In the dynamic world of forex trading, understanding market volatility is crucial for effective risk management and profit maximization. The Average True Range (ATR) is a powerful tool that enables traders to gauge the intensity of price fluctuations and make informed decisions. Embark on this comprehensive guide to master the ATR concept, its significance, and how to leverage it in your trading strategies.

Image: www.dolphintrader.com

Navigating Price Volatility: The Role of the ATR

Market volatility, inherently unpredictable, represents the magnitude of price swings and imparts substantial impact on trading outcomes. Volatility can either offer lucrative opportunities or lead to devastating losses, emphasizing its indispensable role in forex trading. The ATR is designed to quantify price volatility, providing traders with an objective measure of potential risk and reward.

Unveiling the Formula: How the ATR is Calculated

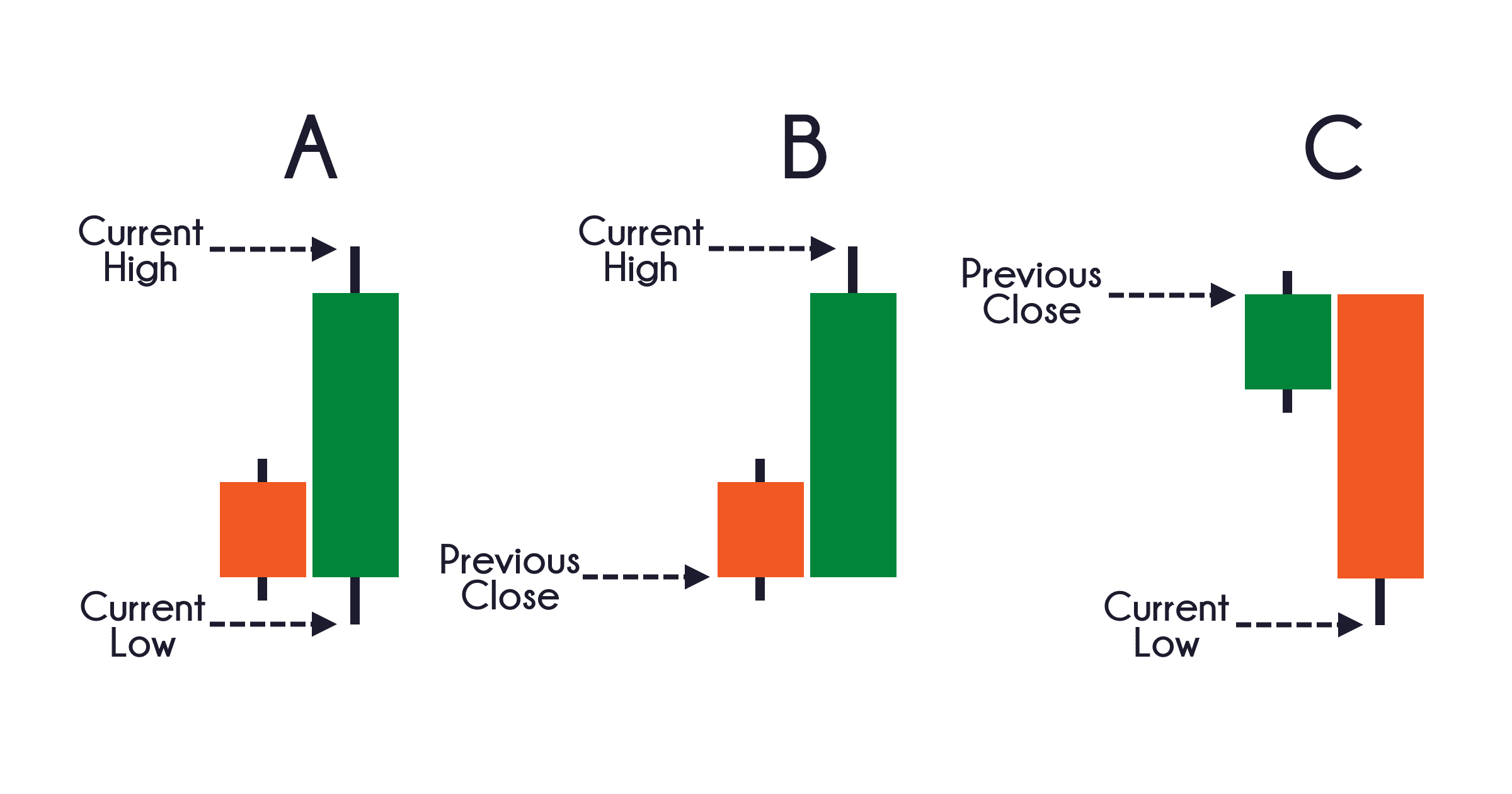

The ATR formula meticulously captures price movements by calculating the average of three true range values:

-

Current High Minus Current Low: This component represents the distance between the day’s highest and lowest prices.

-

Absolute Value of Current High Minus Previous Close: This calculation signifies the difference between the day’s high and the previous day’s closing price.

-

Absolute Value of Current Low Minus Previous Close: This element quantifies the gap between the day’s low and the previous day’s closing price.

By averaging these three values over a specified period (typically 14), the ATR provides a comprehensive measure of volatility. A higher ATR implies greater price volatility, while a lower ATR indicates a more stable market environment.

Harnessing the ATR’s Power in Forex Trading

The ATR serves as an indispensable tool for traders, offering a plethora of strategic advantages:

-

Risk Management: By assessing ATR values, traders can establish appropriate stop-loss levels, ensuring adequate protection against unfavorable market movements.

-

Position Sizing: The ATR aids in determining the optimal trade size, ensuring that potential losses stay within tolerable limits in relation to account size.

-

Trade Entries and Exits: The ATR can pinpoint potential trading opportunities by identifying moments of exceptionally high or low volatility. It also aids in identifying optimal trade exit points, maximizing profit potential.

-

Trend Identification: When combined with other technical indicators, such as moving averages, the ATR can aid in trend identification, helping traders capitalize on sustained market movements.

