In the realm of financial markets, the perpetual debate between Forex (Foreign Exchange) and stocks lingers, leaving aspiring investors perplexed.

Image: www.livingfromtrading.com

I vividly recall my own quandary when embarking on my investment journey. Faced with the allure of both options, I delved into meticulous research, eager to decipher which path held greater promise.

**Forex: The Currency Market’s Dynamic Landscape**

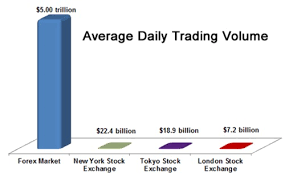

Forex refers to the decentralized, global market where currencies are traded. As the world’s largest financial market, with daily trading volumes exceeding $5 trillion, it offers alluring advantages:

- High Liquidity: Forex’s vast market size ensures instant execution of trades at competitive spreads.

- 24/7 Trading: Unlike stock markets, Forex enables seamless trading round the clock, capitalizing on global events.

- Diversification: With access to numerous currency pairs, investors can diversify portfolios, mitigating risks.

**Stocks: Ownership in Corporate Entities**

Stocks represent fractional ownership in publicly traded companies. When you purchase a stock, you essentially acquire a share in that company’s future earnings and assets.

Investing in stocks can yield substantial returns, but it also carries inherent risks. Nonetheless, it presents several benefits:

- Potential for High Returns: Stocks historically have generated higher average returns than bonds or savings accounts.

- Ownership Rights: Shareholders enjoy voting rights and the potential for dividends, sharing in the company’s success.

- Wide Range of Options: Stock markets offer a vast array of companies and industries to invest in, catering to diverse investment strategies.

**Choosing the Right Path: Forex or Stocks?**

The choice between Forex and stocks hinges on individual risk tolerance and investment goals. Forex may be more suitable for short-term speculation, while stocks tend to perform better over longer investment horizons.

Here are some key considerations to assist your decision:

- Risk Tolerance: Forex trading carries higher levels of risk due to its inherent volatility. Stocks, while less volatile, are still subject to market fluctuations.

- Investment Horizon: Forex is ideal for short-term trading, seeking quick profits within days or weeks. Stocks, on the other hand, are better suited for long-term investments, typically spanning years.

- Initial Capital: Forex trading can be initiated with a relatively small amount of capital, making it accessible to a broader range of investors. Stock investments typically require a higher initial investment.

Image: www.livingfromtrading.com

**Expert Advice for Navigating the Markets**

For aspiring investors, seeking guidance from experienced traders can prove invaluable:

- Learn from Mentors: Connect with successful traders who can share their knowledge and strategies.

- Practice Risk Management: Implement robust risk management techniques to mitigate potential losses.

- Stay Informed: Monitor market trends, economic news, and political events to make informed decisions.

**Clarity through Q&A**

To enhance your understanding of Forex and stocks, here is a concise Q&A:

- Q: What is the difference between spot and forward contracts in Forex?

A: Spot contracts are immediate delivery of currencies, while forward contracts lock in an exchange rate for future delivery. - Q: What are blue-chip stocks?

A: Blue-chip stocks refer to well-established, large-cap companies with strong financial performance and stability. - Q: Is it possible to lose money in Forex trading?

A: Yes, Forex trading carries the potential for substantial losses, especially for novice traders without proper risk management strategies.

Forex Or Stocks Which Is Better

**Conclusion: Embarking on Your Investment Journey**

Deciding between Forex and stocks is a crucial step in your investment journey. By carefully considering the key factors outlined above, you can align your choice with your financial goals and risk appetite.

Whether you choose the dynamic world of Forex or the long-term potential of stocks, embarking on this journey can open new doors to financial growth. Remember, knowledge is power, and continuous learning will empower you as you navigate the ever-changing markets. Are you stoked to delve deeper into the world of Forex and stocks?