If you’ve ever wondered how professional traders navigate the complexities of the forex market, look no further than Elliott Wave analysis. This powerful trading tool has been used by generations of investors to identify profitable trading patterns and time market movements.

Image: forextraininggroup.com

Understanding Elliott Wave: A Cyclical Dance in the Markets

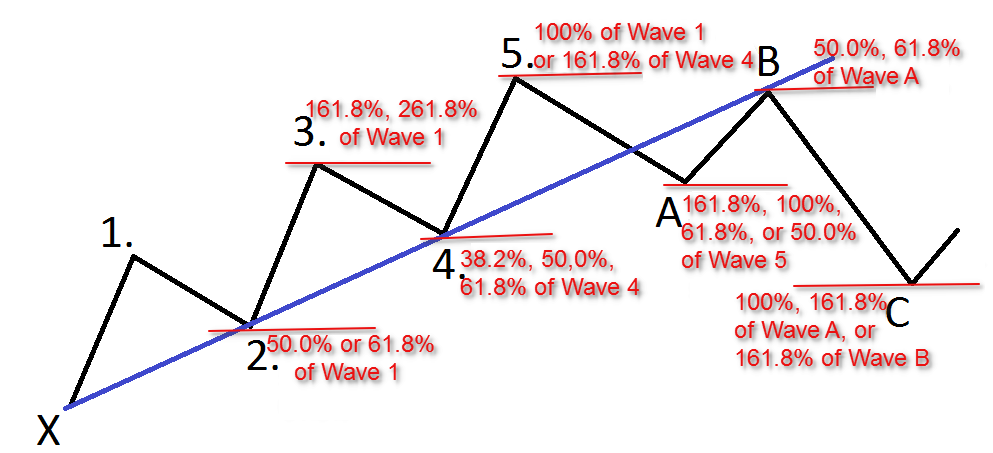

The Elliott Wave Principle revolves around the belief that financial markets move in predictable, repetitive patterns known as waves. These waves resemble a dance, alternating between impulsive and corrective phases, similar to the ebb and flow of the tides. Each wave holds valuable clues about potential market direction and turning points.

The impulsive waves, labeled as 1, 3, and 5, represent the primary trend of the market. They are characterized by a decisive and sustained momentum in one direction. The corrective waves, labeled as 2, 4, and A-B-C, are essentially retracements or pullbacks that occur against the primary trend.

Applying Elliott Wave in Forex Trading

To harness the power of Elliott Wave analysis in forex trading, you need to identify and count the different wave patterns. By carefully studying past market data and current market conditions, traders can determine the wave number and its position within the larger cycle. This information provides crucial insights into the market’s potential next move.

For example, identifying a Wave 3 pattern suggests that the market is in an impulsive uptrend and is likely to continue upward. Conversely, spotting a Wave 4 correction indicates a potential period of consolidation or retracement before the primary trend resumes. By understanding these wave patterns, traders can anticipate market reversals and adjust their trading strategies accordingly.

Tips and Expert Advice for Effective Elliott Wave Trading

Mastering Elliott Wave analysis takes practice and patience, but here are some tips and expert advice to enhance your trading experience.

- Choose the Right Time Frames: Elliott Wave patterns can be applied to various time frames, but beginners should focus on daily and weekly charts for easier recognition.

- Study Historical Examples: Analyze past chart patterns to understand how markets have behaved in different wave numbers. This provides a foundation for identifying future patterns.

- Look for Confirmation: Don’t rely solely on Elliott Wave analysis. Use additional trading tools, like technical indicators or fundamental analysis, to confirm your wave counts.

Image: www.forex-ratings.com

FAQs on Elliott Wave in Forex Trading

Q: Is Elliott Wave a self-fulfilling prophecy?

A: While the Elliott Wave Principle is based on market psychology, it’s not entirely self-fulfilling. Traders’ awareness of the patterns can influence market behavior, but it’s not a guarantee.

Q: Can Elliott Wave analysis predict the future with certainty?

A: Elliott Wave analysis is a probabilistic tool that provides insights into potential market movements. It cannot predict the future with absolute accuracy, but it can increase your chances of making informed trading decisions.

How To Use Elliott Wave In Forex

Conclusion

Elliott Wave analysis, when used skillfully, can be an invaluable tool for forex traders. By understanding the wave patterns and applying the tips provided, you can improve your market timing, identify potential trading opportunities, and navigate market fluctuations with greater confidence.

So, are you ready to learn more about Elliott Wave in forex trading? Dive into the resources below and start your journey to maximizing your trading potential.