Introduction:

Image: www.forex.academy

In the realm of forex trading, volatility is a key aspect that traders need to understand and track. Average True Range (ATR) is a versatile technical indicator that provides valuable insights into market volatility, helping traders make informed decisions and manage risk effectively. Are you ready to delve into the world of ATR and unlock its market-taming powers?

Definition of ATR:

Average True Range, introduced by J. Welles Wilder, measures the volatility of a market by calculating the average range of price movements over a specified period. ATR is expressed in pips or points and helps traders gauge the average amount of price fluctuation expected in the future.

How ATR is Calculated:

ATR is calculated using the following formula:

ATR = (1/n) * [(TR1 + TR2 + ... + TRn)]Where:

- n = the number of periods over which ATR is calculated

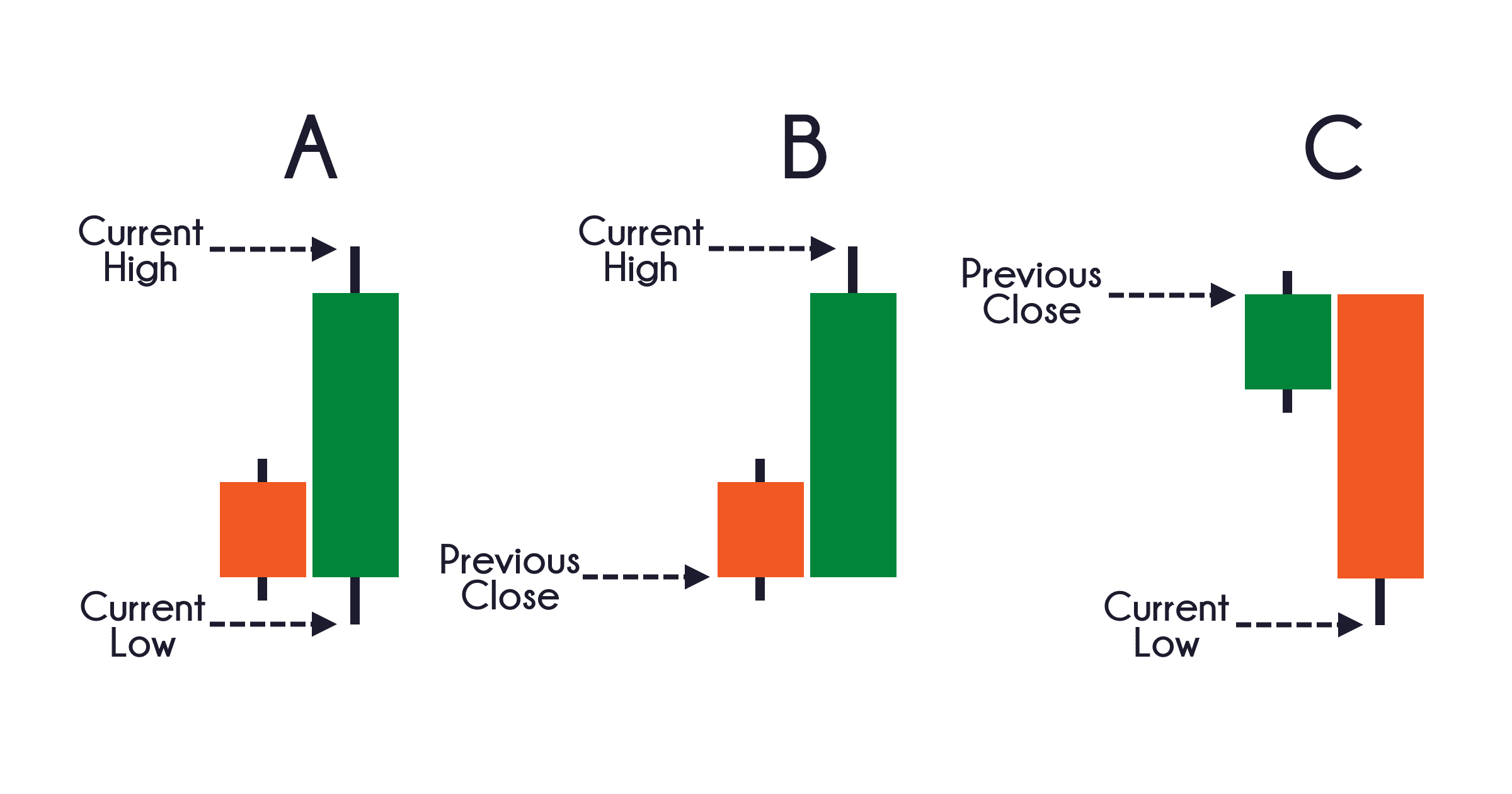

- TR = True Range, which is the maximum of the following three values:

- Today’s High – Today’s Low

- Absolute value of (Today’s High – Yesterday’s Close)

- Absolute value of (Today’s Low – Yesterday’s Close)

Significance of ATR:

ATR serves as a crucial tool for traders for several reasons:

- Volatility Assessment: ATR directly measures market volatility, allowing traders to assess the average price movement range and identify potential trends and reversals.

- Trade Management: By incorporating ATR into trading strategies, traders can define stop-loss and take-profit levels based on historical volatility.

- Position Sizing: ATR helps traders determine an appropriate position size based on their risk tolerance and the volatility of the market they are trading.

Practical Applications of ATR:

- Trend Trading: Traders can use ATR to identify potential trend reversals by comparing the current ATR to the historical range.

- Range Trading: ATR is helpful in identifying range-bound markets where price movements tend to remain within a certain corridor.

- Scalping: Scalpers rely on ATR to determine the average price movement during a specific period, allowing them to execute quick trades with minimal risk.

Expert Insights:

- “ATR is a crucial indicator for risk management. By understanding the volatility of a market, traders can tailor their strategies accordingly.” – Mark Fisher, Forex Trader

- “ATR provides a clear picture of market behavior. It eliminates the subjectivity and gut feelings often associated with trading.” – Dr. Patrick Huston, Forex Educator

Conclusion:

Average True Range (ATR) is a multifaceted tool that empowers forex traders with a deeper understanding of market volatility. By incorporating ATR into their trading strategies, traders can enhance their risk management techniques, identify potential trading opportunities, and navigate market fluctuations with greater confidence. Embrace the power of ATR and unlock the secrets to volatility in the dynamic world of forex trading.

Image: ibonosotax.web.fc2.com

What Is Average True Range In Forex