Introduction

In today’s interconnected world, navigating foreign exchange can be an unnerving task. But with the advent of forex cards, travelers and global citizens now have a convenient and secure solution to manage their overseas finances. Among the leading players in the Indian banking sector, RBL Bank stands out with its comprehensive forex card offerings. This article delves into the intricacies of RBL Bank’s forex card reload process, empowering you to reload your card effortlessly and enjoy seamless financial transactions abroad.

Image: panotbook.com

RBL Bank Forex Card: Your Gateway to Global Finance

RBL Bank’s forex card is a prepaid travel card that allows you to load multiple currencies and spend them conveniently while traveling abroad. It eliminates the hassle of carrying large amounts of cash or exchanging currency at unfavorable rates. Additionally, it safeguards you against exchange rate fluctuations and offers competitive exchange rates, ensuring maximum value for your money.

Step-by-Step Guide to RBL Bank Forex Card Reload

1. Create an Online Account

Begin the reload process by creating an online account at RBL Bank’s forex portal. This account will serve as your central hub for managing your forex card and conducting reload transactions.

2. KYC Verification

As part of the anti-money laundering (AML) regulations, you will need to complete Know Your Customer (KYC) verification before reloading your card. This involves submitting personal details, address proof, and identity verification documents.

3. Add Beneficiary Details

Once your account is set up, add the beneficiary details of the RBL Bank forex card you wish to reload. This includes the card number and the name of the cardholder.

4. Select Reload Amount

Determine the amount of foreign currency you wish to load onto your forex card. RBL Bank offers competitive exchange rates, so it’s advisable to do your due diligence and compare rates before making a decision.

5. Select Payment Option

Choose your preferred payment method from the available options, such as net banking, credit card, or debit card. Make sure the bank account or card you use is in your name and has sufficient funds to cover the reload amount.

6. Finalize Transaction

Review the transaction details carefully to ensure accuracy. Once everything is in order, confirm the transaction to initiate the reload process.

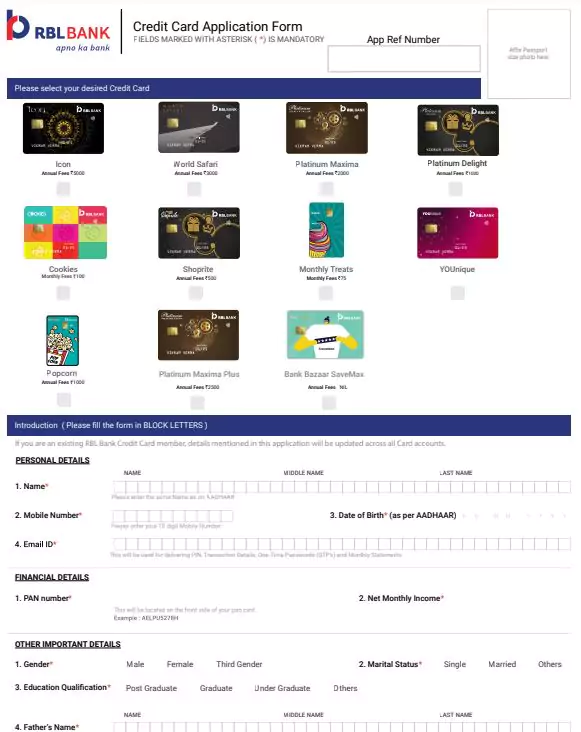

Image: www.youtube.com

Application Form Of Rbl Bank Forex Card Reload

Additional Features and Benefits

Real-Time Tracking: Track the status of your reload transactions in real-time through the RBL Bank forex portal.

Multiple Reload Options: Enjoy the flexibility to reload your forex card via various channels, including online banking, mobile banking, and RBL Bank branches.

Security Guaranteed: RBL Bank employs robust security measures to protect your personal and financial information during the reload process, giving you peace of mind.

Conclusion

Reloading your RBL Bank forex card with the convenient online application process is a breeze. By following the simple steps outlined in this guide, you can seamlessly manage your forex card and enjoy a hassle-free financial experience while abroad. Embrace the benefits of RBL Bank’s forex card and navigate foreign currencies with confidence and ease on your global adventures.