Introducing the Ultimate Foreign Exchange Solution

In today’s interconnected global landscape, navigating international transactions can be a daunting task. Dealing with multiple currencies, exchange rates, and hidden fees can be both time-consuming and costly. However, Yes Bank offers a revolutionary solution with its Multi Currency Forex Card, empowering you to manage your foreign exchange needs effortlessly.

Image: housing.com

Benefits of the Yes Bank Multi Currency Forex Card

The Yes Bank Multi Currency Forex Card is designed to provide seamless convenience and cost-effective currency management. Here’s how it benefits you:

- избавиться от хлопот обмена валюты: Avoid the hassle and potential risks of carrying cash abroad. The card allows you to load up to 10 different currencies, eliminating the need for multiple currency exchanges.

- экономить на обменных курсах: Get the best possible exchange rates guaranteed by Yes Bank. The card offers competitive rates, saving you money on every transaction.

- Отслеживать расходы в реальном времени: Manage your finances effortlessly with real-time transaction notifications and an online account that provides detailed expense tracking.

Understanding the Yes Bank Multi Currency Forex Card

The Yes Bank Multi Currency Forex Card is a prepaid card that allows you to store and use multiple currencies. It functions like a regular debit card, but with the added flexibility of managing different currencies in a single card. You can load the card with the currencies you need before your trip, ensuring you have the right currency for your destination.

To use the card, simply select the currency you want to spend from the card’s chip menu. The card automatically converts the transaction into the local currency, ensuring you get the most favorable exchange rate. You can use the card at any ATM or merchant that accepts Visa or Mastercard.

Latest Trends and Developments in Multi Currency Forex Cards

The Multi Currency Forex Card market is constantly evolving to meet the changing needs of global travelers. Here are some of the latest trends and developments:

- Contactless Payments: Contactless payment technology is becoming increasingly popular for Multi Currency Forex Cards, offering a convenient and secure way to transact without the need for physical card swipes.

- Mobile Integration: Many card issuers now offer mobile apps that allow cardholders to manage their accounts, track expenses, and load currencies on the go.

- Enhanced Security: Multi Currency Forex Cards are equipped with the latest security features to protect against fraud and unauthorized access.

Image: vakilsearch.com

Tips and Expert Advice for Using Multi Currency Forex Cards

To maximize your benefits when using a Multi Currency Forex Card, consider the following tips and expert advice:

- Load the Card Wisely: Plan your travel itinerary and estimate your currency needs before loading the card. This ensures you have the right currencies and avoid unnecessary exchange fees.

- Compare Exchange Rates: Before loading your card, compare exchange rates offered by different issuers to secure the best deal.

- Be Cautious of ATM Fees: ATM withdrawals can incur fees, both from the card issuer and the local ATM operator. Utilize bank ATMs whenever possible to minimize these charges.

FAQs on Yes Bank Multi Currency Forex Card

- Q: What documents are required to apply for a Yes Bank Multi Currency Forex Card?

A: You will need a valid Indian passport, a valid Indian visa (if applicable), and a passport-sized photograph. - Q: What are the charges associated with the Yes Bank Multi Currency Forex Card?

A: There is a one-time issuance fee and a foreign exchange margin fee on every transaction. - Q: Can I add currencies to my card after issuance?

A: Yes, you can add or remove currencies to your card at any Yes Bank branch.

