In the realm of financial markets, where volatility reigns supreme, finding a consistent and profitable trading strategy can be an elusive quest. Yet, within the vibrant world of forex trading, the pursuit of high probability trading strategies shines a beacon of hope for those seeking a more calculated approach. Join us as we delve into the captivating world of high probability forex trading strategies, unlocking the secrets to making informed decisions and maximizing your trading profits.

Image: www.youtube.com

Decoding the Enigma of High Probability Trading

Before embarking on our journey to uncover high probability trading strategies, let’s demystify the concept itself. A high probability trading strategy refers to an approach that identifies trading opportunities with a higher likelihood of success based on well-defined criteria and parameters. These strategies strive to increase the probability of a profitable outcome by minimizing risk and capitalizing on patterns and market behaviors that exhibit a higher probability of recurrence.

Embracing the Power of Technical Analysis

Technical analysis stands as a cornerstone of high probability forex trading strategies. This analytical approach examines historical price data to identify patterns, trends, and support and resistance levels. By studying charts and applying technical indicators, traders seek to forecast future price movements and increase the probability of entering and exiting trades at optimal points. Prominent technical indicators such as moving averages, Bollinger Bands, and Relative Strength Index (RSI) provide invaluable insights into market momentum, volatility, and overbought/oversold conditions.

Harnessing the Momentum of Price Action

Another potent aspect of high probability forex trading strategies lies in the analysis of price action. Unlike technical analysis, which relies heavily on historical data, price action focuses on the current and evolving price behavior. This method involves identifying candlestick patterns, trendlines, and breakout points to make trading decisions. By understanding the underlying dynamics of price movements, traders can increase the probability of catching trend reversals and capitalizing on market momentum.

Image: www.warriortrading.com

Mastering the Art of Risk Management

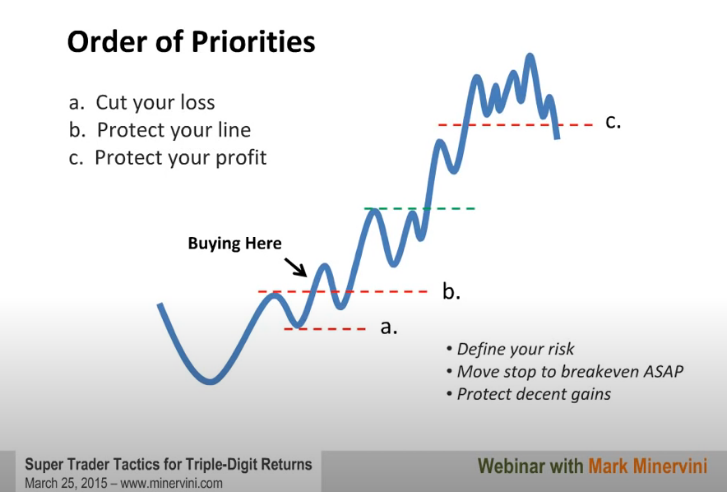

In the realm of forex trading, risk management reigns supreme. High probability trading strategies emphasize the importance of meticulously managing risk exposure to preserve capital and enhance profitability. Traders employ a variety of risk management tools, such as stop-loss orders, position sizing, and risk-reward ratios. By proactively defining risk tolerance and implementing sound risk management practices, traders can enhance the probability of mitigating losses and safeguarding their trading accounts.

Unveiling the Power of Backtesting and Forward Testing

Before implementing any high probability forex trading strategy, it is imperative to thoroughly test it through backtesting and forward testing. Backtesting involves simulating the strategy using historical data to assess its performance under various market conditions. Forward testing, on the other hand, involves testing the strategy on live market data to gauge its real-time effectiveness. By meticulously evaluating the performance and making necessary adjustments, traders can increase the probability of success when deploying the strategy in live trading.

High Probability Forex Trading Strategies

Conclusion: Embracing Discipline and Continuous Learning

Unveiling the secrets of high probability forex trading strategies requires a blend of technical proficiency, risk management acumen, and an unwavering commitment to discipline. By consistently honing one’s analytical skills, embracing sound risk management principles, and continuously seeking knowledge, traders can increase the probability of navigating the complexities of forex trading and reaping consistent profits. Remember, the path to trading mastery is an ongoing journey, marked by continuous learning, adaptation, and relentless dedication. Embrace the challenge, and may the high probability winds of success guide you towards financial prosperity.