Ever wondered how seasoned traders spot potential turning points in the market and capitalize on them with uncanny accuracy? It’s not magic; it’s a sophisticated technique rooted in the Fibonacci sequence, a mathematical pattern found throughout nature, and its application in technical analysis — **Fibonacci Retracement settings**. This guide delves into the world of Fibonacci retracement settings, demystifying its intricacies and revealing its power as a valuable tool for traders of all levels.

Image: investbro.id

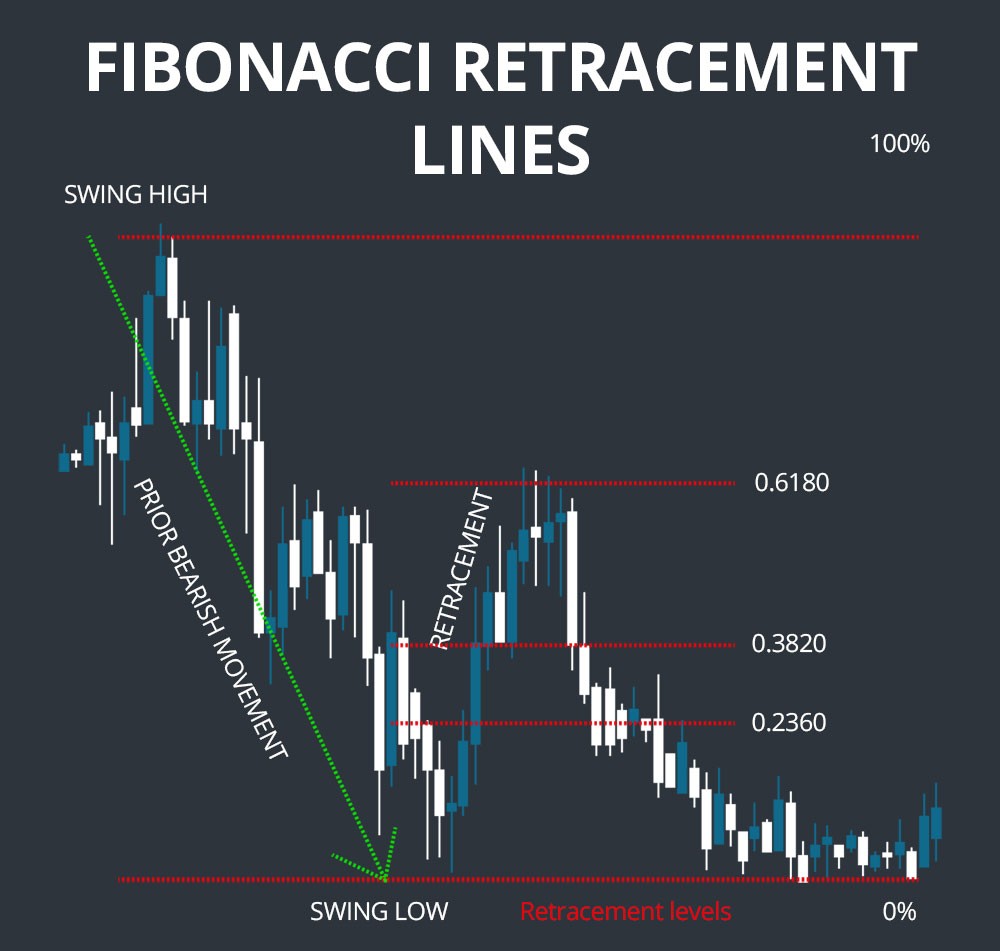

Fibonacci retracement settings are powerful indicators used by technical analysts to identify support and resistance levels in the market. Based on the famous Fibonacci sequence, these tools help traders predict where price reversals might occur, providing valuable insights for making informed trading decisions. Let’s dive deeper into understanding the fascinating world of Fibonacci retracement settings, their history, and how they can benefit your trading strategies.

Unveiling the History of Fibonacci Retracement: A Journey Through Time

The foundation of Fibonacci retracement settings lies in the mathematical brilliance of Leonardo Pisano, better known as Fibonacci, an Italian mathematician of the 13th century. His groundbreaking discovery, the Fibonacci sequence, is a series where each number is the sum of the two preceding ones (e.g., 0, 1, 1, 2, 3, 5, 8, 13, 21…). Intriguingly, this sequence appears in nature — from the arrangement of leaves on a stem to the spiral patterns of seashells — highlighting its fundamental significance.

Decades later, Ralph Nelson Elliott, a self-taught accountant, observed that stock market price movements closely resembled the Fibonacci sequence. Elliott’s groundbreaking work, the “Elliott Wave Theory,” established a framework for understanding market trends and predicting potential reversals based on this sequence. This discovery paved the way for the integration of Fibonacci retracement into technical analysis, transforming the field of trading.

