With the rapid evolution of the forex market, choosing the right trading platform has become paramount for successful traders. In this comprehensive guide, we delve into the world of forex trading platforms, exploring their features, advantages, and how to select the one that best aligns with your trading needs and strategies.

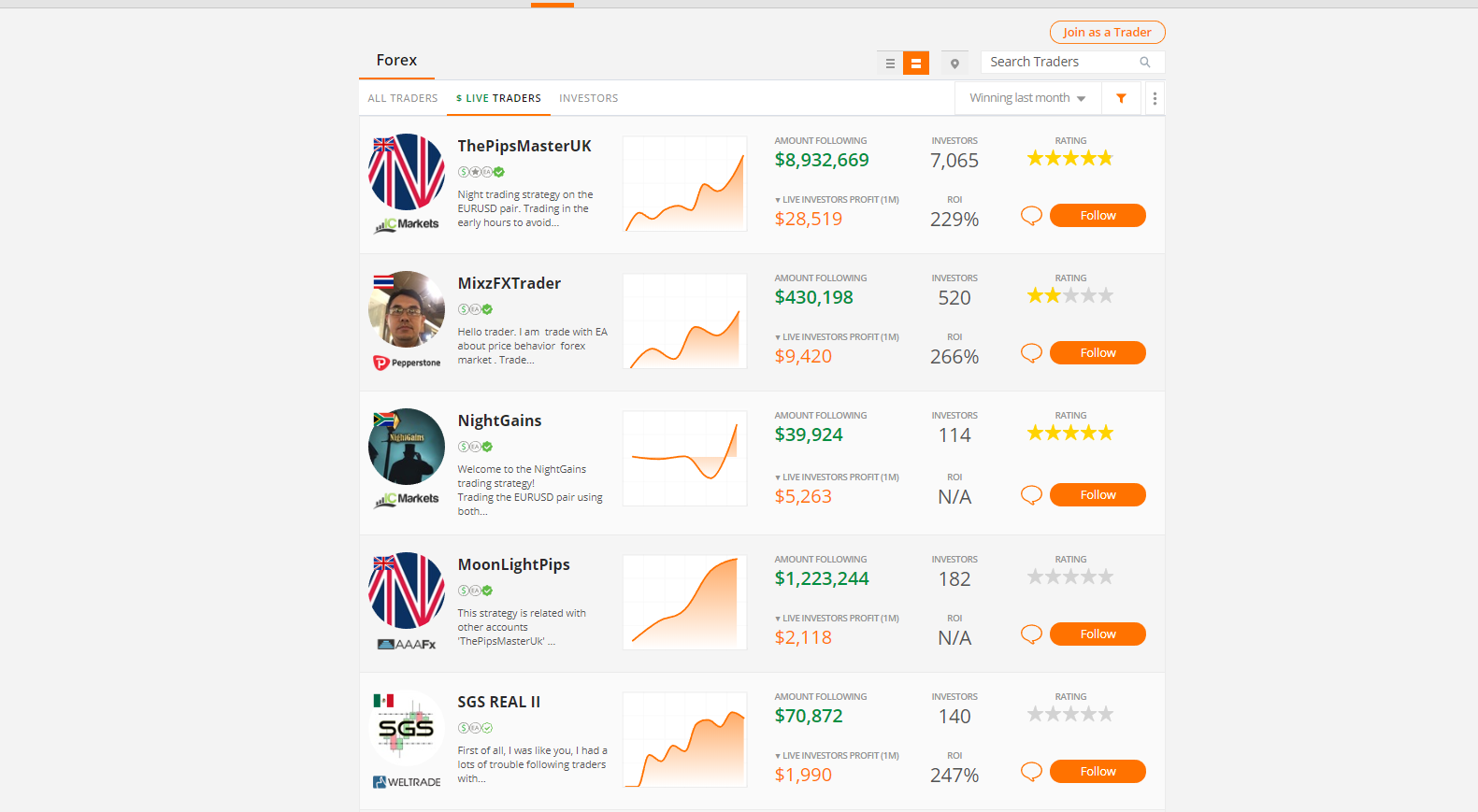

Image: www.forexpeacearmy.com

Understanding Forex Trading Platforms

A forex trading platform is a software application that provides traders with access to the foreign exchange market. It allows them to analyze price charts, place orders, and manage their trades in real-time. Forex trading platforms have evolved significantly over the years, offering a wide range of features and capabilities to meet the diverse needs of traders.

