Introduction

Image: tradersunion.com

In the captivating world of finance, forex trading presents a tantalizing opportunity to multiply your wealth. Yet, embarking on this adventure can be a daunting task, fraught with risks and uncertainty. To navigate these turbulent waters safely, it’s imperative to entrust your hard-earned capital to a trusted and reliable broker. And that’s where SEBI comes into the picture.

The Securities and Exchange Board of India (SEBI) is the regulatory body entrusted with the responsibility of safeguarding the interests of investors in India. SEBI-registered forex brokers adhere to stringent regulations and guidelines, ensuring your money is in safe hands. By choosing a SEBI-approved broker, you can trade with confidence, knowing that your investments are protected from malicious intent and unethical practices.

SEBI’s Role in Forex Trading

SEBI plays a pivotal role in regulating the Indian forex market, enforcing strict compliance with regulations. Here are some key functions performed by SEBI:

-

Licensing and Registration: SEBI licenses and registers all forex brokers operating in India. Only brokers who meet the prescribed eligibility criteria and adhere to the regulatory framework can obtain SEBI registration.

-

Monitoring and Surveillance: SEBI continuously monitors the activities of registered brokers to ensure compliance with regulations. Any deviations or violations are promptly addressed, protecting investors from fraudulent activities.

-

Dispute Resolution: SEBI provides an effective mechanism for resolving disputes between brokers and investors. By acting as an impartial adjudicator, SEBI ensures that investors’ rights are upheld, and their grievances are addressed fairly.

How to Identify SEBI Registered Brokers

Verifying a broker’s SEBI registration is crucial before entrusting them with your investments. Here are some simple steps to help you confirm a broker’s SEBI registration:

-

Visit SEBI’s Website: SEBI maintains a comprehensive list of all registered forex brokers on its website. You can access this list at www.sebi.gov.in/web/sebiweb/list-of-registered-forex-brokers.

-

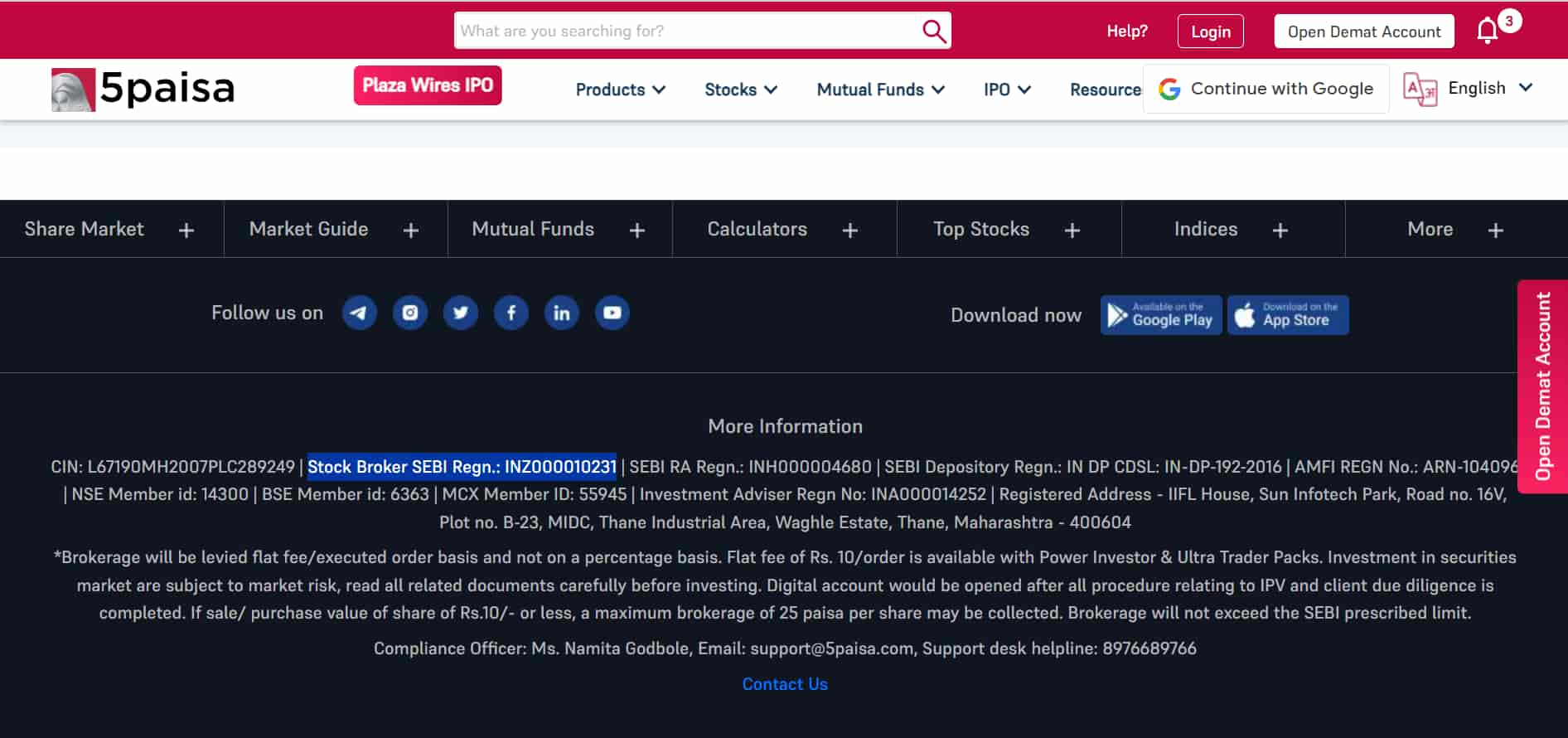

Check the Broker’s Credentials: Reputable brokers should prominently display their SEBI registration number on their website, marketing materials, and other communication channels. Verify this registration number against the list published on SEBI’s website.

Benefits of Trading with SEBI Registered Brokers

Choosing a SEBI-registered forex broker offers numerous advantages, fostering a secure and profitable trading environment. These benefits include:

-

Peace of Mind: Trading with a SEBI-approved broker gives you the peace of mind that your investments are protected against fraud and unethical practices.

-

Transparency and Compliance: SEBI-registered brokers are bound by stringent regulations, ensuring transparent and compliant trading practices. You can expect fair dealing, accurate trade execution, and transparent fee structures.

-

Dispute Resolution: In the event of any disputes or grievances, investors can seek recourse through SEBI’s dispute resolution mechanism. This independent and impartial platform ensures that your rights as an investor are protected.

Conclusion

Navigating the world of forex trading can be a challenging endeavor, but choosing a SEBI-registered broker paves the path to a secure and potentially profitable trading journey. By adhering to SEBI’s strict regulations, these brokers create a trustworthy environment where investors can trade with confidence. Remember, your hard-earned capital deserves the protection of SEBI’s vigilant supervision. Embrace the guidance provided in this article, and embark on your forex trading adventure with the assurance of SEBI’s unwavering support.

Image: www.cnbctv18.com

Sebi Registered Forex Brokers List