In the relentless arena of forex trading, where the tides of the market perpetually shift, arming yourself with the right tools and knowledge is paramount. Among these indispensable tools, the forex calendar stands tall as a beacon of invaluable insights, shaping the decisions of seasoned traders and beginners alike.

Image: www.forex.academy

Unlocking the Potential of the Forex Calendar

A forex calendar, a meticulously curated record of upcoming economic events that directly impact currency exchange rates, empowers traders with crucial information. By aligning trading strategies with the anticipated market movements triggered by these events, traders can dramatically enhance their probability of success.

i. Economic Indicators: These events, ranging from interest rate announcements to manufacturing indices, provide unparalleled insights into a country’s economic health. By positioning their trades in anticipation of market reactions to these indicators, traders can capitalize on favorable movements.

ii. Political Events: The political landscape can significantly influence currency values. Elections, speeches, and changes in government policies can send shockwaves through the market, equipping traders with advance notice can enable them to navigate these volatile periods with greater confidence.

iii. Market Holidays: Identifying market holidays is essential for avoiding trading during periods of inactivity or reduced liquidity. This knowledge allows traders to plan their trading schedules accordingly and avoid costly mistakes.

Key Features of the Forex Calendar

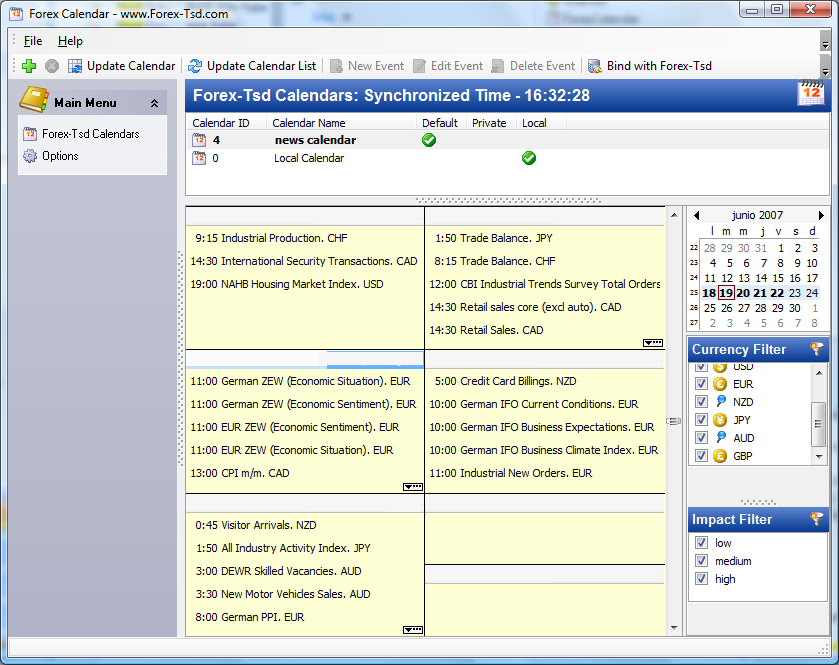

Delving deeper into the structure of the forex calendar, we uncover several key features that enhance its utility:

i. Event Timeline: This chronological listing of upcoming economic and political events allows traders to pinpoint critical events and assess their potential impact on currency pairs.

ii. Currency Pairs Affected: The calendar meticulously specifies the currency pairs that will likely be swayed by each event. This granular information empowers traders to focus their analysis and trading activities on the most relevant markets.

iii. Historical Data: Many forex calendars provide access to historical data on past events, enabling traders to analyze the market’s reaction to similar events and formulate more informed trading decisions.

Mastering the Forex Calendar: A Step-by-Step Guide

To harness the full potential of the forex calendar, traders must adopt a systematic approach to its implementation:

i. Identify Relevant Events: Review the calendar thoroughly and identify events that align with your trading strategies and risk tolerance.

ii. Forecast Market Reactions: Study historical data and market analysis to anticipate the probable impact of each event on currency pairs.

iii. Plan Trading Strategies: Utilizing the insights gleaned from the calendar, formulate trading strategies that capitalize on anticipated market movements.

iv. Execute with Precision: Monitor the calendar relentlessly, tracking upcoming events, and executing trading strategies meticulously.

Image: ebidobyt.web.fc2.com

Expert Insights and Tips

Augmenting your understanding of the forex calendar, consider the following insights and tips from seasoned traders:

i. Accuracy is Paramount: Always verify the credibility of the forex calendar you rely on to ensure the accuracy and timeliness of the data.

ii. Consider Historical Data: Past events offer invaluable insights into the market’s behavior. Analyze historical reactions to similar events to refine your trading strategies.

iii. Correlate with Other Analysis: Integrate the forex calendar with other technical and fundamental analysis techniques to form a more comprehensive trading approach.

Frequently Asked Questions (FAQs)

Q: What types of events are included in a forex calendar?

A: Economic indicators (interest rate announcements, GDP reports), political events (elections, speeches), and market holidays.

Q: How can I interpret the potential impact of an event on currency pairs?

A: Examine historical data, market analysis, and expert forecasts to gauge the likely reaction of currency pairs to specific events.

Q: How frequently should I check the forex calendar?

A: Monitor the calendar regularly, especially before executing trades or adjusting trading strategies.

How To Use Forex Calendar

Conclusion

The forex calendar is not merely a tool; it’s a roadmap to navigating the dynamic landscape of the forex market. By embracing the insights it offers, traders can transform themselves from passive bystanders to proactive decision-makers, reaping lucrative rewards and achieving trading mastery.

Call to Action: Enhance your trading arsenal by incorporating the forex calendar into your trading routine. Its invaluable insights will guide your path to success, empowering you to conquer the forex market with confidence and precision.