Introduction

Embark on a journey into the captivating realm of Forex trading, where technical analysis stands as the guiding light, illuminating the path to profitability. Among the diverse tools at a trader’s disposal, candlesticks and patterns emerge as indispensable elements, offering profound insights into market behavior and price movements. Understanding the intricate language of candlesticks and patterns empowers traders with the ability to make informed decisions, navigate market volatility, and potentially reap substantial returns.

Understanding Candlesticks

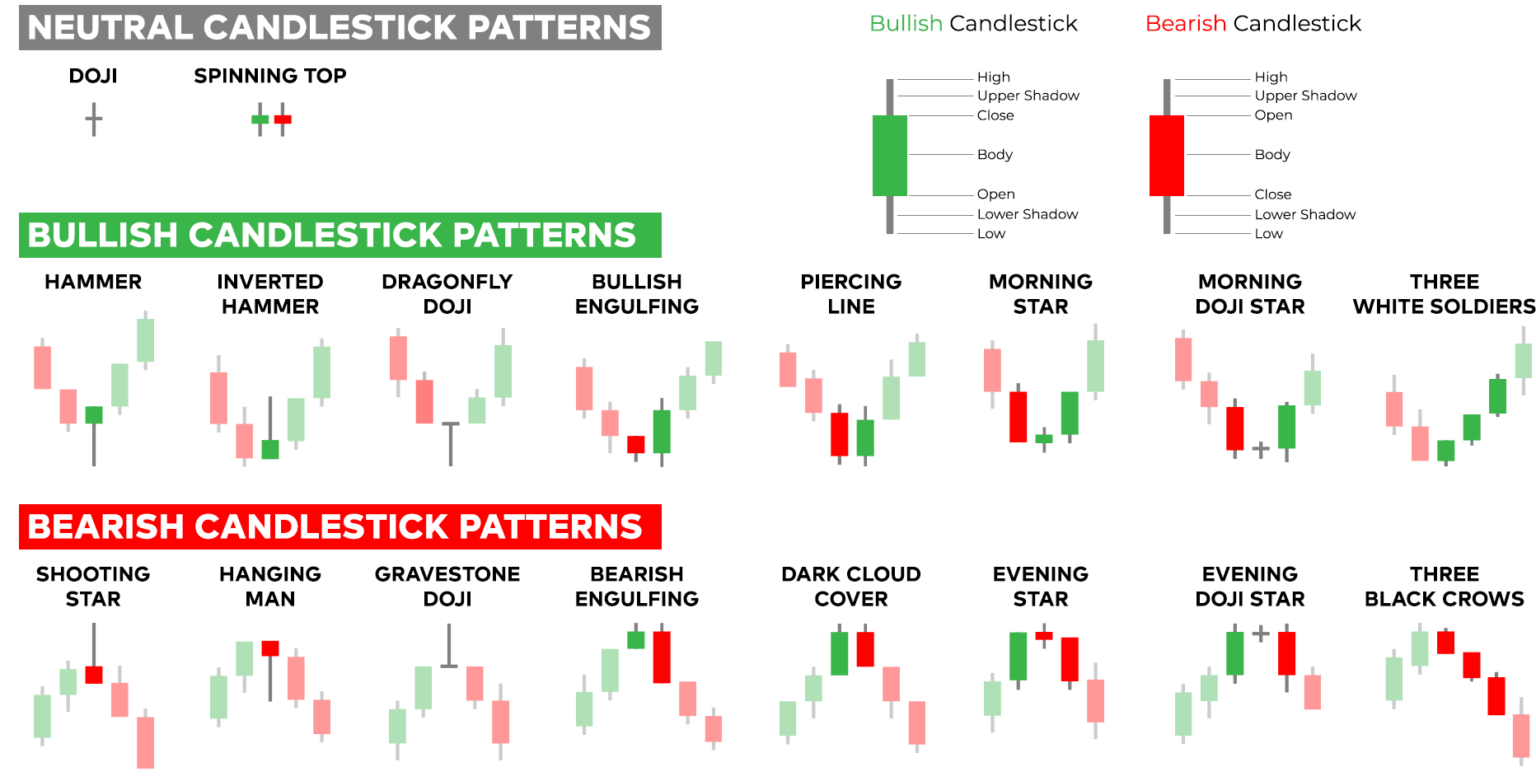

Candlesticks serve as a visual representation of price action over a specific time interval, typically hourly, daily, or weekly. Their unique structure provides invaluable clues about market sentiment, momentum, and potential future price movements. Each candlestick comprises a body, which depicts the price range between the open and close, and two lines extending from the body, known as the upper and lower shadows or wicks. These elements collectively convey a wealth of information about price dynamics.

Exploring Candle Patterns

Beyond individual candlesticks, technical analysts have identified an array of candle patterns that offer valuable insights into market sentiment. These patterns, formed by the arrangement of multiple candlesticks, provide signals regarding potential price reversals, continuations, or consolidations. By studying these patterns and their implications, traders can gain a competitive edge in the ever-changing Forex market.

Common Candlestick Patterns

-

Bullish Engulfing Pattern: This pattern occurs when a downtrending candlestick is followed by a bullish candle that completely engulfs the previous day’s range. It signifies a potential reversal of the downtrend and is considered a bullish signal.

Image: www.pinterest.com -

Bearish Engulfing Pattern: Similar to the bullish engulfing pattern, this pattern occurs when a downtrending candle is followed by a bearish candle that completely engulfs the previous day’s range. It indicates a potential reversal of the uptrend and is considered a bearish signal.

-

Tweezer Tops and Bottoms: These patterns consist of two candlesticks with equal highs or lows, signaling indecision and a potential reversal of the current trend.

-

Piercing Line Pattern: This pattern occurs when a bearish candlestick is followed by a bullish candle that penetrates more than halfway into the previous day’s trading range. It is considered a potential reversal of the downtrend.

-

Harami Pattern: This pattern consists of a small candlestick (Inside Candle) engulfed by a larger candle (Outside Candle). It signals indecision and a potential continuation of the current trend.

Pattern Trading Strategies

Candle patterns can serve as the cornerstone of effective trading strategies. By identifying and implementing predefined trading rules based on these patterns, traders can improve their chances of success in the Forex market. However, it’s crucial to note that no single pattern guarantees profitability, and multiple factors must be considered in decision-making.

Limitations of Technical Analysis

While technical analysis serves as a powerful tool, it’s essential to recognize its limitations. Candle patterns and other technical indicators provide insights into historical price movements but cannot guarantee future outcomes. It’s vital to combine technical analysis with other methods, such as fundamental analysis or risk management, to enhance accuracy and adapt to market dynamics.

Image: www.andrewstradingchannel.com

Technical Analysis Forex Trading With Candlestick And Pattern

Conclusion

Technical analysis, particularly the study of candlesticks and patterns, offers valuable insights into price behavior and market sentiment in Forex trading. By mastering this technique, traders can potentially improve their decision-making, enhance their understanding of market dynamics, and potentially increase their chances of profitability. Remember, however, that risk management and constant learning remain essential ingredients for long-term success in the competitive Forex market.