As a seasoned forex trader, I vividly recall my initial encounters with candlestick charts. Little did I know that these seemingly intricate patterns would become indispensable tools in my trading arsenal. Their ability to convey a wealth of market information, ranging from price action to sentiment, captivated me from the outset. Embark on this comprehensive guide, dear reader, and unveil the secrets of candlesticks, empowering you to navigate the dynamic forex markets with confidence.

Image: www.stockmarkethacks.com

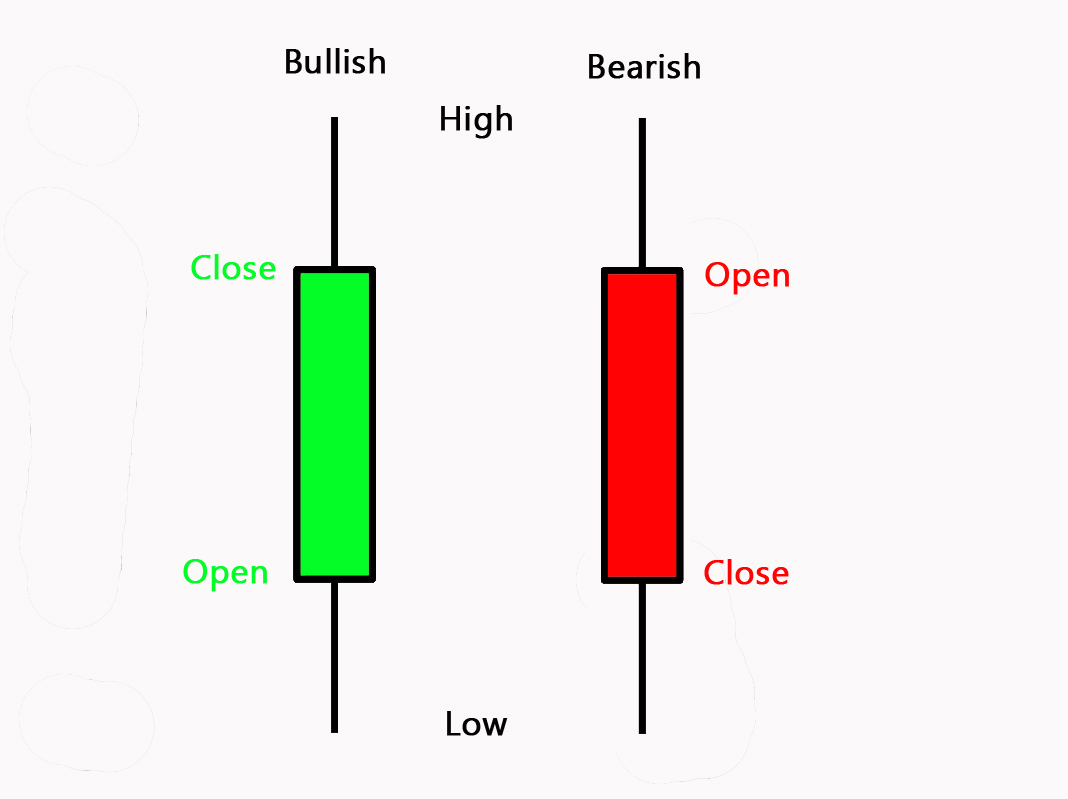

Understanding Candlestick Basics

Candlesticks are graphical representations of price movements over a specified period, typically ranging from a minute to a month or more. Each candlestick comprises several components: the body, upper wick, and lower wick. The body denotes the range between the opening and closing prices, while the wicks extend beyond the body, indicating the highest (upper wick) and lowest (lower wick) prices reached during the interval.

Anatomy of a Candlestick

- **Body:** Represents the price difference between the opening and closing prices.

- **Upper Wick:** Extends above the body, indicating the highest price reached.

- **Lower Wick:** Extends below the body, indicating the lowest price reached.

