Introduction

Image: www.protradingschool.com

In the enigmatic realm of financial trading, discerning patterns amidst market volatility is akin to navigating a labyrinth. Fibonacci retracement levels, derived from the famous mathematical sequence, offer traders a potent tool to decipher market movements and make informed trading decisions. Join us as we explore the intricacies of Fibonacci trading, illuminating the power of this ancient knowledge in the modern financial arena.

Unveiling Fibonacci’s Legacy

Leonardo Fibonacci, an Italian mathematician of the 13th century, unearthed a remarkable sequence of numbers that has captivated mathematicians, scientists, and traders alike for centuries. The Fibonacci sequence unfolds as follows: 1, 1, 2, 3, 5, 8, 13, and so forth. Each subsequent number is simply the sum of its two predecessors.

Fibonacci in Trading: A Guiding Force

Fibonacci’s sequence manifests in countless natural phenomena, from seashells to galaxy formations. In trading, these ratios are believed to govern price movements, offering traders valuable insights into market trends. Fibonacci retracement levels, derived from these ratios, represent specific points at which a price is likely to pause or reverse its course.

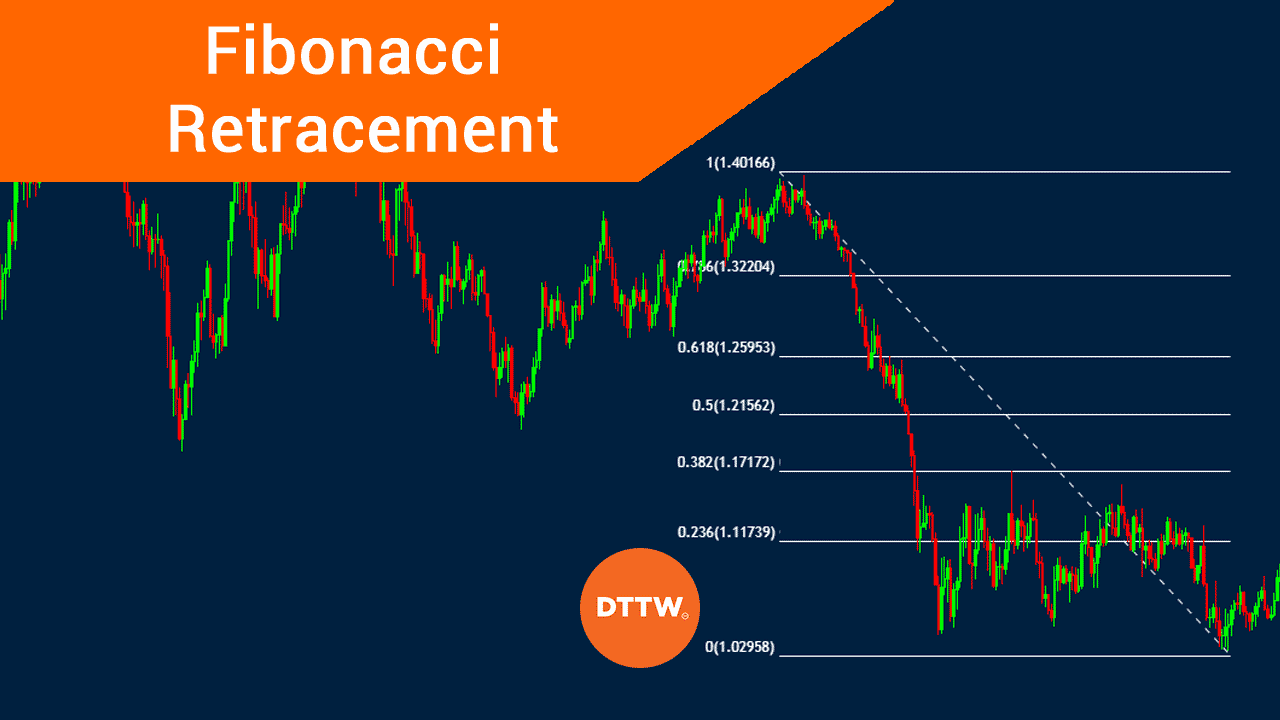

Understanding Fibonacci Retracement Levels

Key retracement levels in Fibonacci trading include:

- 23.6%: A common support or resistance level, often providing a short-term bounce or reversal.

- 38.2%: A stronger support or resistance level, indicating a potential trend reversal.

- 50.0%: The midpoint of a price move, acting as a critical decision point for traders.

- 61.8%: A significant retracement level, indicating a strong potential for a trend continuation.

- 78.6%: The largest Fibonacci retracement level, suggesting a substantial correction or a potential trend change.

Practical Applications of Fibonacci Trading

Traders harness Fibonacci retracement levels in various ways, including:

- Identifying Trading Opportunities: Retracement levels serve as potential entry or exit points for trades based on market support or resistance levels.

- Managing Risk: Fibonacci levels help traders determine stop-loss and take-profit points, minimizing risk and maximizing returns.

- Confirming Market Trends: Traders use Fibonacci retracements to confirm existing trends and anticipate their continuation or reversal.

Expert Insights and Actionable Tips

FX expert Karen Jones emphasizes the significance of Fibonacci trading: “Fibonacci techniques provide valuable context for price movements, enabling traders to recognize potential trading opportunities and make more informed decisions.”

Here are some actionable tips for incorporating Fibonacci in your trading:

- Seek Independent Confirmation: Combine Fibonacci analysis with other technical indicators for greater trading accuracy.

- Balance Risk and Reward: Set appropriate stop-loss and take-profit levels based on Fibonacci levels to manage risk and target potential gains.

- Practice Patience: Fibonacci trading requires patience and discipline. Wait for clear confirmation signals and avoid acting impulsively.

Conclusion

Fibonacci trading unlocks a realm of possibilities for traders seeking to harness market wisdom. By understanding the intricacies of the Fibonacci sequence and its applications in trading, you can gain a competitive edge in the constantly evolving financial landscape. Remember to approach Fibonacci analysis prudently, complementing it with other trading tools for optimal results. As you delve into the depths of Fibonacci trading, you will discover its transformative power in guiding your financial journey.

Image: www.daytradetheworld.com

How To Use Fibonacci In Trading