Key Features of Forex Trading Platforms

- Technical Analysis Tools: Most platforms offer a comprehensive suite of technical analysis tools, such as charting capabilities, indicators, and drawing tools, enabling traders to identify trading opportunities and make informed decisions.

- Order Types and Execution: Forex trading platforms provide access to various order types, including market orders, limit orders, and stop orders. They also offer different order execution modes, such as instant execution and pending orders.

- Risk Management Features: To mitigate risks and protect capital, trading platforms provide risk management tools like stop-loss orders, take-profit orders, and trailing stops, allowing traders to define their risk tolerance and manage their positions effectively.

- Account Management: Forex trading platforms allow traders to easily manage their accounts, including depositing and withdrawing funds, viewing trading history, and accessing account statements.

- Mobile Trading: Modern trading platforms offer mobile trading capabilities, enabling traders to access their accounts and trade on the go, providing greater flexibility and convenience.

Choosing the Right Forex Trading Platform

Selecting the right forex trading platform depends on several factors, including trading style, experience level, and individual preferences. Here are some key considerations to keep in mind:

Image: www.forex.academy

1. Trading Instruments and Markets

Consider the trading instruments and markets you plan to trade. Different platforms offer access to various forex pairs, CFDs, and other financial instruments. Ensure the platform supports the instruments you intend to trade.

2. Technical Analysis Capabilities

If you rely heavily on technical analysis, choose a platform with advanced charting features, a wide range of indicators, and customizable time frames. This will enhance your ability to identify trading opportunities.

3. Order Execution and Trading Costs

The speed and reliability of order execution can significantly impact trading performance. Research the platform’s order execution speed and trading costs, including spreads, commissions, and slippage.

4. User Interface and Usability

Choose a platform with a user-friendly interface that aligns with your trading style. Consider factors such as the platform’s navigation, layout, and customization options to ensure it provides a seamless trading experience.

Top Forex Trading Platforms on the Market

Among the numerous forex trading platforms available, a few have consistently ranked among the best. Here are some of the most popular and well-regarded platforms:

1. MetaTrader 4 (MT4)

MT4 is a classic trading platform known for its ease of use, customizable interface, and extensive range of technical analysis tools. It remains a popular choice among retail forex traders.

2. MetaTrader 5 (MT5)

MT5 is the successor to MT4, offering a more advanced platform with additional features and capabilities. It includes Depth of Market (DOM), algorithmic trading capabilities, and a built-in economic calendar.

3. cTrader

cTrader is a cutting-edge trading platform that emphasizes speed, precision, and transparency. It offers low latency execution, advanced charting tools, and a FIX API for institutional clients.

4. TradingView

TradingView is primarily a charting platform that has expanded into offering trading capabilities. It provides comprehensive technical analysis tools, a global community of traders, and the ability to create and share custom indicators.

5. OANDA Trade

OANDA Trade is a proprietary platform developed by OANDA, one of the leading forex brokers. It offers a user-friendly interface, advanced risk management features, and direct market access through the OANDA FX Global MTF.

Most Popular Forex Trading Platform

Conclusion

Choosing the right forex trading platform is essential for maximizing trading success. By considering your trading style, needs, and preferences, you can select a platform that provides the tools, features, and functionality to help you navigate the complexities of the forex market. Whether you’re a beginner or an experienced trader, taking the time to research and select the right platform can significantly enhance your trading experience and improve your overall profitability.