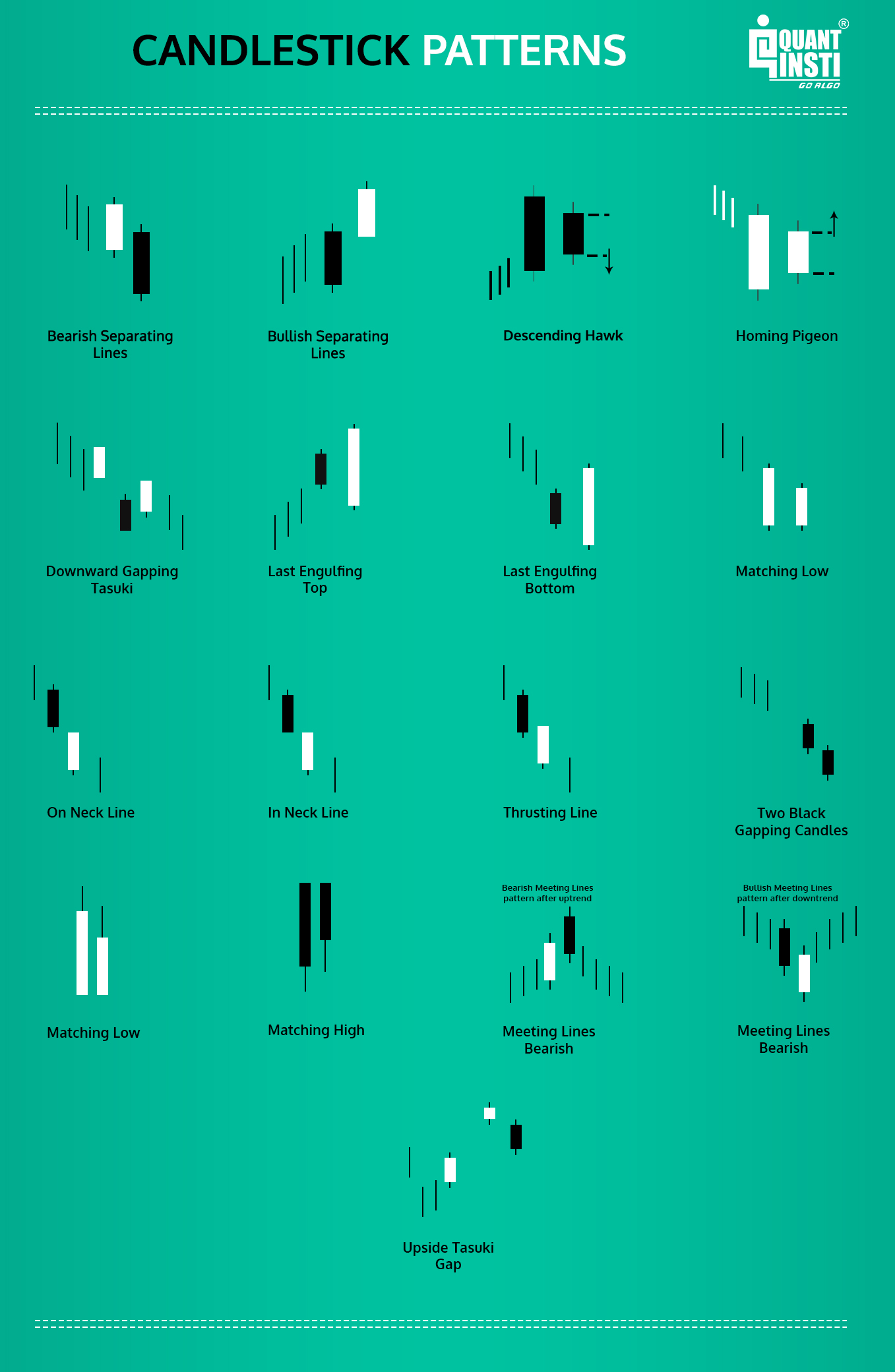

The Significance of Candlestick Patterns

Beyond their descriptive nature, candlesticks hold profound significance in technical analysis. Experienced traders decipher patterns formed by sequences of candlesticks to gauge market sentiment and predict future price movements. Various patterns exist, each carrying unique implications. For instance, a bullish engulfing pattern suggests a reversal in the downtrend, while a bearish engulfing pattern signals a impending market correction.

Image: www.sexizpix.com

What Are Candlesticks In Forex

Key Candlestick Patterns

- Bullish Engulfing:** Small bearish candlestick followed by a large bullish candlestick that engulfs the previous body.

- Bearish Engulfing:** Large bearish candlestick followed by a small bullish candlestick that engulfs the previous body.

- Hammer:** Small body with a long lower wick and a short or nonexistent upper wick.

- Inverted Hammer:** Small body with a long upper wick and a short or nonexistent lower wick.

- Doji:** Cross-shaped candlestick with the opening and closing prices very close to each other.

Tips and Expert Advice from an Experienced Trader

Mastering candlestick analysis requires practice and a keen eye for detail. Here are a few tips from my years of trading experience:

- Context is Crucial:** Interpret candlesticks in relation to the broader market context, considering factors like trend, support and resistance levels.

- Combine Multiple Patterns:** Use confluence of patterns to enhance accuracy. For example, a bullish engulfing pattern at a support level strengthens the bullish signal.

- Pay Attention to Volume:** High volume candlesticks indicate strong convictions and support the reliability of patterns.

Frequently Asked Questions

- Q: What timeframe is best for candlestick analysis?

A: Candle timeframes vary based on trading strategy. Intraday traders may use 5-minute or 15-minute candlesticks, while long-term traders may prefer daily or weekly charts. - Q: How do I recognize reliable candlestick patterns?

A: Consistent adherence to size, color, and wick formation enhances the accuracy of candlestick patterns.

Conclusion

Congratulations, dear reader! You now possess a comprehensive understanding of candlesticks in forex. Remember, the key to successful trading lies in consistently applying these insights to your market analysis. Embrace the nuances of candlestick patterns, heed the advice of experts, and cultivate your intuition to make informed trading decisions. As you delve deeper into this fascinating subject, you will undoubtedly unlock new strategies and opportunities in the dynamic forex market. Would you like to learn more about this topic?