Introduction

The foreign exchange (forex) market, an ever-evolving realm of global finance, serves as the platform where currencies are traded. Within this dynamic ecosystem, the exchange rate between the United States dollar (USD) and the Singapore dollar (SGD) plays a crucial role in international trade, investment, and tourism. This article delves into the intricacies of the USD/SGD exchange rate, exploring its historical trends, current outlook, and implications for individuals and businesses alike.

Image: www.marketsmuse.com

The USD, the world’s reserve currency, and the SGD, a prominent Asian currency, have exhibited a fluctuating relationship over the years. Understanding the factors influencing their exchange rate is essential for participants in the forex market seeking to capitalize on opportunities or mitigate risks.

Historical Trends: A Rollercoaster Ride

Examining the historical trajectory of the USD/SGD exchange rate reveals a terrain marked by peaks and valleys. During the Asian financial crisis of 1997-1998, the SGD plummeted against the USD, touching a low of 1 USD = 1.765 SGD. However, the Singaporean government’s swift and decisive intervention, coupled with the country’s strong economic fundamentals, led to a gradual recovery of the currency.

In the aftermath of the 2008 global financial crisis, the USD strengthened against most major currencies, including the SGD. As the US economy rebounded, the demand for the USD as a safe-haven asset increased, bolstering its value.

Current Outlook: Cautious Optimism

As of the current economic climate, the USD/SGD exchange rate hovers around 1 USD = 1.35 SGD. Analysts forecast a relatively stable exchange rate in the near term, with the SGD likely to remain within a narrow range against the USD.

Singapore’s prudent fiscal and monetary policies, coupled with its export-oriented economy, provide support for the SGD. However, uncertainties stemming from global trade tensions and geopolitical risks may introduce volatility into the market.

Implications for Individuals and Businesses

The USD/SGD exchange rate has significant implications for individuals and businesses engaged in cross-border transactions. For Singaporeans traveling to the US, a stronger SGD means they can purchase more goods and services with the same amount of SGD. Conversely, a weaker SGD benefits Singaporeans studying or working in the US, as it reduces their living expenses.

Businesses involved in international trade need to monitor the exchange rate closely to manage currency risk. Importers may benefit from a weaker SGD, while exporters may prefer a stronger SGD to enhance their competitiveness.

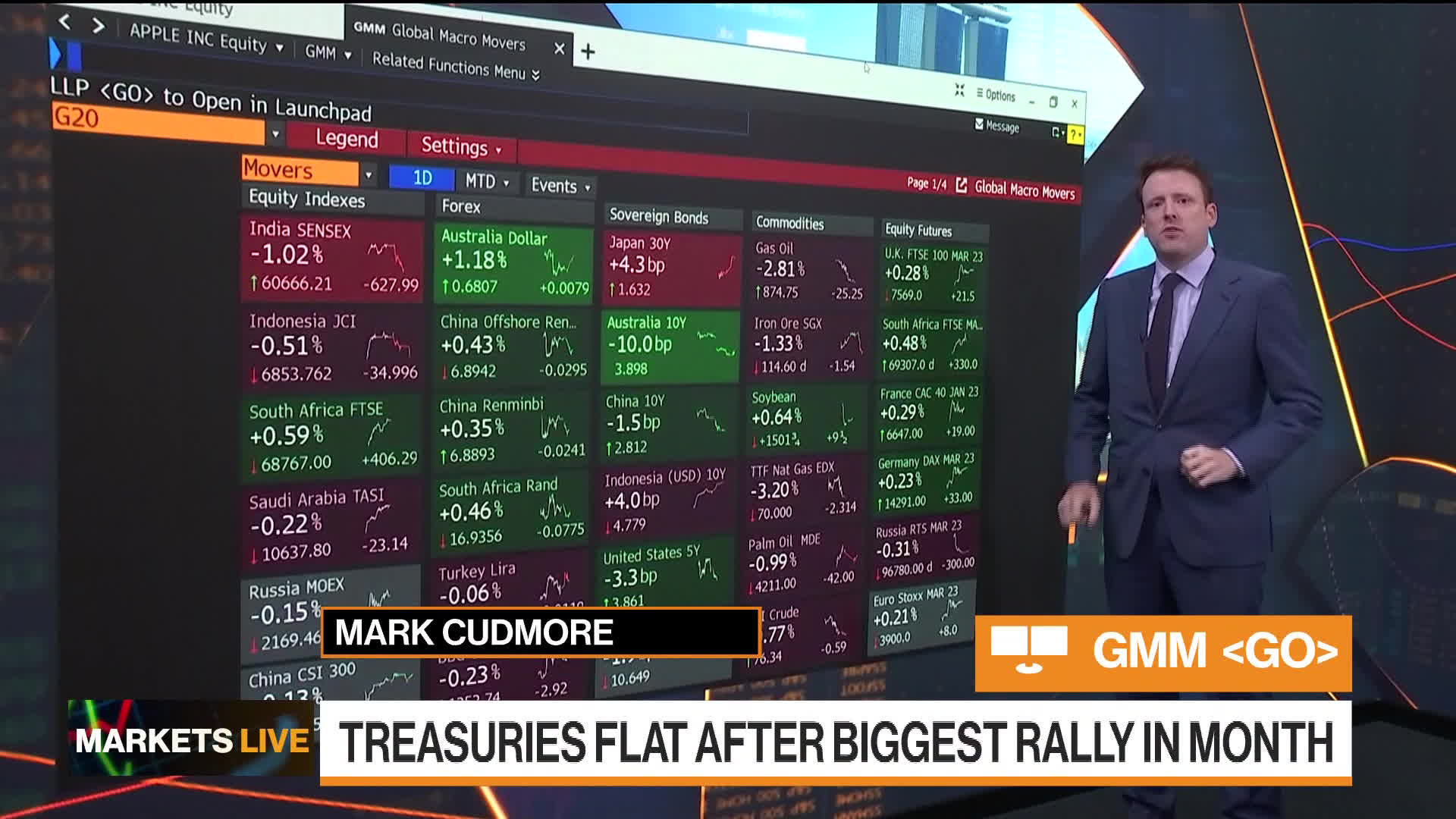

Image: www.bloomberg.com

Bloomberg Forex Usd To Sgd

Conclusion

The USD/SGD exchange rate serves as a barometer of the economic relationship between the US and Singapore. Understanding its historical trends, current outlook, and implications empowers individuals and businesses to make informed decisions in the global financial arena. By staying abreast of currency market dynamics, participants can navigate the complexities of cross-border transactions and harness the opportunities presented by fluctuating exchange rates.

As the financial landscape continues to evolve, the USD/SGD exchange rate will likely remain a key indicator of global economic health and a focal point for market participants worldwide.