Begin your forex trading journey with a significant advantage by utilizing a 0 pip spread forex broker. These brokers eliminate the traditional spread, which can eat into your profits, empowering you with a cost-effective and competitive trading environment. Learn more about 0 pip spread forex brokers, their advantages, and how to choose the best broker for your needs.

Image: icoqerum.web.fc2.com

Understanding the 0 Pip Spread Advantage

In traditional forex trading, the spread is the difference between the bid and ask prices. This spread represents the market cost of executing a trade and is usually taken as a commission by the broker. However, with a 0 pip spread forex broker, this spread is eliminated, significantly reducing the trading costs for traders.

This reduction in trading costs directly translates into increased profit potential, especially for high-volume traders who frequently enter and exit positions. By removing the spread as a factor, traders can maximize their returns on each trade and enjoy a more competitive trading experience.

Benefits of Choosing a 0 Pip Spread Forex Broker

- Enhanced Profitability: The elimination of the spread allows traders to keep more of their profits, boosting their bottom line.

- Reduced Trading Costs: Removing the spread reduces the overall trading costs, making forex trading more affordable and accessible.

- Improved Execution: With no spread to overcome, order execution is faster and more efficient, leading to improved trade performance.

- Increased Flexibility: Traders can take advantage of even the smallest price movements without having to factor in the spread, allowing for greater flexibility in their trading strategies.

Choosing the Right 0 Pip Spread Forex Broker

Selecting the right 0 pip spread forex broker is crucial for a successful trading experience. Here are key factors to consider:

- Regulation: Ensure that the broker is regulated by a reputable body to guarantee the safety of your funds.

- Trading Conditions: Examine the broker’s trading conditions, including liquidity, slippage, and order execution speeds.

- Reputation: Research the broker’s online reviews and reputation to assess its reliability and customer satisfaction levels.

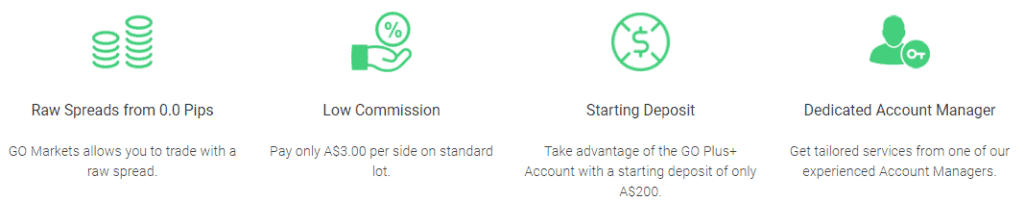

- Fees and Commissions: While the spread may be 0, check for any other fees or commissions that the broker charges.

- Platform and Tools: Evaluate the broker’s trading platform and the tools provided to ensure they meet your trading needs and preferences.

Image: www.compareforexbrokers.com

0 Pip Spread Forex Broker

https://youtube.com/watch?v=XbcCs4XnFpo

Conclusion: Embracing the Cost-Effective Advantage

With its numerous benefits, choosing a 0 pip spread forex broker can significantly enhance your trading performance. By eliminating the spread, traders can maximize their earnings and enjoy a more competitive trading environment. Carefully consider the factors discussed above when choosing a broker to find the best fit for your trading goals and embark on a more cost-effective and rewarding forex trading experience.