, wide acceptance, and ease of calculation. Indirect quotation, while less prevalent, provides intuitive appeal for beginners and compatibility with specific regional practices. Understanding the nuances of these two quotation methods allows traders to navigate the forex market effectively, communicate clearly, and make informed decisions based on accurate price