Financial Flexibility at Your Fingertips

Imagine yourself traveling to exotic destinations, seamlessly making purchases and accessing local currencies without exorbitant fees or exchange hassles. That’s the power of a multi currency forex card! As an avid traveler and seasoned financial enthusiast, I’ve experienced firsthand the convenience and savings offered by these cards. With a multi currency forex card, you can roam the world with financial freedom, avoiding hidden charges and exorbitant transaction fees.

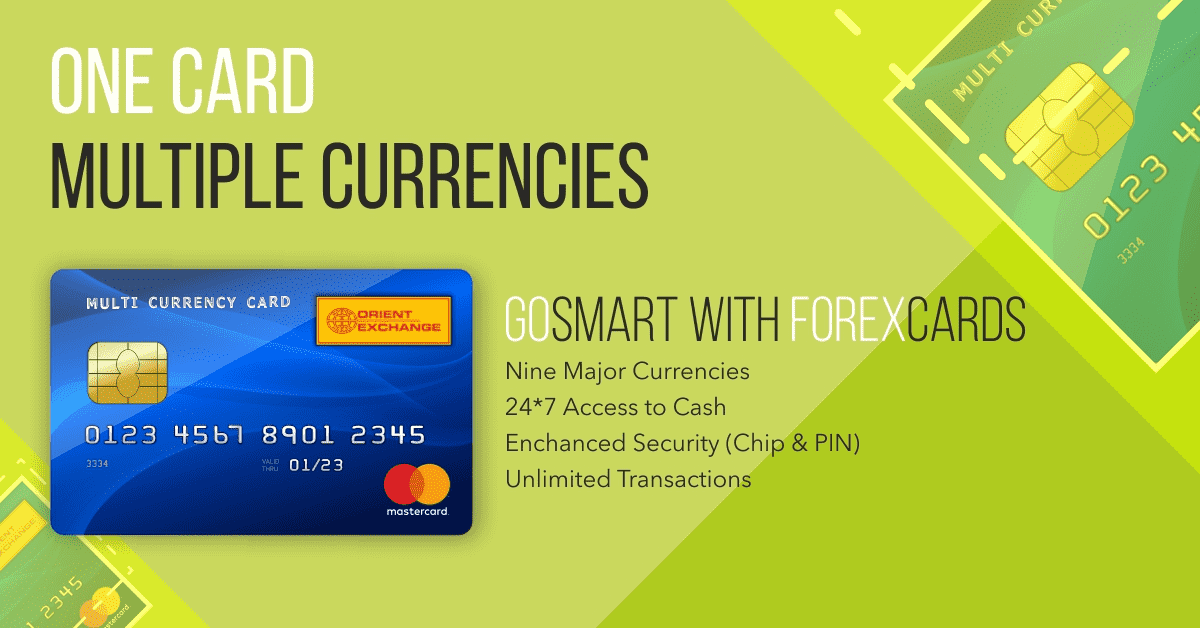

Image: www.orientexchange.in

Decoding Multi Currency Forex Cards

A multi currency forex card is a prepaid card that allows you to store multiple currencies simultaneously. It eliminates the need to carry physical cash and offers competitive exchange rates, saving you significant amounts on currency conversions. Each card typically supports multiple currencies, providing flexibility and convenience while eliminating the need for multiple cards for different destinations.

Benefits of Using Multi Currency Forex Cards

The advantages of using multi currency forex cards are undeniable:

- Avoid Unfavorable Exchange Rates: Forex cards offer competitive exchange rates, ensuring you get the most value for your money when converting currencies.

- Eliminate Currency Conversion Fees: Say goodbye to hidden charges and surprise fees associated with traditional currency exchange methods. With a forex card, you pay a one-time transaction fee and enjoy hassle-free currency conversion.

- Stay Protected against Fraud: Forex cards provide security features to safeguard your funds in case of loss or theft, giving you peace of mind while traveling.

- Easy Acceptance Worldwide: Multi currency forex cards are widely accepted at ATMs, point-of-sale machines, and online vendors, giving you global access to your funds.

Navigating the Sea of Multi Currency Forex Cards

The Indian market offers a range of multi currency forex cards to meet diverse traveler needs. Key features to consider include:

- Currency Support: Choose a card that supports the currencies of the countries you plan to visit, ensuring hassle-free spending.

- Transaction Fees: Compare transaction fees charged by different providers. Opt for a card with low fees to maximize savings.

- Reload Options: Consider the reload options available to replenish your card balance while abroad. Choose a card that offers convenient reload methods, such as online portals, mobile apps, or local agencies.

- Customer Support: Look for providers with reliable and responsive customer support to address any queries or issues you may encounter during your travels.

Image: www.bookmyforex.com

Expert Tips and Insights

As an experienced traveler and financial expert, here are some tips to optimize your use of multi currency forex cards:

- Load Your Card Wisely: Determine your estimated expenses and load your card accordingly to avoid unnecessary conversions and fees.

- Monitor Exchange Rates: Keep an eye on currency exchange rates to identify the most favorable time to convert your funds.

- Use the Card for All Purchases: Maximize the benefits of your forex card by using it for all your expenses, including dining, shopping, and transportation.

- Consider Additional Security Measures: In addition to the security features offered by the card provider, consider using a PIN or enabling SMS notifications for additional protection.

FAQs for Multi Currency Forex Cards

Q: Are multi currency forex cards safe to use?

A: Yes, reputable multi currency forex cards offer robust security features to protect your funds.

Q: Can I use my multi currency forex card at any ATM?

A: Most multi currency forex cards can be used at ATMs worldwide, but specific terms and fees may apply depending on the provider and location.

Q: How do I add funds to my forex card?

A: You can typically add funds to your forex card online, through a mobile app, or by visiting a designated agent.

Best Multi Currency Forex Card In India

Conclusion

Multi currency forex cards empower global travelers with financial flexibility, convenience, and cost savings. Whether you’re embarking on a thrilling adventure or handling business overseas, a multi currency forex card is an indispensable companion.

Are you ready to experience the benefits of seamless currency management on your next global expedition? Explore the wide range of multi currency forex cards available in the Indian market and choose the one that best suits your travel needs. Let financial freedom and peace of mind accompany you on your journeys!