In the turbulent waters of the forex market, where price fluctuations can leave traders adrift, the MACD divergence indicator emerges as a beacon of hope, a potent tool that can guide you towards profitable trades. Brace yourself as we unravel the intricacies of MACD divergence, empowering you to harness its full potential and navigate the forex labyrinth with confidence.

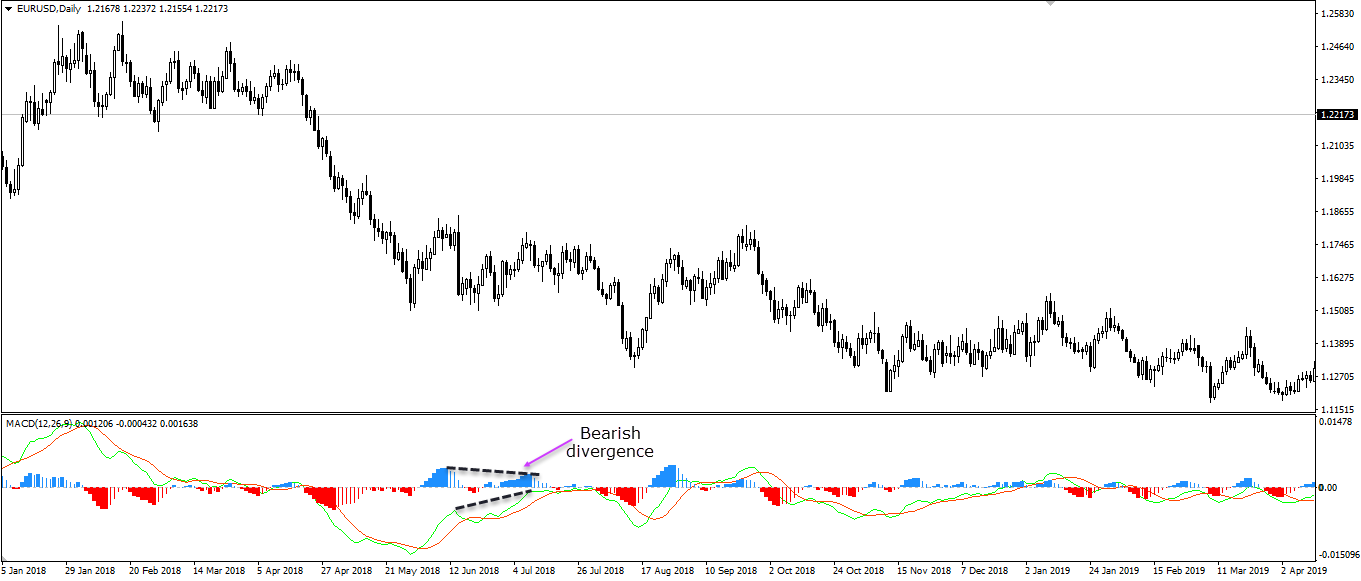

Image: www.fpmarkets.com

Unveiling the MACD Enigma

The Moving Average Convergence Divergence (MACD) indicator is a technical analysis tool that tracks the relationship between two moving averages, providing valuable insights into price momentum and trend direction. Its unique ability to detect divergences between price action and the MACD line offers traders a powerful edge, enabling them to identify potential trend reversals and capitalize on market opportunities.

Divergence Unveiled: A Tale of Misalignment

Divergence occurs when the price of an asset and the MACD line move in opposing directions. This misalignment signals a potential trend reversal, as it suggests that the market’s underlying momentum is diverging from price action. Traders can utilize this discrepancy to anticipate impending market shifts and position themselves accordingly.

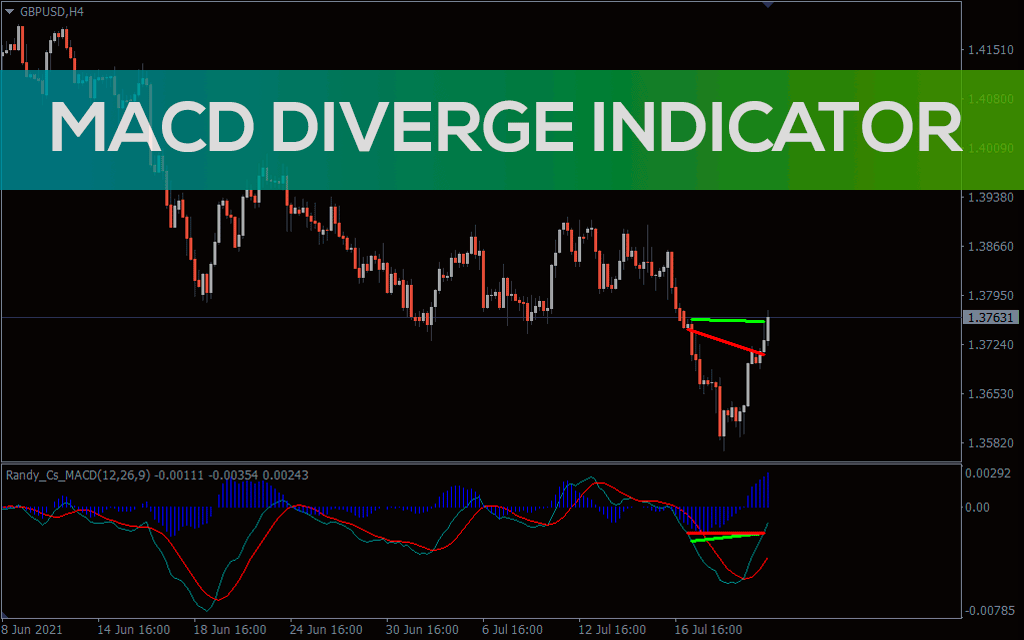

Bullish Divergence: A Ray of Hope

Bullish divergence emerges when the price of an asset creates a higher low while the MACD indicator forms a lower low. This divergence suggests that the market’s underlying momentum is strengthening despite a temporary price dip. It often precedes an upward trend reversal, beckoning traders to buy the dip and ride the impending bullish wave.

Bearish Divergence: A Cautionary Signal

On the flip side, bearish divergence occurs when the price of an asset creates a lower high while the MACD indicator forms a higher high. This divergence serves as a warning sign, indicating that the market’s underlying momentum is weakening despite a temporary price rally. Traders should heed this signal and prepare to sell their positions or brace for a potential market reversal.

Expert Insights: Navigating the Divergence Maze

Renowned forex trader Mark Douglas once said, “The outcome of trading is not a matter of luck or talent. It is a function of your understanding of what is going on in the market.” Equipped with an understanding of MACD divergence, traders can unlock invaluable insights from market behavior.

Expert traders recommend using MACD divergence as a complementary tool alongside other technical indicators to confirm trading signals. By triangulating information from various sources, traders can increase their confidence and make informed trading decisions.

Image: indicatorspot.com

Actionable Tips: Leverage Divergence to Your Advantage

-

Look for clear divergences between price action and the MACD line. Strong divergences hold greater significance and offer higher probability trades.

-

Confirm divergences with other technical indicators to enhance your trading strategy.

-

Manage your risk by setting appropriate stop-loss levels to mitigate potential losses.

-

Don’t blindly follow every divergence signal. Exercise caution and consider the overall market context before entering a trade.

Macd Divergence Indicator Mt4 Forex Factory

Embracing the MACD Divergence Edge

MACD divergence is a powerful weapon in the forex trader’s arsenal, offering invaluable insights into market momentum and potential trend reversals. By mastering the art of divergence trading, you can navigate the forex market with greater precision and confidence, unlocking the gateway to profitable trading opportunities.