With the vast and ever-evolving realm of forex trading, selecting the optimal currencies for your endeavors can be a pivotal step towards maximizing potential and mitigating risks. In this comprehensive exploration, we will delve into the intricacies of currency selection, empowering you to make informed decisions that align with your trading strategies and goals.

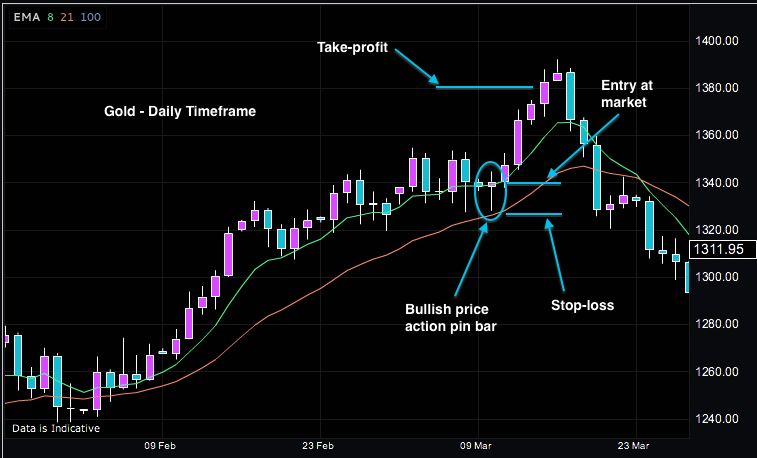

Image: www.tradegoldonline.com

Understanding Currency Pairs

At the core of forex trading lies the exchange of currency pairs, with the value of one fluctuating against the other. Each pair is typically denoted by a three-letter currency code, such as EUR/USD, where the first symbol represents the base currency being bought and the second represents the quote currency being sold.

Factors Influencing Currency Selection

Selecting the right currencies for forex trading hinges upon a multifaceted analysis encompassing economic indicators, market conditions, and personal preferences. Key factors to consider include:

1. Economic Stability and Growth

Currency values are often influenced by the economic health of the countries they represent. Robust economic growth, stable inflation, and low unemployment tend to bolster a currency’s value, while economic weakness can trigger depreciation.

Image: www.veteranstoday.com

2. Interest Rates

Interest rate differentials between countries play a significant role in currency fluctuations. Higher interest rates typically attract foreign investment, leading to currency appreciation. Conversely, lower interest rates can lead to depreciation.

3. Political Stability and Events

Political stability and events can significantly impact currency values. Uncertainty, geopolitical tensions, and economic sanctions can all cause currency volatility and depreciation.

4. Tradability and Liquidity

Forex traders seek currencies with high liquidity, enabling the execution of trades quickly and at competitive prices. High-liquidity currencies include the US dollar, the euro, the Japanese yen, and the British pound.

Major Currency Pairs

The foreign exchange market features several major currency pairs that dominate trading volumes due to their high liquidity and global importance. These include:

1. EUR/USD

Known as the “Euro”, this pair reflects the exchange rate between the euro and the US dollar. It is the most widely traded currency pair globally, accounting for over 50% of daily forex transactions.

2. USD/JPY

Referred to as the “Dollar/Yen”, this pair represents the exchange rate between the US dollar and the Japanese yen. It is the second most traded currency pair and often influenced by Japan’s economic policies and safe-haven status.

Which Currency Is Best For Forex Trading

3. GBP/USD

Known as the “Cable”, this pair denotes the exchange rate between the British pound and the US dollar. It is heavily influenced by the political and economic landscape of the United Kingdom and the relationship between the UK and the European Union.

Many other currency pairs are traded in the forex market, offering opportunities for diversification and strategic trading. Choosing the right currency pairs depends on individual trading strategies and risk tolerance. By carefully considering the factors discussed above, traders can enhance their chances of identifying optimal currencies for their trading endeavors.