Embarking on the thrilling realm of forex trading often sparks a pertinent question: “How much capital do I need to initiate my trading journey?” The answer to this pivotal inquiry hinges upon a multifaceted array of factors, including your financial objectives, risk tolerance, and trading strategy. Understanding these parameters will empower you to make an informed decision, ensuring a well-calculated start to your forex trading endeavors.

Image: www1.equiti.com

Navigating the Gateway to Forex Trading: A Journey of Initial Capital

To delve into the dynamic world of forex trading, a minimum capital requirement serves as the gateway, providing the foundation for potential profits and prudent risk management. However, it is imperative to dispel any misconceptions that substantial capital is an absolute necessity to attain success in this arena. In fact, with a disciplined approach, even those with modest capital can unlock the potential for significant returns.

Factors Influencing Capital Requirements: A Tailor-Made Approach

The ideal amount of capital to commence forex trading is a highly individualized determination, meticulously calibrated to your unique circumstances and trading goals. Key factors that warrant careful consideration include:

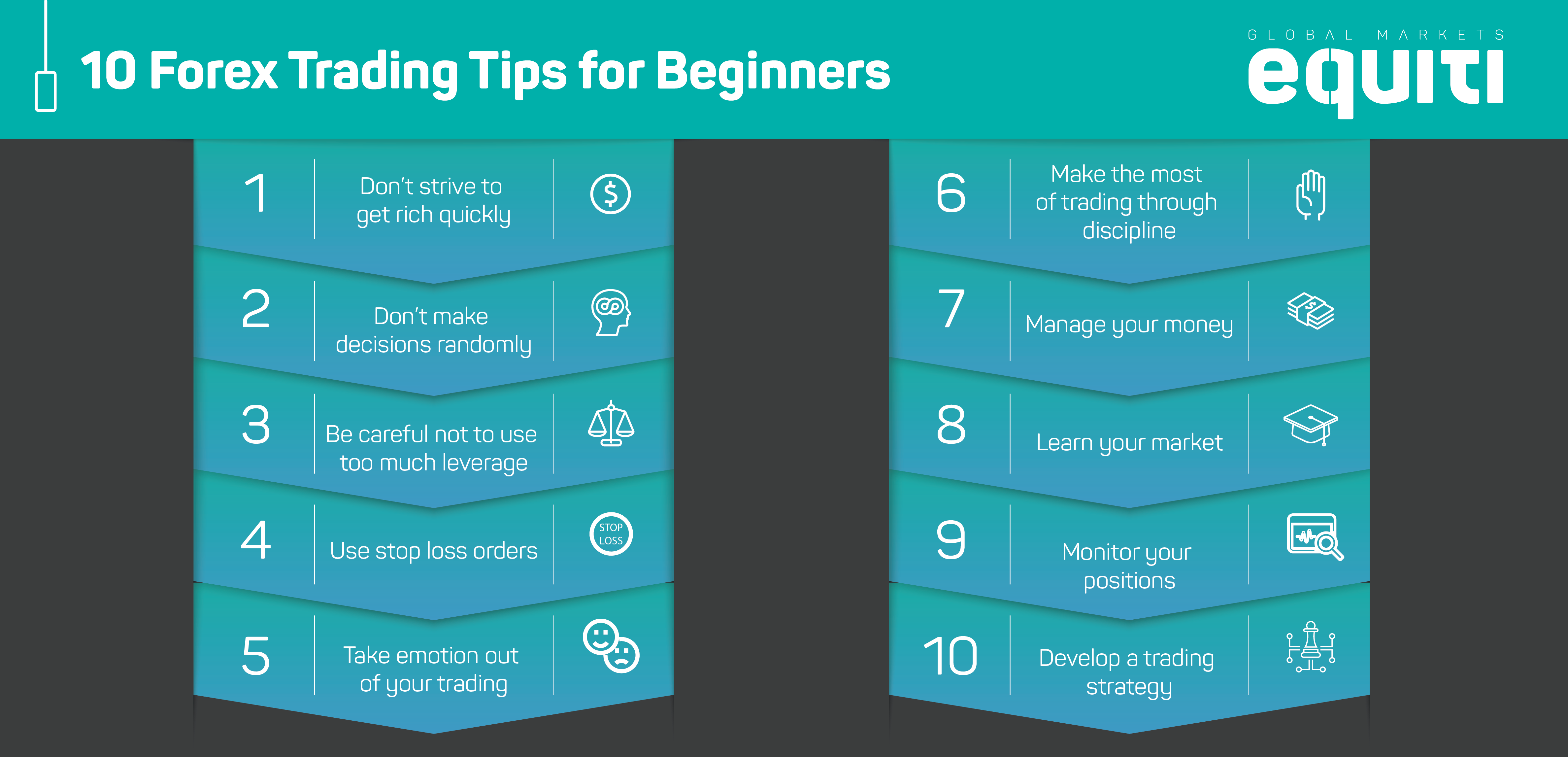

- Risk Tolerance: Assessing your comfort level with potential losses is paramount. A conservative approach may necessitate higher initial capital to mitigate risk, while a more aggressive strategy may allow for lower capital.

- Trading Frequency: High-frequency trading often demands larger capital to accommodate multiple trades simultaneously, while infrequent trading may permit lower capital.

- Trading Strategy: Different strategies impose varying capital requirements. Scalping or day trading, which involves executing numerous trades within a short timeframe, may necessitate higher capital to maintain open positions. Conversely, swing trading or position trading, which involve holding trades for extended periods, may require less capital.

- Market Conditions: Prevailing market conditions can influence capital needs. Periods of high volatility may warrant larger capital to withstand market fluctuations, while calmer markets may allow for lower capital.

The Power of Leverage: Unlocking Amplified Potential

Forex trading offers the unique advantage of leverage, essentially allowing traders to control a larger position than the size of their account balance. This mechanism can amplify both profits and losses, making it crucial to exercise prudent leverage commensurate with your risk tolerance.

Image: www.forexbrokers.co.za

Finding the Sweet Spot: Establishing an Optimal Capitalization

While determining the optimal initial capital for forex trading is subjective, seasoned traders often recommend starting with an amount you can comfortably afford to lose. This prudent approach minimizes the psychological impact of potential losses, allowing for rational decision-making during market fluctuations.

Cautions for the Prudent Trader: A Path of Realism

It is essential to temper expectations and recognize that consistent profitability in forex trading is not a guarantee. Even with adequate capital, success hinges on sound trading strategies, risk management techniques, and a deep understanding of market dynamics.

How Much Do You Need To Start Trading Forex

Closing Thoughts: A Calculated Start for Forex Success

As you embark on your forex trading journey, meticulously consider your financial objectives, risk tolerance, and trading strategy to ascertain the ideal initial capital requirement. Remember, success in forex trading is not solely predicated on the size of your capital but rather on your knowledge, discipline, and unwavering commitment to navigating the dynamic markets.