Imagine this: you’re ready to take the plunge into the exciting world of stock trading. You’ve researched, you’ve learned, you’re brimming with confidence. But then, a roadblock: a mysterious term called “margin requirement.” What is it, and why should you care? This is where the humble, yet powerful, margin requirement calculator becomes your key to unlocking the potential of leverage in your trading journey.

Image: www.mql5.com

Before stepping into the intricacies of margin requirements, let’s get on the same page. Simply put, a margin requirement is the amount of money you need to deposit with your broker as collateral to open and maintain a leveraged position. It’s like a security deposit, ensuring you have the financial capacity to cover potential losses. But what makes it so crucial?

Demystifying Margin Requirements: A Deep Dive

The concept of margin requirements is deeply intertwined with the power of leverage. Leverage amplifies your trading profits, but it also amplifies your losses. Let’s break this down with a relatable analogy. Imagine you’re trying to move a large, heavy sofa. You could use all your strength, but it might be a struggle. Now, imagine you have a lever. By applying force to the lever, you amplify your effort, making it easier to move the sofa. Leverage in trading works similarly – you’re essentially using borrowed money to increase your buying power, potentially leading to bigger gains. However, just like with the sofa, if you don’t use the lever carefully, you could end up causing more harm than good.

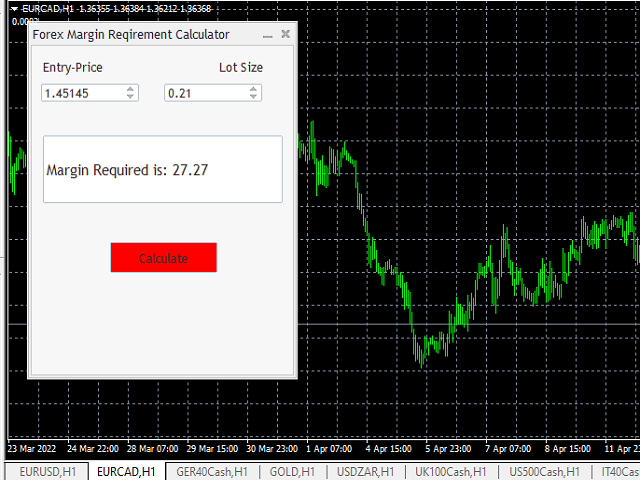

Now, back to margin requirements. The percentage of margin required depends on factors like the specific asset you’re trading, the current market volatility, and the regulations of your broker. This is where the margin requirement calculator comes into play.

Your Pocket-Sized Ally: The Margin Requirement Calculator

The margin requirement calculator is a powerful tool that helps you understand the financial implications of leveraged trading. You input the necessary details – like the price of the asset, the desired position size, and the prevailing margin requirement – and the calculator instantly tells you how much money you need to put up as collateral. This information is crucial for making informed trading decisions, ensuring you don’t overextend yourself financially.

Navigating the World of Margin: Key Insights

Imagine yourself standing at the helm of your trading ship, ready to navigate the sometimes choppy waters of the market. The margin requirement calculator acts as your trusty compass, guiding your decisions and minimizing the risks of getting lost at sea. Here’s how:

- Understanding Leverage and Risk: Leverage can be a double-edged sword. While it can amplify profits, it can also magnify losses. With the margin requirement calculator, you can visualize the potential impact of leverage on your trading capital, allowing you to make more calculated decisions.

- Predicting Margin Calls: A margin call occurs when the value of your position falls below the required margin level. If you don’t deposit additional funds to meet the margin requirement, your position might be forcibly closed, potentially leading to significant losses. The margin requirement calculator can help you understand the potential for margin calls based on different market scenarios, enabling you to take proactive steps to mitigate the risk.

- Optimizing Your Trading Strategy: By utilizing the margin requirement calculator, you can adjust your position sizes to align with your risk tolerance and available capital. This helps you manage risk effectively and avoid scenarios where you overextend your financial capabilities.

Image: www.mql5.com

Beyond the Numbers: Expert Advice and Actionable Tips

The margin requirement calculator is a valuable tool, but it’s not a substitute for sound financial knowledge and disciplined trading practices. Here’s what experts recommend:

- Start Small: When venturing into leveraged trading, it’s crucial to begin with small position sizes and gradually increase them as you gain experience and confidence. Think of it like learning to swim: you start in the shallow end before confidently diving into deeper waters.

- Know Your Risk Tolerance: Every trader has a different appetite for risk. Some prefer a conservative approach with minimal leverage while others seek more aggressive strategies. Understand your risk tolerance and ensure your trading activities align with it.

Margin Requirement Calculator

https://youtube.com/watch?v=Al4vzcbblhc

Embracing the Power of Informed Trading

The margin requirement calculator stands as a testament to the transformative potential of technology in the world of finance. By understanding the role of margin requirements and using tools like the calculator, you can enhance your trading journey, minimize risks, and pursue your financial aspirations with greater clarity and control.

Remember, knowledge is power. Equip yourself with the tools and resources available, make informed decisions, and embark on a successful path in the dynamic world of trading. As you navigate the markets, let the margin requirement calculator be your trusted guide, helping you turn your potential into reality.