Introduction:

Image: timesofindia.indiatimes.com

In the ever-evolving landscape of global finance, the health of a nation’s foreign exchange reserves stands as a beacon of economic resilience and international standing. India, a rising economic powerhouse, has been diligently accumulating foreign exchange reserves, amassing a formidable stockpile that serves as a cornerstone of its economic stability. Join us as we delve into the depths of how much forex reserve in india, exploring its history, significance, and implications for the nation’s economic future.

Defining Foreign Exchange Reserves: A Strategic Cushion

Foreign exchange reserves, simply put, are the stockpiles of foreign currencies, gold, and other financial assets held by a country’s central bank. These reserves serve as a strategic cushion, providing essential liquidity in times of economic stress and facilitating international trade. By maintaining adequate foreign exchange reserves, India ensures its ability to meet its external obligations, safeguard its currency’s value, and insulate itself from global economic shocks.

India’s Forex Journey: A Steady Ascent

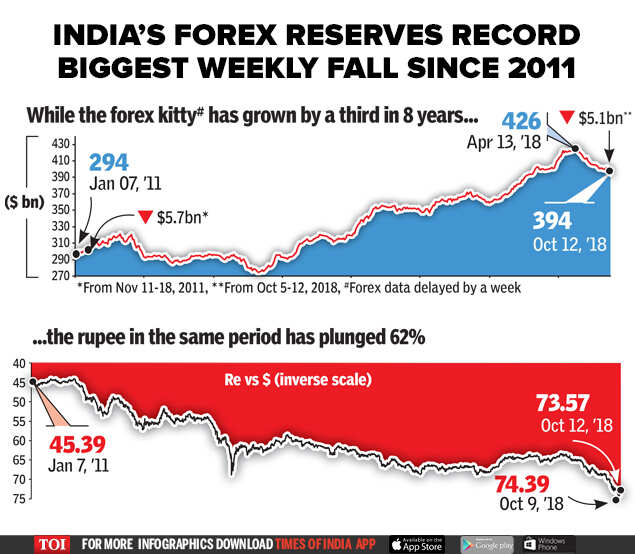

India’s foreign exchange reserves have witnessed a remarkable journey, steadily climbing over the decades. As of March 2023, India’s forex reserves stood at a staggering $572.83 billion, marking a significant increase from the $292.64 billion held in March 2014. This impressive accumulation reflects India’s growing economic strength, prudent fiscal policies, and increased foreign direct investment.

Significance of Robust Forex Reserves for India

The hefty foreign exchange reserves held by India carry immense significance. They act as a shield against external economic shocks, such as sudden capital outflows or currency crises. Ample reserves provide the Reserve Bank of India (RBI) with the flexibility to intervene in the foreign exchange market, stabilizing the rupee’s exchange rate and preventing excessive volatility. Furthermore, robust forex reserves enhance India’s creditworthiness in the global financial markets, attracting foreign investment and strengthening its bargaining power in international negotiations.

Expert Insights: Navigating the Forex Landscape

Experts in the financial industry emphasize the crucial role of foreign exchange reserves in macroeconomic stability. “Robust forex reserves provide India with a vital buffer against adverse economic conditions,” says Dr. Arvind Virmani, a former Chief Economic Advisor to the Government of India. “They enhance India’s ability to manage external vulnerabilities and maintain macroeconomic stability.”

Leveraging Forex Reserves for Smart Economic Strategies

The prudent management of foreign exchange reserves is essential for maximizing their benefits. The RBI utilizes reserves to manage the exchange rate, ensuring that it does not fluctuate too sharply, which can harm exporters and importers. Additionally, forex reserves can be invested in various financial instruments to generate returns, further boosting India’s economic growth.

Conclusion: The Bulwark of India’s Economic Prowess

India’s robust foreign exchange reserves stand as a testament to the nation’s economic resilience and financial prudence. They serve as a bulwark against economic headwinds, ensuring India’s continued economic growth and prosperity. By maintaining and judiciously managing its forex reserves, India positions itself as a formidable player in the global economic arena, capable of weathering economic storms and sustaining its trajectory towards economic prosperity.

Image: www.bqprime.com

How Much Forex Reserve In India