Introduction

In the fast-paced world of forex trading, finding reliable strategies to navigate market fluctuations is crucial. The 4-hour MACD forex strategy stands out as a robust and effective tool that empowers traders with valuable insights into market momentum and potential trade opportunities. In this comprehensive guide, we’ll delve into the fundamentals of this strategy, empowering you with the knowledge to make informed trading decisions and unlock the path to profitability.

Image: strategy4forex.com

The Power of the MACD Indicator

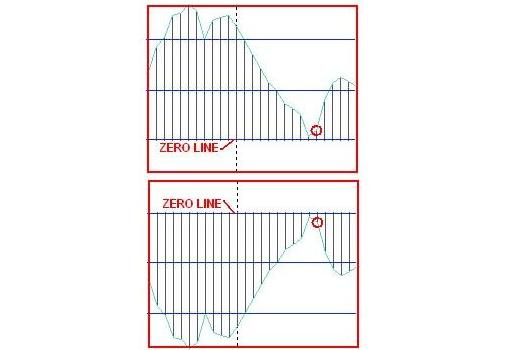

The 4-hour MACD (Moving Average Convergence Divergence) is a technical analysis indicator that measures the relationship between a security’s closing prices and its moving averages. By identifying the convergence or divergence between these averages, traders can gain valuable insights into the market’s strength, momentum, and potential trend reversals.

How the 4-Hour MACD Strategy Works

The 4-hour MACD strategy leverages the MACD indicator to identify short-term trading opportunities based on the following rules:

- Buy Signal: When the MACD line crosses above the signal line (which is typically set to a shorter period) and remains above it, it suggests a bullish momentum. This usually signals an opportune time to enter a buy position.

- Sell Signal: Conversely, if the MACD line crosses below the signal line and stays below it, it indicates a bearish momentum. This triggers an opportunity for short sellers to enter the market.

Real-World Applications of the 4-Hour MACD Strategy

Let’s illustrate the practical application of the 4-hour MACD strategy with an example. Suppose you’re trading the GBP/USD currency pair on a 4-hour timeframe:

- Upward Crossover: If the MACD line intersects and moves above the signal line at the 0.10 level, it signifies a buy signal. Traders can consider entering a long position with a stop-loss below the nearest swing low or support level.

- Downward Crossover: If the MACD line crosses and moves below the signal line at the -0.10 level, it indicates a sell signal. Traders can enter a short position with a stop-loss above the nearest swing high or resistance level.

Image: apkpure.com

Maximizing Your Success with the 4-Hour MACD Strategy

While the 4-hour MACD strategy is powerful, its effectiveness can be further enhanced by incorporating additional technical indicators and risk management techniques:

- Identify Trends: Use moving averages, like the 200-period Simple Moving Average (SMA), to identify market trends and align your trades with the overall market direction.

- Confirm with RSI: Employ the Relative Strength Index (RSI) to gauge market overbought or oversold conditions and confirm your trading signals.

- Set Appropriate Stop-Losses: Utilize proper stop-loss orders to limit potential losses and protect your trading capital.

4 Hour Macd Forex Strategy

Conclusion

The 4-hour MACD forex strategy empowers traders with a reliable framework to navigate market fluctuations and identify potential trading opportunities. By understanding the basic principles of this strategy and incorporating additional indicators and risk management techniques, you can unlock the world of profitable forex trading. Remember, successful trading is a continuous journey of learning, adaptation, and disciplined execution. Embrace the knowledge shared in this guide to unlock the full power of the 4-hour MACD strategy and achieve your financial goals in the forex market.