Introduction:

Welcome to the bustling metropolis of the foreign exchange market, where currencies collide in a captivating dance. Among the various trading sessions, the New York session reigns supreme—a time when markets ignite and the pulse of global trade beats at its strongest. Join us as we delve into the depths of the New York forex session, unravelling its intricacies and empowering you with the knowledge to conquer this financial realm.

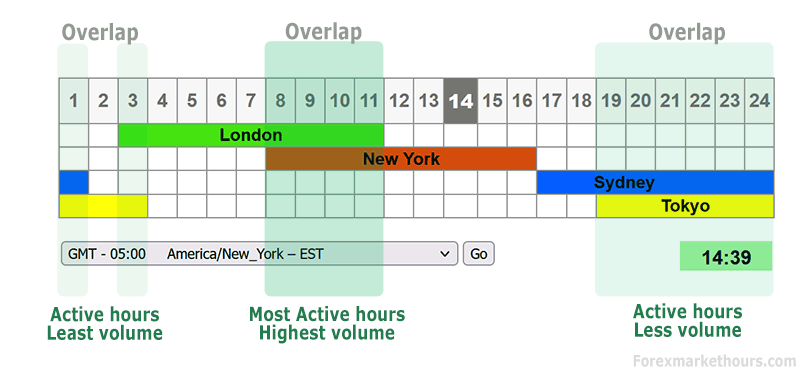

Image: www.forexmarkethours.com

Delving into the New York Forex Session:

The New York forex session commences at 8:00 AM Eastern Time (ET), coinciding with the opening bell of the New York Stock Exchange (NYSE). It extends until 5:00 PM ET, offering traders a solid nine-hour window to engage in currency exchanges. This session, arguably the most significant in the global forex market, captivates traders from around the globe, accounting for nearly half of the daily trading volume.

Why the New York Session Matters:

The timing of the New York session is not merely coincidental; it aligns perfectly with the peak trading hours in the world’s major financial hubs, including London, Zurich, Frankfurt, and Tokyo. As a result, market liquidity soars to unprecedented levels, providing traders with tighter spreads and enhanced opportunities. This liquidity advantage makes the New York session an ideal environment for scalpers and high-frequency traders seeking to capitalize on fleeting price movements.

Navigating the New York Session:

To successfully navigate the New York session, a comprehensive understanding of market dynamics is paramount. During this session, the US dollar takes center stage, with its movements significantly influencing other currency pairs. Major currency pairs such as EUR/USD, GBP/USD, and USD/JPY exhibit increased volatility, presenting both potential rewards and risks for traders. Armed with real-time market news, economic data releases, and technical analysis, traders can make informed decisions and optimize their trading strategies.

Riding the Waves of Volatility:

Volatility, often seen as a hindrance in financial markets, becomes a trader’s ally during the New York session. The influx of economic data, corporate earnings reports, and geopolitical events creates ample price fluctuations, offering opportunities to capture profits. However, it is crucial to exercise caution and manage risk effectively, as volatility can also lead to rapid reversals and substantial losses. A disciplined trading plan and strict risk management measures serve as anchors in this dynamic trading environment.

Expert Insights and Trading Strategies:

To enhance your trading prowess, seek guidance from seasoned experts in the forex market. Their insights and strategies, honed through years of experience, can provide invaluable direction. Consider implementing these strategies into your own trading, tailoring them to your unique risk appetite and trading style. Remember, while these strategies offer guidance, they are not foolproof, and success in trading ultimately stems from a deep understanding of market dynamics and disciplined execution.

Conclusion:

The New York forex session presents a dynamic and rewarding trading environment for those who possess the knowledge and skills to navigate its complexities. By embracing the principles outlined in this article, you can unlock the secrets of this session, enhancing your trading strategies and positioning yourself for success. Remember, the journey to mastery is an ongoing pursuit, and the New York forex session serves as a perpetual proving ground, where traders are tested and their skills are refined.

Image: iq-study.com

New York Session Forex Pairs