Introduction

In the bustling world of forex trading, understanding chart timeframes is paramount to making informed decisions. Among them, the M30 or 30-minute chart holds immense significance, providing traders with a crucial perspective on market movements. In this comprehensive guide, we’ll delve into the intricacies of the M30 chart, exploring its benefits, applications, and how it can empower traders to navigate the forex landscape with confidence.

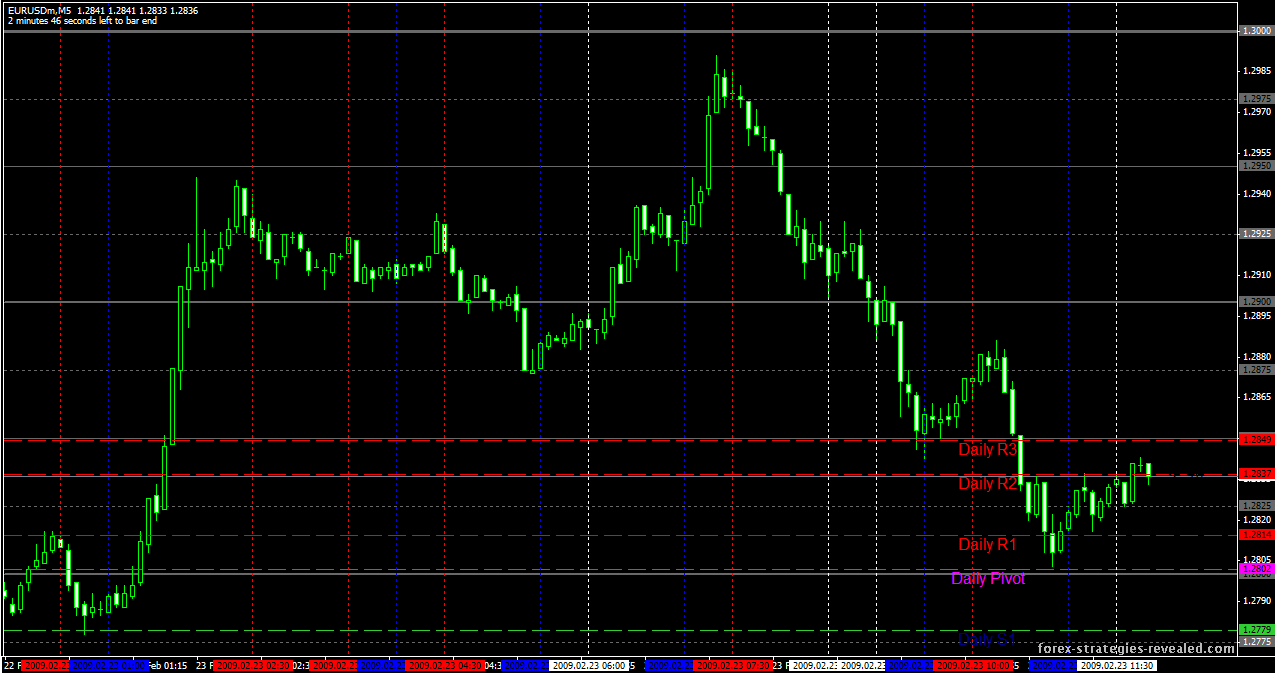

Image: forex-strategies-revealed.com

Exploring the M30 Chart: A Foundation for Success

The M30 chart, as its name suggests, encapsulates price activity over 30-minute intervals. This medium-term timeframe offers a balance between short-term volatility and long-term trends, allowing traders to observe market dynamics at an optimal level. It bridges the gap between quick price fluctuations and broader trends, providing a comprehensive view of price action.

Advantages of M30 in Forex Trading

- Spotting Short-Term Trends: By analyzing periods of price movement within 30-minute intervals, traders can identify potential trade opportunities and assess the direction of market sentiment.

- Confirming Price Patterns: The M30 chart can aid in confirming chart patterns, such as support and resistance levels, pennants, and triangles. These patterns provide vital clues about future price behavior.

- Identifying Market Swings: The M30 timeframe helps traders gauge the extent of price swings and identify areas where a trend may reverse or consolidate.

- Managing Risk: Using the M30 chart, traders can assess risk factors and determine appropriate stop-loss and take-profit levels for their trades.

- Scalping Opportunities: Scalpers, who seek to profit from short-term market fluctuations, find the M30 chart particularly suitable for identifying quick entry and exit points.

Practical Applications of the M30 Chart

Image: www.youtube.com

Identifying Trend Directions

The M30 chart serves as a reliable indicator of trend direction. When prices consistently make higher highs and higher lows, an uptrend is likely unfolding. Conversely, lower highs and lower lows signal a downtrend.

Identifying Support and Resistance Areas

Support and resistance levels are crucial in technical analysis, indicating points where price action tends to bounce or meet resistance. By identifying these levels on the M30 chart, traders can predict potential areas of price reversal.

Detecting Price Reversals

The M30 chart can provide valuable insights into upcoming price reversals. Divergences between price action and technical indicators or the creation of reversal patterns can forewarn traders of a potential change in trend.

Identifying Trading Opportunities

Traders can leverage the M30 chart to identify potential trading opportunities. Specific price patterns, such as breakouts of support or resistance, or candlestick reversal formations, may present viable entry and exit points.

Expert Insights and Practical Tips

Insights from Seasoned Traders

- “The M30 chart is my primary timeframe for swing trading,” advises expert trader Mark Douglas. “It offers the ideal balance between speed and detail, helping me identify profitable trends.”

- “Always consider multiple timeframes,” suggests technical analyst Anna Coulling, “Combining the M30 chart with other perspectives provides a more comprehensive trading strategy.”

Actionable Tips for Enhanced Trading

- Experiment with different technical indicators on the M30 chart to find those that align best with your trading style.

- Integrate the M30 chart with other timeframes to gain a broader market understanding.

- Utilize price action strategies, such as candlestick patterns and chart analysis, to enhance your profit potential.

- Practice risk management diligently by employing proper stop-loss and take-profit orders.

What Is M30 In Forex

Conclusion

The M30 chart is an indispensable tool for savvy forex traders, offering a unique perspective on market movements. By understanding its advantages and applying the practical tips outlined in this guide, traders can unlock the power of the M30 timeframe, improving their trading performance and navigating the forex markets with confidence. Remember, continuous learning, market analysis, and risk management will always be crucial to achieving success in this dynamic trading realm.