Image: www.forex.academy

Incorporating the ATR into Your Trading System

Integrating the ATR into trading strategies enhances risk management and optimizes trading decisions. Consider these practical applications:

-

ATR Stop-Loss Placement: As a general rule, stop-loss orders should be set at a distance of 2-3 times the ATR from the entry price, providing ample breathing room for market fluctuations.

-

ATR-Based Position Sizing: Allocate 1% to 2% of account equity per trade, ensuring sufficient diversification while safeguarding against excessive losses.

-

ATR-Triggered Trading: When the ATR exceeds a certain threshold, consider it a potential trading opportunity, especially when coupled with other favorable technical signals.

Unlocking Market Insights with ATR: A Holistic Perspective

The ATR is a versatile tool that extends beyond its primary role of quantifying volatility. By unraveling its intricate details, traders can harness its power to extract valuable market insights:

-

Market Conditions: Elevated ATR values signal periods of heightened volatility, often indicating increased trading opportunities but also amplified risks. Conversely, subdued ATR values suggest a more stable market environment.

-

Trend Strength: An expanding ATR alongside a rising trend indicates a robust uptrend. Conversely, a contracting ATR in an uptrend may herald a potential trend reversal.

-

News and Events: The ATR can anticipate market reactions to news and events. A sudden spike in the ATR often precedes or coincides with significant market developments.

Embracing the Dynamic Nature of the ATR

It’s crucial to acknowledge that the ATR is a dynamic measure that constantly adapts to changing market conditions. Volatility is an ever-evolving phenomenon, and the ATR adjusts accordingly.

-

Adjust ATR Period: The default 14-period calculation may not always align with the specific market being traded. Experiment with different periods to optimize the ATR’s sensitivity.

-

Consider Multiple Time Frames: Applying the ATR to different time frames provides a more comprehensive understanding of volatility across various market cycles.

-

Combine with Other Indicators: The ATR is not a standalone indicator but a valuable complement to other technical tools. Use it in conjunction with other indicators for more accurate and comprehensive market analysis.

Average True Range In Forex

Conclusion: Mastering the ATR for Forex Trading Success