Introduction to Leverage in Forex Trading

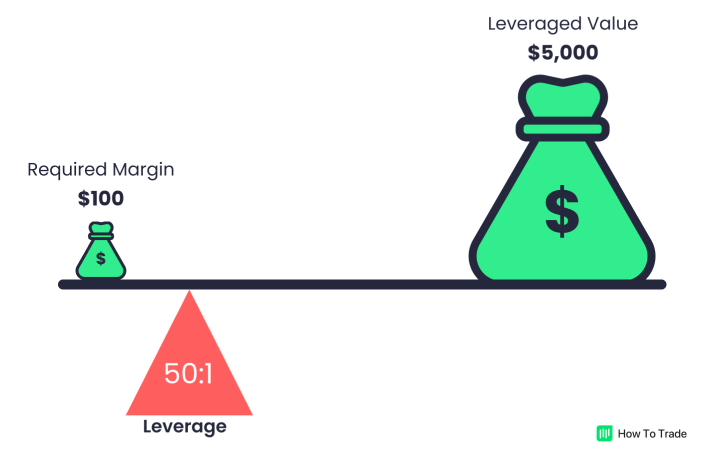

Leverage is a double-edged sword in Forex trading. It allows traders to amplify their potential profits, but it also comes with increased risk. Understanding how leverage works is crucial for Forex traders who want to maximize their returns while minimizing losses.

Image: howtotrade.com

In essence, leverage enables traders to trade with an investment amount larger than their initial capital. This magnifies their potential profits, as well as their potential losses

The Mechanism of Leverage

Forex brokers provide leverage to traders through a margin account. When a trader opens a margin account, they deposit a certain amount of money, which serves as collateral. The broker then allows the trader to trade with a multiple of that amount, known as the leverage ratio.

For example, if a trader deposits $1,000 and the broker offers 100:1 leverage, the trader can trade with $100,000

Benefits of Leverage

The primary benefit of leverage is the ability to amplify profits. By trading with a larger amount of capital, traders can potentially make more money from smaller price movements.

Leverage also allows traders to maintain larger positions, which can increase their chances of success. Higher positions give traders greater exposure to the market, enabling them to capitalize on favorable trends

Risks of Leverage

While leverage has its advantages, it also comes with increased risks. Amplifying profits also amplifies losses. If the market moves in an unforeseen direction, traders can lose their entire initial deposit and even more.

High leverage can lead to margin calls, where traders are asked by their brokers to add more funds to their accounts to cover potential losses. Failure to meet a margin call can result in forced liquidation of positions, further exacerbating losses

Image: www.youtube.com

Managing Leverage Wisely

To mitigate the risks of leverage, traders must use it prudently. Start with a low leverage ratio, such as 10:1 or 20:1, and gradually increase it as you gain experience.

Always calculate the potential risks and rewards before executing trades. Determine the maximum amount of funds you’re willing to lose on any single trade and set stop-loss orders to limit potential losses.

Tips and Expert Advice

Experienced Forex traders recommend using leverage responsibly. They advise starting with a low leverage ratio and gradually increasing it as you become more comfortable with the risks involved.

They also emphasize the importance of developing a sound trading strategy, managing risk effectively, and always trading within your financial means.

FAQ on Leverage in Forex

Q: What is the ideal leverage ratio for Forex trading?

A: The ideal leverage ratio depends on your individual risk tolerance and trading experience. Beginners are advised to start with a low ratio, such as 10:1 or 20:1.

Q: Can I lose more money than my initial deposit when using leverage?

A: Yes, using leverage increases the potential for losses beyond your initial deposit. It’s crucial to manage your risk carefully to avoid this scenario.

Q: What is a margin call?

A: A margin call is a demand from your broker to deposit more funds into your account to cover potential losses. It occurs when your trading positions lose value and you no longer have enough equity in your account to cover them.

How Does Leverage Affect Forex Trading

Conclusion

Leverage is a powerful tool in Forex trading that can enhance profits and market participation. However, it’s crucial to understand the risks involved and use it responsibly. By following the tips and expert advice outlined above, you can harness the benefits of leverage while minimizing its potential pitfalls.

Would you like to learn more about how to use leverage effectively in Forex trading? Share your thoughts and questions in the comments section below.