Venturing into the world of forex trading, knowing how to calculate lot size is crucial for managing your risk and maximizing your trading potential. In this ultimate guide, we’ll delve into the intricacies of lot size calculation, providing step-by-step instructions and valuable advice to help you accurately determine the appropriate lot size for your trades.

Image: forextraininggroup.com

Understanding Lot Size

In forex, a lot represents a standardized unit of currency traded in the market. The value of a single lot is set at 100,000 units of the base currency in the currency pair being traded. For instance, if you’re trading the EUR/USD pair, one lot would represent 100,000 euros.

Formula for Calculating Lot Size

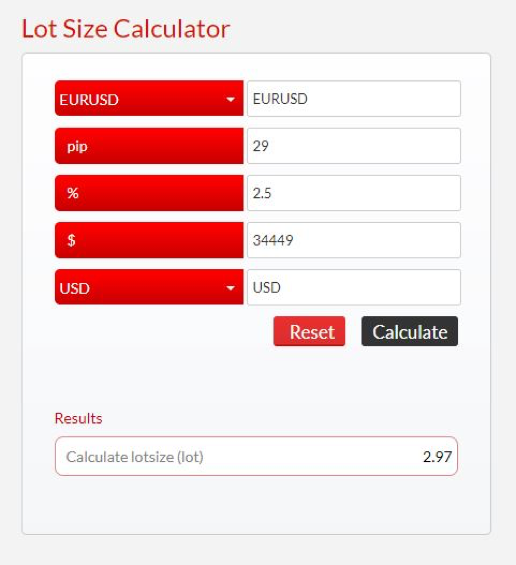

Calculating lot size is fairly straightforward. Here’s a simple formula to guide you:

Lot Size = (Risk Capital * Leverage) / (Pip Value * Contract Size * Points at Risk)

- Risk Capital: The amount of capital you’re willing to risk on a single trade.

- Leverage: The ratio provided by your broker that amplifies your trading capital.

- Pip Value: The value of a one-pip movement in the exchange rate.

- Contract Size: The value of each lot in units of the base currency (100,000 for standard lots).

- Points at Risk: The number of pips you’re willing to accept as a loss.

Step-by-Step Calculation

To illustrate the calculation, let’s consider a scenario where you’re trading the EUR/USD pair with a risk capital of $1000, using a leverage of 50:1. Assuming the current pip value is 0.0001 and you’re aiming for a maximum of 50 pips as points at risk:

Lot Size = (1000 * 50) / (0.0001 * 100,000 * 50) = 1 lot

This means you can trade one standard lot on the EUR/USD pair, considering your trading parameters.

Image: analiticaderetail.com

Expert Advice and Tips

1. Determine Your Risk Tolerance: Before calculating lot size, assess your risk tolerance and risk capital to avoid overexposure.

2. Consider Leverage Wisely: Leverage can boost your returns but also magnify losses. Use it judiciously to manage risk and avoid substantial drawdowns.

3. Understand Pip Value: Calculate the pip value for the currency pair you’re trading to accurately estimate the potential profit or loss.

4. Choose Points at Risk Prudently: Determine an appropriate number of pips at risk based on your trading strategy and risk tolerance.

FAQs

- Q: Why is it important to calculate lot size accurately?

- A: Correct lot size calculation ensures you control your risk, optimize capital usage, and avoid exceeding your risk tolerance.

- Q: How can I minimize the risk associated with lot size?

- A: Choose a lot size appropriate for your risk capital, use leverage responsibly, and define clear stop-loss points.

Conclusion

Mastering lot size calculation is crucial for informed decision-making in forex trading. By understanding the formula and incorporating expert advice, you can effectively determine appropriate lot sizes to manage your risk, maximize your profitability, and elevate your trading experience.

How To Calculate Lot Size In Forex

Are You Ready to Master Lot Size Calculation?

If you’re eager to delve deeper into the world of forex trading, our comprehensive guides and expert insights will empower you with the knowledge and strategies you need to succeed. Explore our website today and unlock your trading potential!