Demystifying Fibonacci Retracement Settings: A Practical Guide

Fibonacci retracement settings are constructed by drawing horizontal lines at specific percentage levels of a price trend, derived from the Fibonacci sequence. These levels represent key areas where price is expected to find support or resistance. The most commonly used Fibonacci retracement levels are:

- **0% Retracement:** Represents the starting point of the price trend.

- **23.6% Retracement:** Often a point where the initial price momentum may slow down.

- **38.2% Retracement:** A slightly stronger level of potential price reversal.

- **50% Retracement:** Represents the halfway point of the trend, often considered a significant level of support or resistance.

- **61.8% Retracement:** Known as the “Golden Ratio,” a highly significant level for price reversals.

- **100% Retracement:** Represents the end of the current trend and the potential start of a new one.

Applying Fibonacci Retracement Settings in the Real World

Fibonacci retracement settings are primarily used to identify support and resistance levels, but they can be applied in various ways to enhance your trading strategies. Here’s a glimpse into some common applications:

Image: www.fidelity.com

Identifying Potential Entry and Exit Points

Traders often use Fibonacci retracement levels to identify potential entry and exit points in the market. When prices pull back towards a significant retracement level, it might present an attractive opportunity to enter a trade. Conversely, if the price bounces off a retracement level, it might indicate a potential exit point for traders aiming to lock in profits.

Managing Risk and Setting Stop-Loss Orders

Fibonacci retracement levels can also be utilized to manage risk effectively. Setting stop-loss orders below key retracement levels can help limit losses if a trade goes against you. By placing your stop-loss order at a strategic retracement level, you can minimize potential risk and protect your trading capital.

Understanding Trend Strength

The extent to which prices pull back towards Fibonacci retracement levels can provide insights into the strength of the underlying trend. A shallow retracement might suggest a strong trend, while a deeper retracement indicates potential weakness. Understanding this dynamic can help traders adjust their strategies based on the overall market sentiment.

Navigating the Nuances of Fibonacci Settings: Tips for Success

While Fibonacci retracement settings offer valuable insights, it’s crucial to use them wisely and in conjunction with other technical indicators for optimal results. Here are some key considerations to keep in mind:

Combining Fibonacci Retracement with Other Indicators

Fibonacci retracement settings work best when integrated with other technical analysis tools, such as moving averages, momentum indicators, or volume analysis. This helps confirm the validity of potential trading signals and increase your overall trading accuracy.

Market Context is Key

The effectiveness of Fibonacci retracement levels can vary depending on market conditions. It’s essential to consider the overall market sentiment, news events, and other factors that might influence price action before relying solely on Fibonacci retracement signals.

Don’t Overrely on One Single Tool

Fibonacci retracement settings are valuable but shouldn’t be considered an absolute guarantee of market behavior. Use them as part of a comprehensive trading strategy rather than solely relying on them for decision-making.

Continuously Evaluate Your Results

Regularly evaluating the effectiveness of Fibonacci retracement settings in your trading strategies is crucial for optimization. Track your trades, analyze results, and adjust your approach as needed to maximize profitability and mitigate risks.

The Future of Fibonacci Retracement Settings: Emerging Trends

The world of trading is constantly evolving, and Fibonacci retracement settings are no exception. New tools and techniques are emerging to enhance the use of Fibonacci retracement, expanding its capabilities and offering traders even more possibilities. Some of these emerging trends include:

Automated Trading

With the advent of automated trading platforms and algorithms, Fibonacci retracement settings are being integrated into sophisticated systems that automate trading decisions based on predetermined strategies. This streamlines the trading process and opens the door to more efficient execution.

Artificial Intelligence and Machine Learning

The integration of artificial intelligence and machine learning techniques is revolutionizing trading analysis. These advanced algorithms are being used to interpret market data, including Fibonacci retracement levels, to provide more accurate and timely trading signals.

Real-Time Data Analysis

Real-time data analysis is becoming increasingly crucial in today’s fast-paced markets. Platforms are developing that process live market data instantly, allowing traders to identify opportunities and act decisively based on real-time Fibonacci retracement indicators.

Fibonacci Retracement Settings

Conclusion

Mastering the art of Fibonacci retracement settings is an essential step towards elevating your trading game. By understanding their historical significance, practical applications, and potential pitfalls, you can employ them effectively as a powerful tool to identify support and resistance levels, manage risk, and refine your trading strategies. Remember that while Fibonacci retracement settings offer valuable insights, they should be combined with other technical analysis tools and a comprehensive understanding of market dynamics. Embrace continuous learning and adaptation to navigate the ever-changing landscape of trading and unlock the full potential of Fibonacci retracement settings in your trading journey.