Navigate Currency Exchange with Confidence

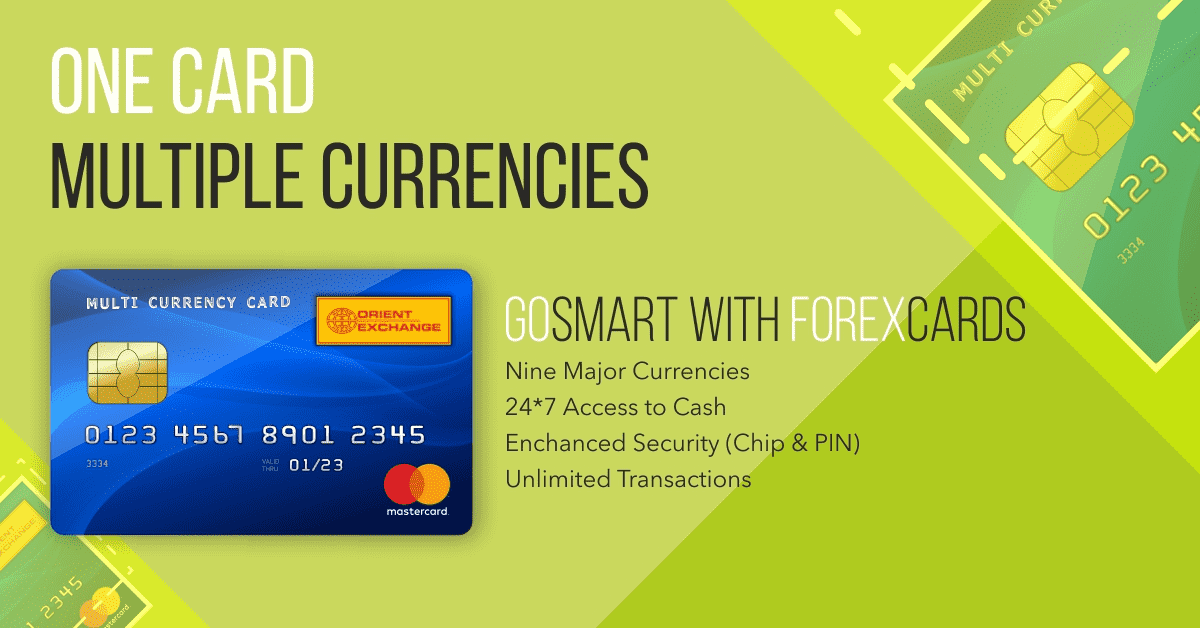

When embarking on international adventures or business endeavors, the convenience of a forex card can be invaluable. Orient Exchange’s forex card offers a seamless way to manage your currency exchange needs. However, it’s crucial to understand the associated charges to avoid any surprises.

Image: www.orientexchange.in

Scrutinizing Forex Card Charges

Orient Exchange’s forex card comes with a set of charges that vary depending on the transaction type and destination country. These charges typically include:

- Transaction fee: A small fee charged for each currency exchange or cash withdrawal transaction.

- ATM withdrawal fee: An additional fee charged by ATM operators when using your forex card for cash withdrawals.

- Inactivity fee: A fee charged after a prolonged period of inactivity on your forex card.

- Forex markup: A spread between the prevailing market exchange rate and the rate you receive when exchanging currencies through the forex card.

Understanding Forex Markups

The forex markup is a percentage added to the market exchange rate to cover Orient Exchange’s operating costs. The size of the markup can vary depending on factors such as the transaction amount, currency pair, and destination country. It’s important to compare the markup offered by Orient Exchange with other providers to ensure you’re getting the best value.

For instance, if the market exchange rate between INR and USD is 75 INR per USD and Orient Exchange charges a markup of 2%, you will receive 73.5 INR per USD when exchanging through their forex card.

Tips for Minimizing Forex Card Charges

To keep your Orient Exchange forex card charges to a minimum, consider these tips:

- Use ATMs cautiously: ATM withdrawal fees can add up, so avoid withdrawing small amounts frequently. Instead, plan your withdrawals in larger increments.

- Exchange currencies in large amounts: Transaction fees are often applied per transaction. By exchanging currencies in larger sums, you can reduce the number of transactions and lower your overall charges.

- Compare forex providers: Don’t blindly stick to Orient Exchange. Research other forex card providers to compare their charges and find the one that offers the best deal for your specific needs.

Image: www.orientexchange.in

FAQ on Orient Exchange Forex Card Charges

Q: What is the typical transaction fee charged by Orient Exchange?

A: The transaction fee ranges from 1% to 2% of the transaction amount, depending on the transaction type and destination country.

Q: How often is the inactivity fee charged?

A: The inactivity fee is typically charged after 12 months of inactivity on the forex card.

Q: Can I avoid the forex markup?

A: No, the forex markup is an unavoidable charge associated with using a forex card. However, you can minimize the impact by comparing markups from different providers.

Orient Exchange Forex Card Charges

Empowering Your Currency Exchange Experience

Understanding and managing Orient Exchange forex card charges is essential for optimizing your currency exchange experience. By following these tips and utilizing the information provided, you can make informed decisions and avoid unnecessary expenses. Whether you’re exploring new destinations or conducting global business, a forex card can be a valuable tool with the proper knowledge.

Are you ready to navigate currency exchange with confidence? Embrace the power of knowledge and unlock the benefits of using your Orient Exchange forex card effortlessly.