As I ventured into the thrilling world of forex trading, I was bewildered by the vast array of brokers. Each one promised unparalleled services and tantalizing bonuses, leaving me overwhelmed and unsure of which to choose. Embarking on this educational journey, I delved into the intricate world of forex brokers, eager to decipher their complexities and empower my financial decisions.

Image: srading.com

Unveiling the Nuances of Forex Brokers

Forex brokers serve as intermediaries between traders and the global currency market, facilitating the seamless execution of trades. They provide a platform, tools, and support, enabling traders to navigate the intricate landscape of foreign exchange. Understanding the different types of brokers empowers traders to make informed choices, aligning their trading strategies with the ideal brokerage partner.

Full-Service Brokers: A Comprehensive Trading Experience

Full-service brokers offer a comprehensive suite of services, catering to both novice and experienced traders. They provide tailored guidance, in-depth market analysis, and personalized trade recommendations. These brokers often charge higher commissions but compensate for it with their comprehensive offerings and personalized approach.

Nurturing Novice Traders: Retail Brokers

Retail brokers are designed specifically for beginner traders, offering user-friendly platforms, educational resources, and low minimum deposits. They typically have higher spreads (the difference between the bid and ask prices) compared to other broker types, but they prioritize simplicity and ease of use, making them an ideal choice for those starting their forex journey.

Direct Market Access Brokers: Trading at the Interbank Level

Direct market access (DMA) brokers provide a direct connection to the interbank market, where large financial institutions conduct their trades. They offer real-time pricing data, high levels of transparency, and the ability to execute trades at the best available prices. However, DMA brokers require higher account balances and trading experience, making them suitable for advanced traders.

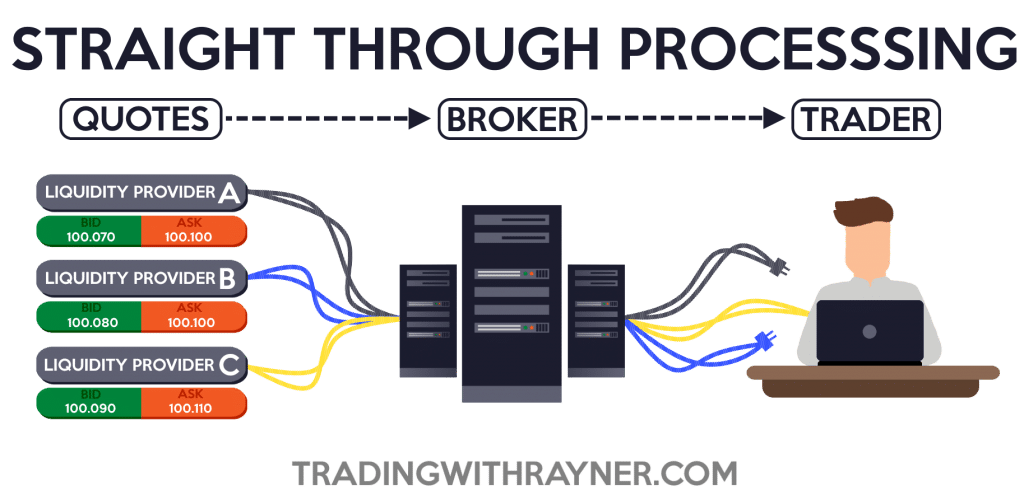

Straight-Through Processing Brokers: Automating Trade Execution

Straight-through processing (STP) brokers automate the trade execution process, offering ultra-fast trade execution speeds and low latency. STP brokers typically have low spreads and transparent fee structures, but they may have limited customer support or educational resources.

Electronic Communication Networks: Connecting the Dots

Electronic communication networks (ECNs) are multilateral trading facilities that connect buyers and sellers directly. They provide access to a vast pool of liquidity and foster greater transparency. ECN brokers often charge a flat fee per trade, but they require a higher level of trading expertise and a strong understanding of the market.

Embracing Innovation: Technology-Focused Brokers

Technology-focused brokers leverage cutting-edge technology to enhance the trading experience. They offer advanced trading platforms, algorithmic trading capabilities, and mobile trading applications. These brokers cater to traders who seek sophisticated tools and high levels of automation.

Expert Tips for Selecting a Broker

Selecting an ideal forex broker hinges on several key considerations. Traders should assess their trading style, experience level, and financial goals to make an informed decision:

1. Consider Trading Style: Determine whether you prefer manual trading, algorithmic trading, or copy trading. Select a broker that aligns with your trading approach.

2. Evaluate Fee Structures: Compare the spreads, commissions, and non-trading fees charged by different brokers. Choose a broker that offers competitive pricing.

3. Assess Customer Support: Opt for a broker that provides reliable customer support through multiple channels, ensuring prompt assistance when needed.

4. Leverage Educational Resources: Seek brokers that offer educational materials, webinars, and market analysis tools to enhance your trading knowledge.

FAQ: Unraveling CommonForex Broker Queries

1. What is the minimum deposit required to open a forex trading account?

Minimum deposit requirements vary across brokers. Some retail brokers offer accounts with low minimum deposits, while DMA brokers may have higher requirements.

2. Are there any hidden fees associated with forex trading?

Be aware of non-trading fees such as inactivity fees, account maintenance fees, and withdrawal fees. Read the broker’s terms and conditions carefully to avoid unexpected charges.

3. What is the difference between a market maker and a non-market maker broker?

Market maker brokers quote their own prices and act as both the buyer and seller, while non-market maker brokers connect traders directly to the interbank market for trade execution.

Conclusion

Selecting the right forex broker is paramount to your trading success. By understanding the different types of brokers, their strengths, and limitations, you can make an informed decision that aligns with your trading goals and preferences. Embrace this knowledge to navigate the forex marketplace with confidence and unlock your trading potential. Are you ready to embark on your forex trading journey?

Image: www.tradingwithrayner.com

Types Of Brokers In Forex