“Forex trading doesn’t have to be a daunting task. With the right platform, you can navigate the market with ease and confidence.”

Embark on a Seamless Trading Journey

Navigating the forex market can be an exhilarating experience, but it can also be daunting for beginners. The vast array of trading platforms available can further complicate matters. However, there is a solution: a user-friendly forex trading platform designed to make your trading journey effortless and enjoyable.

Image: bestbusinesscommunity.com

A user-friendly platform is the key to unlocking successful forex trading. It simplifies the trading process, allowing even novice traders to execute trades with precision. These platforms offer a range of advantages, including intuitive interfaces, robust charting tools, and powerful order execution capabilities.

Features of a User-Friendly Platform

1. Intuitive Interface: A user-friendly trading platform should have a simple and straightforward interface. It should be easy to navigate, with clearly labeled buttons and menus. Traders should be able to quickly access all the essential trading tools and features without getting lost in a maze of complexity.

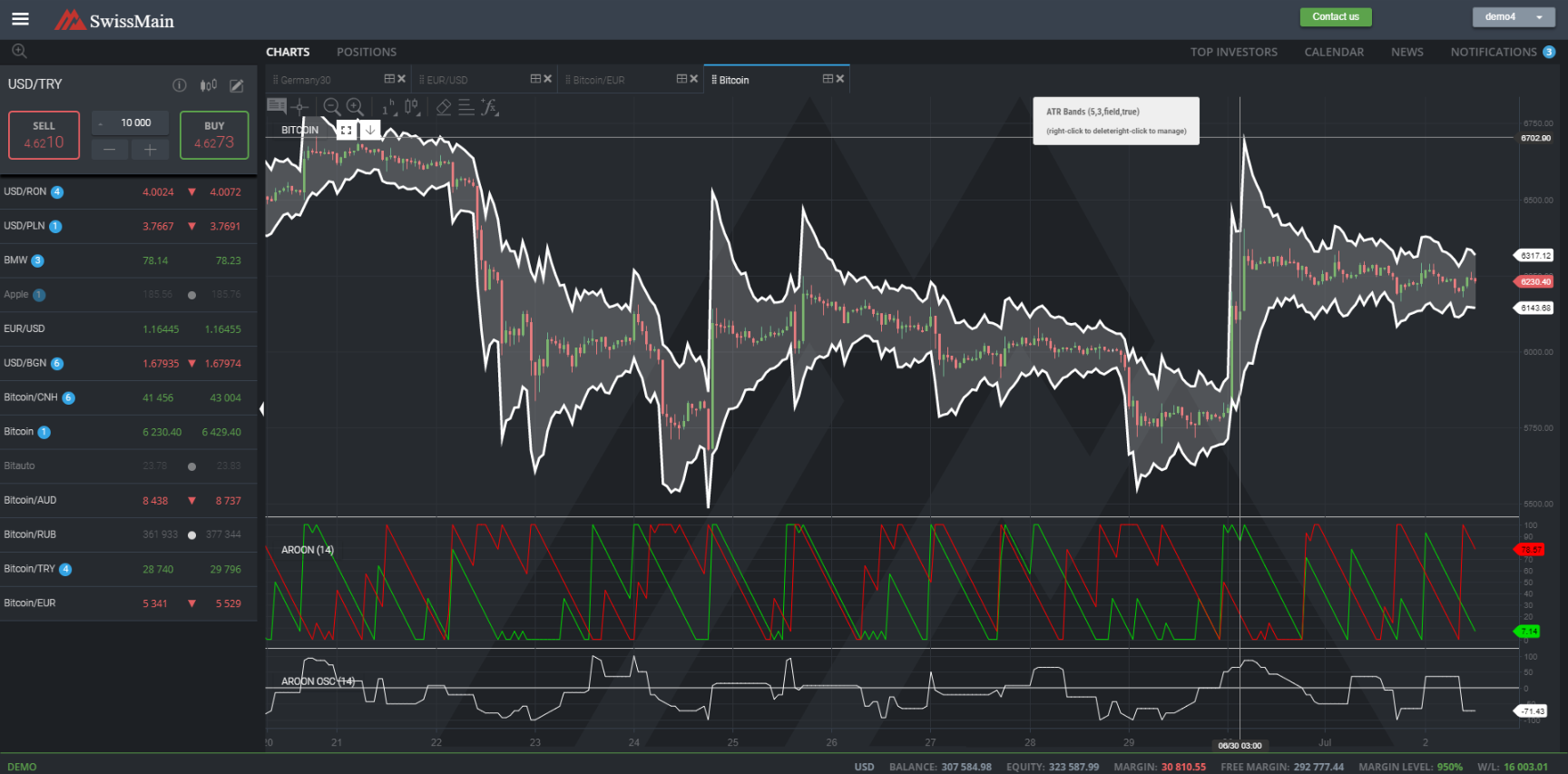

2. Robust Charting Tools: Technical analysis is a crucial aspect of forex trading. The platform should provide comprehensive charting tools that enable traders to analyze market trends, identify trading opportunities, and make informed decisions. The charts should be customizable, allowing traders to tailor them to their specific trading style.

3. Order Execution Capabilities: The trading platform should allow traders to execute orders quickly and efficiently. It should support various order types, including market orders, limit orders, and stop-loss orders. The platform should also provide real-time execution status updates, so traders can monitor the progress of their orders.

The Importance of a User-Friendly Platform

A user-friendly platform plays a vital role in successful forex trading. It:

- Reduces the learning curve for novice traders, making it easier for them to navigate the market and understand the complexities of forex trading.

- Enhances the overall trading experience, making trading enjoyable and less stressful.

- Improves trading performance by providing traders with the necessary tools and features to make informed decisions and execute trades effectively.

Tips for Choosing a User-Friendly Platform

Here are a few tips to help you find the most user-friendly forex trading platform:

1. Consider Your Trading Style: Choose a platform that aligns with your trading style. If you are a technical trader, look for a platform with advanced charting tools. If you are a fundamental trader, find a platform that provides news and economic data.

2. Read Reviews and Testimonials: Before making a decision, take the time to read reviews and testimonials from other traders. This can provide valuable insights into the platform’s usability, features, and customer service.

3. Request a Demo: Many brokers offer demo accounts that allow you to try out the platform before you commit to a subscription. This is a great way to familiarize yourself with the platform and its features.

Image: rnd-solutions.net

Conclusion

Choosing the right user-friendly forex trading platform is essential for maximizing your trading success. By following the tips outlined in this article, you can find a platform that meets your needs and helps you achieve your trading goals. Are you ready to embark on the exciting journey of forex trading with ease and confidence?

User Friendly Forex Trading Platform

FAQ

Q: Are there any free forex trading platforms available?

A: Yes, some brokers offer free forex trading platforms. However, these platforms may have limited features compared to paid platforms.

Q: How do I choose the best user-friendly forex trading platform?

A: Consider your trading style, read reviews, request a demo, and select a platform that aligns with your needs.

Q: Is it safe to trade forex online?

A: Forex trading can be safe if you choose a reputable broker and follow sound risk management practices.