In the fast-paced and dynamic world of forex trading, navigating the opening range can be a daunting task. Yet, with the right strategy and a keen understanding of market dynamics, traders can maximize their profits while navigating the initial trading hours.

Image: forextraininggroup.com

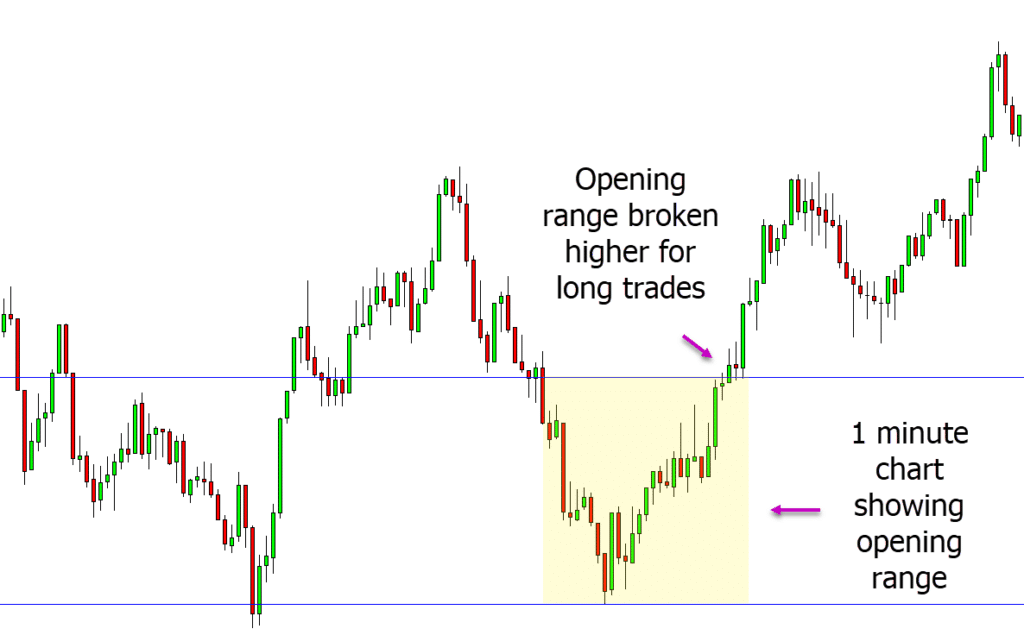

The opening range, defined as the difference between the highest and lowest prices within the first 30 minutes of trading, offers unique opportunities for traders. By studying historical data and understanding the forces driving market movements, traders can identify trading opportunities that align with their risk tolerance and trading style.

The Anatomy of the Opening Range

The opening range is characterized by heightened volatility as traders assess economic data and news events. This volatility creates both opportunities and challenges, as prices can swing rapidly in either direction. Identifying the factors that influence the opening range, such as economic news releases, central bank announcements, and geopolitical events, is crucial for successful trading.

Exploiting Breakouts

A breakout occurs when the price breaches the opening range, signaling a potential trend reversal. Traders looking to exploit breakouts should wait for confirmation of a breakout before entering a position. This confirmation can come in the form of a close outside the opening range or a retest of the breakout level.

Capitalizing on Range Trading

In the absence of a breakout, traders can capitalize on range trading opportunities within the opening range. Range trading involves buying at the lower end of the range and selling at the upper end, profiting from the price fluctuations within the defined range. Risk management techniques, such as stop-loss orders and position sizing, are essential in range trading to mitigate potential losses.

Image: learnpriceaction.com

Tips and Expert Advice for Navigating the Opening Range

1. Research Market History: Studying historical price data for the currency pair you’re trading provides valuable insights into the average opening range and potential trading opportunities.

2. Stay Informed: Monitoring news, economic data, and geopolitical events can identify potential catalysts that may influence market direction during the opening range.

3. Utilize Technical Indicators: Technical indicators, such as moving averages and support and resistance levels, can help identify opportunities and confirm trading signals within the opening range.

4. Practice Risk Management: Risk management is paramount in forex trading. Determine your risk tolerance, set appropriate stop-loss orders, and consider reducing your position size during periods of high volatility.

Frequently Asked Questions

Q: What is the average opening range in forex?

A: The average opening range varies depending on the currency pair and market conditions. However, a range of 10-30 pips is common for major currency pairs.

Q: Is it profitable to trade the opening range?

A: The opening range can offer profitable trading opportunities, provided that traders have a clear strategy, manage their risk, and understand the dynamics of the market during this period.

Master Forex Opening Range Strategy

https://youtube.com/watch?v=gDH_SIUZkoM

Conclusion

By understanding the intricacies of the forex opening range, traders can unlock a wealth of trading opportunities. Combining technical analysis, risk management, and a thorough knowledge of market dynamics empowers traders to navigate the opening range and maximize their profitability.