In the realm of global finance, leverage has emerged as a double-edged sword, amplifying both profits and risks in the high-stakes world of forex trading. For US clients, leveraging opportunities in the forex market through specialized high leverage forex brokers has offered unprecedented access to financial markets. Yet, this power comes with inherent complexities and the need for prudent judgment. In this article, we delve into the captivating world of high leverage forex brokers for US clients, illuminating their advantages, potential pitfalls, and the crucial considerations required to navigate this dynamic landscape.

Image: tradingplatforms.com

Empowering US Traders with High Leverage: A Gateway to Amplified Gains

High leverage forex brokers facilitate trading with borrowed capital, enticing many US clients with the prospect of amplifying potential profits. Leverage ratios, which vary between brokers, significantly increase purchasing power, enabling traders to control larger positions with relatively small deposits. This magnification effect empowers traders to capitalize on market movements, potentially boosting returns exponentially. The allure of high leverage is undeniable, attracting countless traders seeking financial freedom and rapid wealth creation.

Navigating the Risks: A Cautionary Tale of Unbridled Leverage

While the allure of high leverage is undeniable, it is imperative to recognize the inherent risks that accompany this amplified trading power. Uncontrolled leverage can swiftly transform profits into significant losses, leaving traders facing financial ruin. The higher the leverage, the greater the potential for rapid account depletion. Volatility is an inherent characteristic of the forex market, and amplified leverage exponentially magnifies potential losses during adverse price fluctuations. Discipline, risk management techniques, and a deep understanding of forex dynamics become paramount in harnessing high leverage without succumbing to its pitfalls.

Scrutinizing High Leverage Forex Brokers: Essential Considerations for US Clients

Selecting a high leverage forex broker for US clients requires meticulous due diligence. The following crucial considerations guide informed decision-making:

![High Leverage Forex Brokers UK (Updated For 2024]](https://www.compareforexbrokers.com/wp-content/uploads/2022/08/high-leverage-forex-brokers-uk.png)

Image: www.compareforexbrokers.com

Established Regulatory Oversight: A Pillar of Trust and Reliability

The regulatory landscape for forex brokers varies globally, and US clients are advised to prioritize brokers regulated by reputable authorities such as the Commodity Futures Trading Commission (CFTC) or the National Futures Association (NFA). These regulatory bodies enforce strict guidelines, ensuring brokers adhere to ethical standards, maintain adequate capital reserves, and protect client funds through segregation of accounts.

Transparency and Disclosure: Unveiling the Inner Workings

Transparency is paramount in the brokerage landscape. High leverage forex brokers for US clients should provide transparent details about their leverage policies, trading conditions, fees and commissions, and any potential conflicts of interest. Access to trading history, execution reports, and clear explanations of risk management tools empowers traders to make informed decisions.

Tailored Leverage Ratios: Matching Risk Tolerance to Opportunities

Matching leverage ratios to individual risk tolerance is a cornerstone of responsible trading. High leverage forex brokers for US clients should offer flexible leverage options, enabling traders to customize their exposure based on their financial circumstances and risk appetite. Prudent traders opt for lower leverage ratios, while those seeking amplified potential returns may venture into higher leverage territories, fully aware of the associated risks.

Trading Conditions that Nurture Success

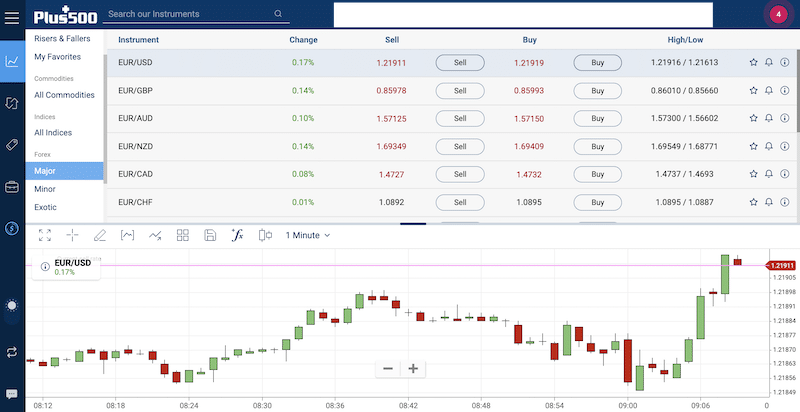

Beyond regulatory compliance and transparency, comprehensive trading conditions play a significant role in overall trading success. Competitive spreads, low commissions, and fast execution speeds are attributes of top-tier high leverage forex brokers. Access to advanced trading platforms with robust charting tools, real-time market data, and sophisticated order types enhances decision-making and risk management capabilities.

Responsible Leverage Usage: A Journey to Sustainable Gains

US clients venturing into the realm of high leverage forex brokers must adhere to responsible trading principles to mitigate risks and maximize potential:

Risk Management: A Lifeline in Turbulent Markets

Risk management should be at the core of every high leverage forex trader’s strategy. Setting stop-loss orders, managing position sizes, and diversifying trading instruments are essential practices to mitigate potential losses and preserve capital. Disciplined risk management empowers traders to navigate market volatility while safeguarding their financial well-being.

Calculated Leverage: Tailoring Leverage to Market Dynamics

Judicious use of leverage is key. Traders should dynamically adjust leverage ratios in response to changing market conditions. During periods of heightened volatility, reducing leverage can minimize exposure to potential losses. Conversely, in more stable market environments, higher leverage can magnify profit-making opportunities.

Continuous Education: A Path to Trading Mastery

Knowledge is power in the high leverage forex trading arena. US clients should invest in continuous education, voraciously consuming market insights, analysis tools, and trading techniques. Understanding market dynamics, macroeconomic indicators, and geopolitical events enhances trading decision-making and reduces the likelihood of costly mistakes.

High Leverage Forex Brokers Us Clients

Conclusion: Empowering US Clients with Informed High Leverage Forex Trading

The allure of high leverage forex brokers for US clients is undeniable. By choosing regulated brokers, scrutinizing trading conditions, and adhering to responsible leverage principles, US traders can harness the potential of amplified financial instruments while mitigating risks. Through education, strategic leverage usage, and prudent risk management, traders can navigate this dynamic financial landscape and unlock the transformative power of high leverage forex trading.