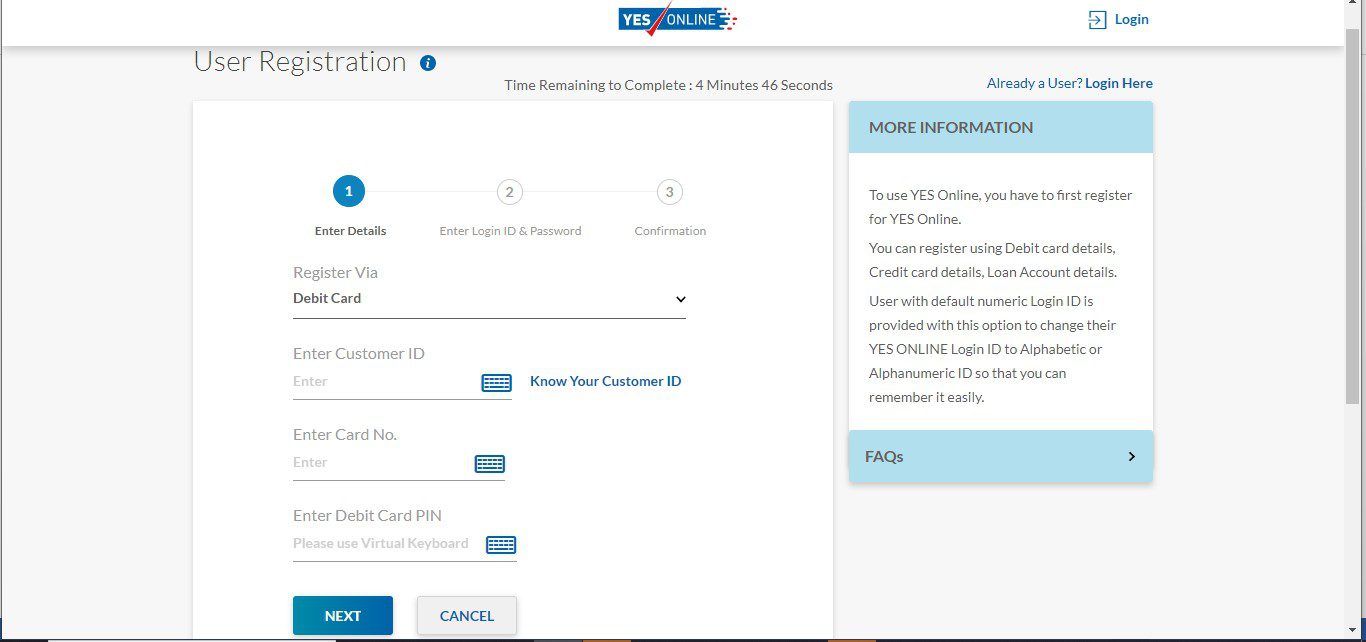

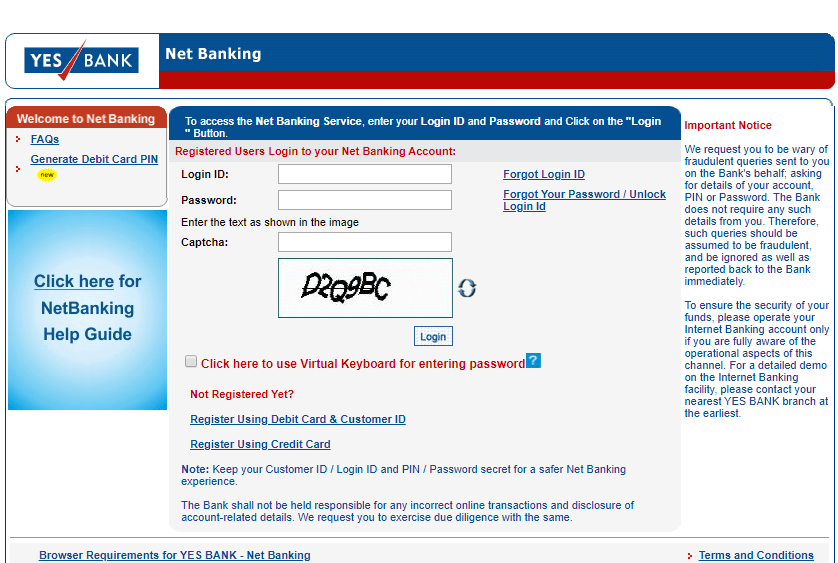

Yes Bank Multi Currency Forex Card Login

Conclusion

The Yes Bank Multi Currency Forex Card is an indispensable tool for global travelers, offering a seamless and cost-effective way to manage foreign exchange needs. With its competitive exchange rates, real-time tracking, and enhanced security features, the card empowers you to navigate international transactions with confidence.

Are you ready to unlock a world of currency convenience with Yes Bank Multi Currency Forex Card? Visit your nearest Yes Bank branch or apply online today.