The forex market, a vast global network where currencies are traded, operates 24 hours a day from Sunday night to Friday evening. However, due to different time zones around the world, the market opening and closing times can vary for different regions. In this article, we will delve into the forex market opening and closing time in India, a crucial piece of information for any Indian trader or investor looking to navigate the complexities of this dynamic market.

Image: www.civilsdaily.com

Understanding the Forex Market: A Global Marketplace

The forex market is the world’s largest financial market, facilitating the exchange of currencies between individuals, businesses, and financial institutions. With a daily trading volume of trillions of dollars, the forex market offers unprecedented opportunities for traders seeking profit from currency fluctuations. As a decentralized market, the forex is accessible to anyone with an internet connection, making it a highly accessible financial avenue.

Forex Market Opening and Closing Time in India: Practical Considerations

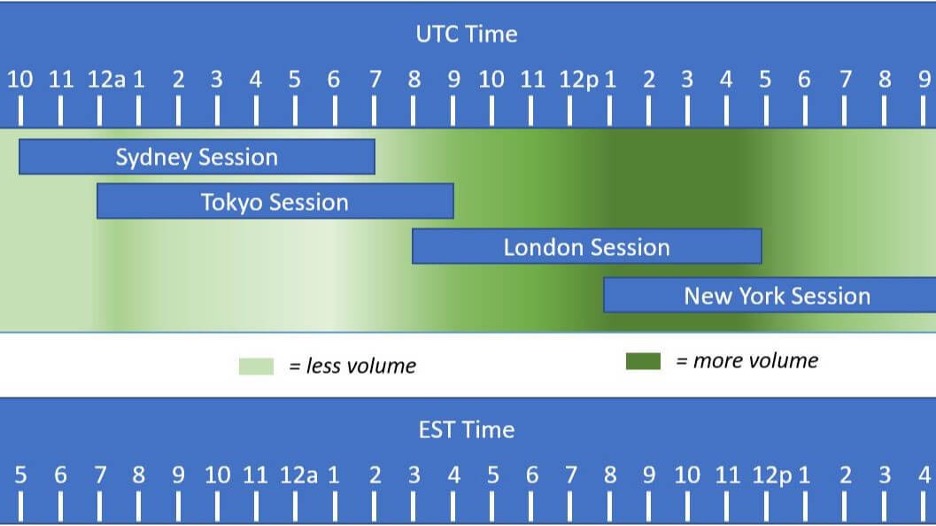

In India, the forex market opens at 9:00 am Indian Standard Time (IST) on Monday and closes at 5:30 pm IST on Friday. This is aligned with the global market hours, which begin with the opening of the Sydney session and conclude with the closing of the New York session. Indian traders have the advantage of accessing the market during most of their business hours, allowing them to monitor and trade currency pairs conveniently.

Key Trading Sessions and Their Impact

While the forex market operates continuously, there are specific trading sessions that correspond to different geographical regions. The major trading sessions include:

-

Sydney Session (11:00 pm IST – 8:00 am IST): This session marks the beginning of the global forex market trading day and sets the tone for the day’s market movements.

-

Tokyo Session (5:00 am IST – 1:00 pm IST): The Tokyo session is known for its high volatility, as it overlaps with the closing of the Sydney session and the opening of the European session.

-

London Session (1:00 pm IST – 9:00 pm IST): Commonly regarded as the most important session, the London session witnesses the highest trading volume and liquidity, influencing global currency trends.

-

New York Session (9:00 pm IST – 5:30 am IST): The New York session overlaps with the end of the London session and the beginning of the Sydney session, providing traders with continued liquidity and market activity.

Understanding the dynamics of each trading session is essential for Indian traders to optimize their trading strategies.

Image: crowdfunding-platforms.com

Factors Influencing Forex Market Volatility

Several economic and political factors can influence the volatility of the forex market, including:

-

Economic Data Releases: Economic data, such as GDP growth, unemployment rates, and inflation figures, can significantly impact currency values.

-

Central Bank Announcements: Policy decisions and interest rate changes made by central banks can drive market sentiment and cause fluctuations in currency pairs.

-

Geopolitical Events: Political events and uncertainties, such as elections, wars, and natural disasters, can also affect currency values.

-

Currency Speculation: Speculation and herd mentality among market participants can contribute to market volatility.

Understanding these factors enables traders to make informed decisions and manage risk effectively.

Forex Market Opening And Closing Time In India

Tips for Indian Traders: Navigating the Forex Market

-

Acquire Essential Knowledge: Familiarize yourself with forex trading concepts, market dynamics, and trading strategies.

-

Choose a Reputable Broker: Select a regulated broker with a proven track record and reliable trading platform.

-

Develop a Trading Plan: Define your trading goals, risk appetite, and trading strategy to guide your market decisions.

-

Practice with a Demo Account: Practice your trading skills using a demo account before risking real capital.

-

Manage Your Risk: Utilize stop-loss orders and proper risk management techniques to control potential losses.

-

Stay Informed: Follow market news, economic releases, and geopolitical events to stay abreast of market movements.

-

Learn from Experienced Traders: Seek guidance from experienced traders or mentors to enhance your understanding and trading acumen.

Remember, successful trading requires patience, discipline, and continuous learning. By adhering to these principles, Indian traders can navigate the forex market with confidence and potentially reap the rewards it offers.

In conclusion, understanding the forex market opening and closing time in India, along with the key trading sessions and volatility factors, empowers Indian traders to make informed decisions. By coupling this knowledge with sound trading practices and a commitment to learning, traders can increase their chances of success in this dynamic and ever-evolving financial market.